Qatar on course to be Middle East’s largest gas producer in the 2030s

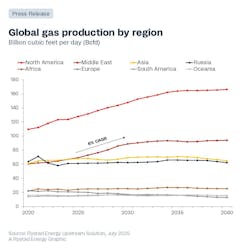

Rystad Energy expects the Middle East region to overtake Asia this year as the world’s second-largest gas producer, behind North America.

Gas production in the region has expanded by about 15% since 2020, the consultants added, with producers intent on monetizing their gas resources and increasing exports to help satisfy global demand.

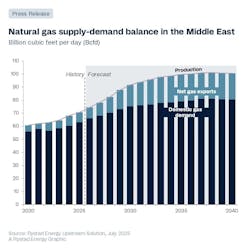

At present, the region produces about 70 Bcf/d. That figure should rise by 30% by 2030 and 34% by 2035, Rystad added, due largely to projects in Saudi Arabia, Iran, Qatar, Oman and the UAE.

By 2030, the Middle East should produce a further 20 Bcf/d, equivalent to half of Europe’s current gas needs. However, that will depend on Brent prices holding steady at $70/bbl and oil-indexed gas prices remaining at $7-9 per million British thermal units (MMBtu).

If prices were to fall below $6 per MMBtu, that could delay new projects, with volume growth maybe pegged at 20% or less, depending on the duration of the price decline.

But producing countries in the region are currently working to have an additional 10 Bcf/d available for export by 2030, which could be offered to Europe and other growing markets in Asia. Total output from the Middle East could hit 90 Bcf/d by the end of this decade, Rystad predicted.

Much of the growth should come from new projects that can produce cost-effectively below a threshold of $5 per thousand cubic feet, notably in Qatar, the UAE and Saudi Arabia.

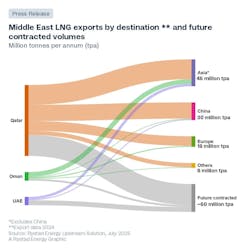

Qatar’s offshore North Field expansion developments should lift the country’s LNG capacity by 80% by the end of the 2020s, from 77 to 142 MM metric tons/year, while maintaining a breakeven price of under $6/MMBtu.

Rahul Choudhary, vice president of Upstream Research at Rystad, said that Middle Eastern projects remain resilient even below this level due to their low breakeven costs, typically under $5/thousand cubic feet.

By 2028, the region should add 60 MMt/year of new capacity, with Qatar providing 48 MMt/year through its North Field East and North Field South offshore projects.

Iran currently leads Middle East gas production at about 25 Bcf/d, followed by Qatar at 16 Bcf/d and Saudi Arabia at 8 Bcf/d. Iran’s gas production should increase by 6% to about 26 Bcf/d toward the end of the decade, mostly from the South Pars Field in the Persian Gulf, despite production being partly shut down recently during the conflict with Israel.

Qatar’s gas output should rise by almost 50% to 24 Bcf/d, due to the ongoing development of the North Field. By the early 2030s, the country will likely overtake Iran as the Middle East’s largest gas producer, Rystad added

The UAE and Saudi Arabia should each contribute a further 3 Bcf/d of gas, while Israel’s production should rise by 1.5 Bcf/d following the next expansion phases at the offshore Leviathan and Tamar fields.