Petrobras set to become world’s largest oil producer, says Rystad

Offshore staff

OSLO, Norway – Petrobras is on track to become the world’s largest oil producer among publicly listed companies by 2030, based on Rystad Energy’s latest data and forecasts.

Brazil’s biggest-ever oil auctions in November were generally deemed to be disappointing, receiving muted interest from international exploration and production companies.

However, national oil company Petrobras could not have asked for a better outcome. The world’s fastest growing oil producer gained nearly full control of more than 8 Bbbl of oil in the Buzios field, where a sixth floater is being planned.

According to the analyst firm, to develop these and other offshore resources, Brazil is set for a $70 billion offshore capital investment spree between 2020 and 2025, solely on field development.

Aditya Ravi, vice president of Rystad Energy’s upstream team, specialized in E&P activities in Latin America, said: “Petrobras can, in a matter of years, become the world’s largest oil producer among publicly listed companies. The significance is huge and symbolic. We predict that Petrobras alone can boost its production numbers by more than 1.3 MMb/d over the next decade.”

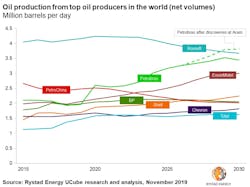

During 2019, Petrobras has evolved from fifth place to become the third largest oil producer, reaching output of around 2.2 MMb/d in 3Q. As it stands, Rosneft and PetroChina top the list over the world’s largest public E&P companies.

Based on Rystad Energy’s latest forecasts, Petrobras could be poised to overtake PetroChina over the next few months, and potentially dethrone Rosneft over the next decade, thanks in no small part to its latest acquisitions.

Brazil’s production could be pushed from 2.8 MMb/d in 2019 average to more than 5.5 MMb/d thanks to Petrobras’ potential peak output of almost 3.8 MMb/d (accounting for a commercial discovery at Aram) by 2030.

Brazilian officials recently indicated the country wishes to join OPEC. Brazil’s current output would make it OPEC’s third-largest producer, behind Saudi Arabia and Iraq.

“Joining OPEC could cause a major disruption for Brazil, bringing the country into the spotlight with the potential risk of having its wings clipped by the cartel just as production takes off,” Ravi cautioned.

This potential shift in ranking has been spurred on in the aftermath of the three Brazilian licensing rounds organized over the past five weeks by the National Petroleum Agency (ANP), in which 45 blocks were on offer. With only one-third of the blocks receiving bids, the rounds raised concerns that Brazil lacks the luster that in the past ensured active and competitive bid rounds.

In the wake of these rounds, the Brazilian Energy Minister remarked that the current legal and tendering structure could warrant a re-think, including a look at Petrobras’ pre-emptive rights on oil blocks. Others have voiced dismay over the steep signature bonuses, the analyst said.

11/19/2019