Offshore to drive record non-OPEC production growth next year, says Rystad

Offshore staff

OSLO, Norway – Rystad Energy predicts that total non-OPEC production (crude oil and condensate) will grow by around 2.26 MMb/d in 2020, creating a challenge for OPEC and Russia as they attempt to balance the global oil market next year. This will eclipse the 40-year-old record by a wide margin.

Espen Erlingsen, head of upstream research at Rystad Energy, said: “The record high production growth from non-OPEC tight oil and offshore puts significant pressure on OPEC’s ability to balance the oil market in 2020. Rystad Energy believes that OPEC will need to extend and deepen production cuts if they have any hope of supporting the oil price in the near term.”

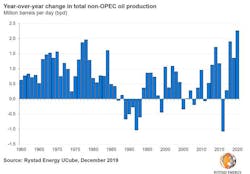

Looking at the year-over-year change in total non-OPEC oil production from 1960 – the year OPEC was founded – toward 2020, production from non-OPEC countries grew the most in 1978, growing 1.96 MMb/d thanks to increases from Russia, the US, the UK, and Mexico.

Next year, this 40-year-old production growth record may be beaten. Tight oil is expected to be a key contributor to the non-OPEC production expansion, contributing around 1.35 MMb/d, according to Rystad analysts. Offshore will balloon by 1.25 MMb/d, almost 0.9 MMb/d of which will come from deepwater.

“In a unique turn of events, it is the offshore segment which will drive much of 2020’s non-OPEC supply growth. The record-high production growth next year comes almost exclusively from tight oil and offshore,” Erlingsen said.

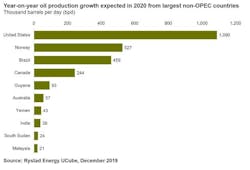

The US tops the list of non-OPEC countries which will see the quickest production growth in 2020, driven by tight oil production. Norway and Brazil, the world’s two dominant offshore players, follow close behind.

Norwegian production growth will in large part be driven by Johan Sverdrup, as well as smaller projects such as Oda, Valhall West Flank, and Trestakk.

“Although a rather mature producer, Norwegian production growth may reach an all-time high next year, boosted by a bevy of young finds,” Erlingsen said.

The same can be said of Brazil, where record-high production growth is expected next year thanks to the Buzios, Lula, and Iara projects.

According to Rystad, Brazil’s state oil company Petrobras is set to become the world’s largest oil producer among publicly listed companies by 2030.

12/04/2019