Middle East offshore development to drive global upstream growth

Key Highlights

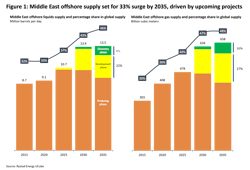

- Offshore supply from the Middle East is projected to grow over 33% by 2035, reaching a 45% share of global offshore production.

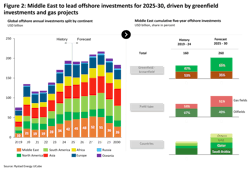

- Key investments include $260 billion in offshore projects between 2025 and 2030, with Qatar and the UAE leading LNG capacity expansions.

- Major upcoming projects like the Upper Zakum expansion, Leviathan Phase 2 and North Field developments will significantly boost regional output.

By Rahul Choudhary and Mrinal Bhardwaj, Rystad Energy

The Middle East is gearing up for a fresh offshore boom that could reshape global oil and gas markets. Offshore supply from the region is projected to climb more than 33% by 2035, lifting its share of global offshore production to over 45%.

Growth in crude output will be anchored by Saudi Arabia and the UAE, with the former turning to offshore projects to counterbalance declines from ageing onshore fields, while the latter accelerates developments to meet its 5-MMbbl/d capacity target by 2027 and extend its trajectory beyond.

On the gas front, Qatar will be the undisputed driver, with plans to expand LNG capacity by an extraordinary 85% by 2030, complemented by significant deepwater contributions from Türkiye’s Sakarya Field and Israel’s Leviathan project.

To fuel this wave of growth, more than $250 billion in offshore spending is set to flow into the Middle East between this year and 2030, making the Middle East the single largest hub for offshore spending worldwide.

New projects to lead supply growth

Offshore liquids supply in the Middle East is expected to rise 25% to 13.4 MMbbl/d by 2030, while offshore gas output is set to grow 32% to about 634 Bcm per annum (Bcma). Much of this growth will come from projects under development and recent discoveries, which are projected to deliver about a quarter of total offshore production by the end of the decade. The region’s share of global offshore liquids and gas output, currently just over one-third, is forecast to reach 45% by 2030.

In Saudi Arabia, expansions at Berri, Marjan and Zuluf will add 1.2 MMbbl/d of capacity, offsetting onshore declines as the kingdom works to sustain its 12-MMbbl/d target.

In the UAE, state player ADNOC is advancing the giant Upper Zakum Field, raising capacity from 1 MMbbl/d today to 1.2 MMbbl/d, with further expansion to 1.5 MMbbl/d under consideration pending a final investment decision (FID) next year.

The key growth in offshore gas supply from the Middle East is expected to come from Qatar, the UAE, Türkiye and Israel. In Qatar, production growth is driven by the phased expansion of the North Field East (NFE), North Field South (NFS) and North Field West (NFW) LNG projects. In the UAE, the Hail, Ghasha and Dalma sour gas and rich gas projects are currently in the development phase and are expected to add 30 Bcma of gas capacity by 2030.

Offshore spending of $260 billion between 2025 and 2030

Over the next five years, the Middle East is set to attract more than $260 billion in offshore investments, equating to more than 20% of the global total—the highest share worldwide.

Greenfield projects will drive more than 60% of this spending, with LNG and gas developments accounting for nearly half.

Qatar and the UAE will lead the charge. Qatar’s NFE and NFS projects are expected to require about $32 billion and $18 billion, respectively, in greenfield capex, while ADNOC’s Al Ruwais LNG project will add another $6 billion. In Saudi Arabia, large liquid-focused projects such as the $18 billion Marjan expansion and the Zuluf development will underpin offshore spending.

Together, Qatar, the UAE and Saudi Arabia will account for the bulk of investment, complemented by key projects in Türkiye, Israel and the Partitioned Neutral Zone.

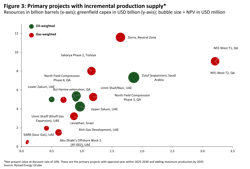

Key upcoming projects

The Middle East benefits from some of the world’s lowest development costs, averaging just $4.5/boe for assets slated for sanctioning in the next five years. The top 20 projects by resource size to be approved by 2030 hold an estimated 18 Bboe of resources and are expected to add nearly 900,000 boe/d of production by the end of the decade. Expansion phases at low-cost giants such as Upper Zakum and Zuluf will play a central role, while first-time developments like the Neutral Zone’s Dorra Field carry comparatively higher costs.

Offshore capacity growth is particularly critical for the UAE, which is targeting 5 MMbbl/d of crude capacity by 2027. Upper Zakum Expansion 3 is now in the front-end engineering and design (FEED) phase, with FID expected in 2027, while Lower Zakum’s long-term development plan and EPS-2 phase are forecast to contribute more than 70,000 bbl/d.

In Israel, partners at the Leviathan Field have sanctioned Phase 2, adding 9 Bcma of capacity with an estimated $3 billion in capex. This will lift Leviathan’s output from 12 Bcma to 23 Bcma by 2030, with Phase 1B Stage One currently in FEED and FID anticipated by the end of this year, followed by Stage Two around 2028.

In Qatar, the two-train NFW project, comparable in size to NFS, is expected to reach FID next year and deliver first gas before 2030. The country is also progressing its North Field Sustainability program, including multiple compression phases, with Phase 3 and Phase 4 scheduled for FID by 2027 and startup by the end of the decade.

The Middle East is fast emerging as the epicenter of global offshore growth. Backed by more than $260 billion in investment, the region will add massive LNG capacity from Qatar and the UAE, while continuing to dominate oil markets as countries look to expand their capacities. Low development costs and a deep pipeline of projects give the Middle East a competitive edge, ensuring its share of global offshore supply climbs to nearly half by 2030.

About the Author

Rahul Choudhary

Rahul Choudhary is vice president of upstream research at Rystad Energy, where he leads strategic analysis and delivers insights into global oil and gas markets. With over four years of experience in upstream research, he has advanced through key roles in analysis and business strategy, helping clients across the energy value chain make data-driven decisions. He holds a master’s degree in business management from Xavier Institute of Engineering and a bachelor’s degree in mechanical engineering from Vellore Institute of Technology.

Mrinal Bhardwaj

Mrinal Bhardwaj is a senior upstream analyst at Rystad Energy, bringing seven years of experience in the commodities sector. He specializes in upstream M&A analysis, portfolio benchmarking and comprehensive country-level studies, providing strategic insights to clients. He holds an MBA in oil and gas management from the University of Petroleum and Energy Studies in India.