MODEC to deliver Barossa FPSO

Offshore staff

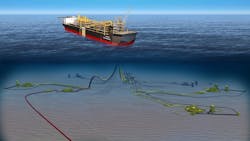

TOKYO – ConocoPhillips Australia has contracted MODEC Inc. to supply an FPSO for the Barossa gas field offshore Australia.

In June 2018, MODEC was awarded a front-end engineering design (FEED) contract for the Barossa FPSO. It has now been selected as the turnkey contractor based upon its successful performance and deliverables of the FEED contract.

The Barossa FPSO is intended to produce gas and condensate from subsea wells and after treatment, supply feed gas to the Darwin LNG plant via a gas export pipeline.

According to MODEC, this is its largest size of “Gas FPSO” to date, which will be able to export more than 600 MMscf/d of gas as well as store up to 650,000 bbl of condensate for export. It has been designed to withstand a 100-year cyclone event at a water depth of 260 m (853 ft) and located some 300 km (186 mi) off north of Darwin.

The company will be responsible for the engineering, procurement, construction, and installation of the FPSO, including topsides processing equipment as well as hull and marine systems. Scheduled for delivery during 2023, the FPSO will be permanently moored by an internal turret mooring system supplied by a MODEC group company, SOFEC Inc.

The Barossa FPSO will be the first application of MODEC’s M350 Hull, a next generation newbuild hull for FPSOs. The full double hull design has been developed to accommodate larger topsides and larger storage capacity than conventional VLCC tankers, with a longer design service life of 25 years and beyond. The hull will be built by Dalian Shipbuilding Industry Co. Ltd. in Dalian, China.

The FPSO features a boiler and steam turbine-based power generation system instead of conventional gas turbines, which is said to help reduce the carbon dioxide footprint of the facility.

The Barossa FPSO will be MODEC’s sixth FPSO in Australia.

The Barossa joint venture is currently formed by ConocoPhillips Australia Barossa Pty Ltd. (field operator, 37.5%), SK E&S Australia Pty Ltd. (37.5%) and Santos Offshore Pty Ltd. (25.0%).

Earlier this month, Santos agreed to buy ConocoPhillips’ northern Australia business for $1.39 billion.

The final investment decision for the Barossa project is expected in early 2020.

10/30/2019