Better year ahead expected for subsea, floating production awards

Offshore staff

LONDON – Westwood Global Energy Group foresees a second consecutive year of growth in 2020 for the offshore oil and gas industry.

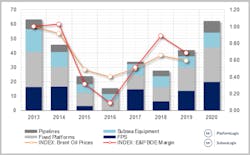

The consultant expects $63 billion of contract awards to be issued for new production infrastructure (subsea production systems, SURF, pipelines, fixed platforms and floating production systems), a 49% increase over 2019 and the highest for seven years.

Expenditure on floating production systems (FPS) should total $20 billion following $13.5 billion of awards last year, according to Westwood’s senior analyst offshore Mark Adeosun.

Latin America is set to dominate activity thanks to major awards such as Mero 3 (2Q), Itapu (4Q) and Sergipe (4Q), all offshore Brazil.

High spots in West Africa include the Sangomar FPSO offshore Senegal, awarded to MODEC last month, BP’s PAJ and Shell’s Bonga SW off Nigeria, both expected to follow late in the year.

Other major contracts anticipated elsewhere are Western Gas’ Equus (Western Australia) and LLOG’s Shenandoah (US Gulf of Mexico).

In 2019, the total number of subsea trees ordered was 212, down from 263 in 2018. Adeosun attributed the tail-off to delays in awarding certain key contracts such as Payara off Guyana (45 trees), Mamba off Mozambique (16 trees), and Sangomar (23 trees).

Woodside contracted the Subsea Integration Alliance of Subsea 7 and Schlumberger to supply the trees for Sangomar in early January, and 321 subsea trees could be ordered in total this year.

But as Adeosun pointed out, the offshore EPC supply chain is still suffering from the post-2014 downturn, fewer project sanctions, and the relentless push to drive down prices, with drilling, field development and production costs are significantly lower compared with 2013/14 highs.

With most E&Ps budgets based on oil prices of $60-$65/bbl, there appears to be little room for pricing growth, he added, so contractors will have to find ways to improve margins and profitability in their operations.

With FPSO market leaders such as MODEC and SBM Offshore building up order backlogs, E&P companies are having to broaden their search for EPC contractors that can deliver projects on time and on budget, Adeosun said.

At the same time, contractors may need to develop a clearer grip on future tender activity and contracting dynamics so that they can prioritize internal resources and “stay right sized and relevant.”

02/14/2020