Floating production market outlook continues to improve

David Boggs, Energy Maritime Associates Pte Ltd.

As operators keep close watch on costs and spending, offshore activity levels are expected to increase at a measured pace. The floating production sector is clearly the brightest spot in the offshore industry today.

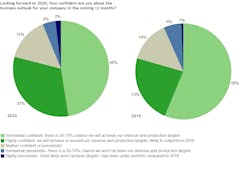

The market outlook continues to strengthen, making this the fourth year in a row that more than 50% of respondents expressed positive sentiment (somewhat confident to highly confident), according to EMA’s annual Global Floating Production Industry Survey. The results show an increasing bifurcation, with the percentage of respondents who are highly confident rising from 23% last year to 31% this year. At the same time, the number of very pessimistic respondents doubled from 1% to 2%. The number of respondents expressing somewhat pessimistic outlooks dropped slightly from 6% to 4%, as did those with somewhat optimistic outlooks (from 56% to 48%). Interestingly, the proportion of those in the middle with a neutral outlook remained almost unchanged. This suggests that the lion’s share of work is going to only a select number of companies, with most companies fairly busy and a few that are truly struggling.

A few key quotes are highlighted below.

“We are seeing an uptick in orders currently awarded and expected and are maxing our capacity.”

Among the bullish respondents expressing high confidence, many pointed to the activity in Brazil and the changes that have taken place. There are now a range of operators with new floating production developments including Shell, Equinor, Enauta, Karoon, and BWO, as well as Petrobras.

“We are well positioned in Brazil and this will be the big market in 2020.”

“Brazilian offshore is increasing a lot, now lead not only by Petrobras, but also by other major operators.”

Impact of the upturn

Now that the FPS industry has turned the corner, we asked how the industry will change during this upswing. Now that the leading contractors are in high demand, the top response by far was closer collaboration between oil company and contractor. This has already been seen in the long-term agreement between ExxonMobil and SBM Offshore announced in September 2019.

Another sign of increasing supplier power is the expectation for more balanced contracts, which moved up from sixth place last year to the second position. With growing demand, 16% of respondents believe that new entrants will try to enter the floating production market. To cope with lack of available lease contractors, another 15% thought that there would be a shift in contracting strategy to more EPC contracts. Only 10% expected that the increased activity levels would lead to additional cost and schedule delays.

Costs typically escalate during period of high activity. This year we asked our respondents how much cost inflation they expected in the coming year. Respondents did not believe costs would increase dramatically in 2020, as it is only the beginning of the upcycle.

The largest proportion, more than 40%, felt that there would only be 5-10% growth in costs. Another 35% expected less than 5%, while 8% did not think there would be any cost inflation. Only 16% believed there would be cost inflation of 10% or more.

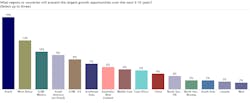

Greatest growth obstacles

For the sixth year in a row, the price of oil was identified as the greatest obstacle to offshore project growth. Most respondents are concerned with the volatility in oil prices rather than the overall level.

The other top concerns remain unchanged from last year with access to finance rose in second, closely followed by political issues and more attractive investment opportunities. In addition to challenges from onshore/unconventional oil, there is a growing push for investment in renewable energy as opposed to hydrocarbons. In-line with this trend, concern over environmental regulations moved up to fifth place from sixth.

For the first time, industry capacity was included as a concern. It ranked at the same level as environmental regulations and technical challenges, with 8% of responses.

“The major FPSO suppliers are becoming busy and this may result in a slowdown in new projects.”

“Limited available talent resources: people.”

Costs remain low on the list of concerns with FPS, drilling and subsea costs in the last positions this year.

Potential bottlenecks

After three years of no major capacity constraints, respondents expressed concerns in five areas: fabrication yards, offshore installation, project management, FEED engineering, and shipyards. This new ranking reflects the growing recovery as the backlog increases and companies that downsized struggle to meet this new demand.

Fabrication yards moved up from fourth position last year as orders resume at experienced yards, all of which had downsized. Similarly, offshore installation was in sixth position last year and moved up as activity has restarted. There was also concern over the lack of experienced personnel, as many have left the sector during the downturn.

Constraints in drilling and subsea remained low, reflecting substantial availability in 2020-2021. These two industries have undergone significant consolidation and although activity has picked up, there is still plenty of uncommitted capacity in the near term.

Most attractive growth regions

Brazil and West Africa ranked the top two growth regions again this year, as they have been since the beginning of the FPS Market Sentiments Survey. Brazil improved its standing as Petrobras has continued ordering FPSOs and other operators are progressing new developments.

The ranking of the top seven regions remain unchanged from last year. The Mexican side of the Gulf of Mexico (GoM) remains in third place, closely followed by South America (ex-Brazil), driven by the opportunities in Guyana. Respondents remain optimistic about the US side of the GoM as well, buoyed by greenfield and brownfield deepwater developments.

FPS types with largest growth potential

FPSOs remained the clear leader as the floating production system with the most promising growth potential, according to almost one-third of respondents. FLNGs remained in second position with 21%. The outlook for production semis increased for the second year in a row and now is tied for third place alongside FSRUs. The continued interest in semis has been driven by new developments and discoveries in the GoM, Australia, and China. There was no major change for the other unit types.

Summary

The sentiment for the global FPS industry has continued to improve since 4Q 2016. However, there has been an increasing divide between the “haves” and “have nots,” with some companies struggling to manage record backlogs and others struggling to survive. Offshore development costs remain low, fueled by excess drilling and subsea capacity. However, offshore project sanctions continue to be delayed as operators cherry-pick the best opportunities in their global portfolios. •

About the survey

The seventh annual Global Floating Production Industry Survey, by EMA, gauges the current market sentiment as well as where the industry is heading in the future. Respondents come from a mix of oil companies, engineering firms, financial institutions, equipment providers, construction yards, and asset owners/operators. Respondents also come from a wide range of functions, including strategy/planning, sales/business development, engineering/technical, project management, and commercial/finance.