Timing matters: What the Transocean-Valaris merger really changes

Key highlights:

- The merger is driven by market timing and valuation, not financial distress, as offshore floaters tighten and high-spec assets become more valuable.

- Transocean focuses on premium deepwater and harsh-environment rigs, divesting older assets to improve fleet quality and reduce idle inventory, with a strategic emphasis on reactivation potential.

- Valaris adds a diversified fleet, including a significant jackup portfolio, expanding geographic coverage and providing flexibility without diluting Transocean’s core focus on deepwater assets.

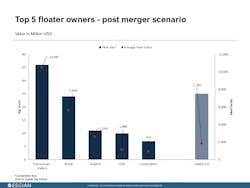

- The combined fleet is valued at about $11.5 billion to $12.88 billion, making it the largest and most valuable offshore drilling portfolio globally, with a focus on high-spec, modern rigs.

By Sofia Forestieri, Esgian

The proposed merger between Transocean and Valaris comes at a very different point in the offshore cycle than most large drilling M&A of the past decade.

This is not a transaction driven by balance-sheet stress or liquidity constraints. It is being announced as floater utilization tightens, day rates hold steady amid market softness and operators face a shrinking pool of high-spec offshore rigs.

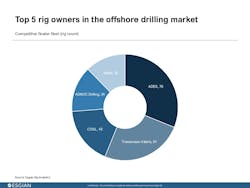

At first glance, the deal is about floaters, and that is where its immediate impact lies. However, Valaris brings more than ultradeepwater rigs into the combination. With a sizeable and competitive premium and harsh-environment jackup fleet, the transaction also returns Transocean to a segment it exited in 2017, at a time when the jackup market has already consolidated significantly following the ADES-Shelf Drilling takeover.

The offshore drilling sector has undergone several rounds of consolidation over the past decade, most of them driven by necessity. Following the 2014 downturn, contractors merged to survive. Assets were written down, fleets were cold-stacked, and many rigs were permanently removed from the market. Transactions such as Ensco-Rowan, Noble-Maersk and Transocean-Songa were primarily defensive, focused on stabilizing balance sheets rather than positioning for growth.

The current environment is different. In floaters, supply has tightened greatly. High-spec ultradeepwater drillships are increasingly in demand and the newbuild pipeline remains effectively closed. In jackups, consolidation has already reshaped the market, with ownership concentrated among a small number of global contractors, many backed by Middle Eastern capital.

As a result, consolidation today has a different valuation impact, as it concentrates ownership of a smaller pool of high-spec assets following years of fleet rationalization.

Transocean and Valaris before the merger: Fleet profile and valuation

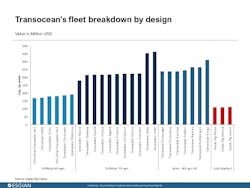

Transocean enters the transaction as the contractor most exposed to the premium end of the floater market. Over the past decade, the company exited the jackup segment and reduced fleet size, concentrating its capital on 7th generation drillships and harsh-environment semisubs.

Its competitive fleet is comprised of 24 floaters (17 drillships and seven harsh-environment semisubs), and it also has three long-term cold-stacked 7th generation drillships, Ocean Rig Mylos, Apollo and Athena.

From a valuation perspective, Esgian values Transocean’s competitive floater fleet at $6.98 billion to $7.7 billion. Until recently, part of this value was weighed down by a large cold-stacked drillship inventory. Until mid-2025, Transocean held nine cold-stacked drillships, the largest idle inventory in the industry.

Esgian previously analysed the challenges associated with these rigs, including high reactivation costs, limited near-term demand and book values materially exceeding market values, increasing the risk of rigs becoming permanently “dead-stacked.”

Since then, Transocean has taken concrete steps to reduce this exposure. Six cold-stacked drillships were divested, leaving only the three Ocean Rig drillships. The clean-up also included the recycling of two semisubs, and the harsh-environment semisub Henry Goodrich is held for sale for recycling/conversion.

This has significantly improved the quality of Transocean’s fleet, although it has resulted in a non-cash impairment charge of close to $2 billion. The Ocean Rig units are valued between $104 million and $117 million each.

However, with reactivation costs potentially reaching $150 million or more per rig and demand in key deepwater regions shifting into late 2026 and beyond, there is little economic incentive to pursue reactivation in the near term.

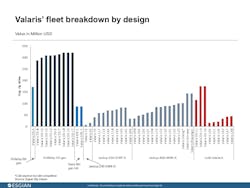

Valaris brings a more diversified offshore fleet into the transaction.

On the floater side, the company contributes a competitive fleet of 12 floaters (10 drillships and two benign semisubs). Importantly, Valaris is also one of the world’s largest jackup contractors, with 31 jackups owned, of which 25 are competitive.

Esgian values Valaris’ fleet at $4.67 billion to $5.2 billion. Within this, the jackup fleet alone carries a valuation of $1.7 billion to $1.87 billion, despite recent market disruptions and contract suspensions.

Since its restructuring, Valaris has divested older and less capable units, leaving a modern, high-spec portfolio. Six jackups remain held for sale as part of ongoing fleet optimization.

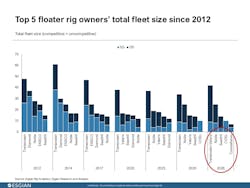

The combined fleet: Scale, valuation and asset quality

On a combined basis, the Transocean-Valaris merger creates the largest and most valuable offshore drilling portfolio globally. Esgian estimates the combined competitive floater fleet to be valued at $9.9 billion to $11 billion, placing the merged entity clearly ahead of most peers in ultradeepwater and harsh-environment segments. When Valaris’ competitive jackup fleet is included, the total offshore fleet valuation rises to approximately $11. 5 billion to $12.88 billion, widening the valuation gap to contractors such as Noble and Seadrill.

This scale matters as utilization tightens. Contractors with depth and flexibility are better positioned to secure longer contracts and maintain pricing discipline. Compared with peers, the combined entity benefits not only from fleet size but from the concentration of premium rigs.

The merger also improves the quality of idle exposure. Valaris contributes three cold-stacked 7th generation drillships, Valaris DS-11, DS-1 and DS-14. Modern newbuilds DS-1 and DS-14 were stacked shortly after delivery and have never worked (currently valued at $166 million to $184 million), while DS-11 has been idle for about three years (valued at $109 million to $121 million). Given their modern designs and limited work history, these rigs are better positioned for reactivation as demand strengthens toward 2027-2028, contrasting with Transocean’s remaining long-term idle rigs.

Thus, the transaction increases fleet value while improving the quality of the combined portfolio. Following the merger, the remaining cold-stacked drillship inventory in the market sits entirely within the combined Transocean-Valaris fleet, making it the only source of potential future reactivations.

Geographic footprint and commercial implications

The merger expands geographic coverage across key offshore regions, including Brazil, the US Gulf, West Africa and the North Sea.

In floaters, this broader footprint supports multi-rig campaigns and longer-term contracting strategies.

In jackups, Valaris’ competitive fleet spans multiple regions, including the Middle East, the North Sea, Mexico, West Africa, the Caribbean and Southeast Asia. This provides exposure to a range of markets with more fragmented jackup demand and a broader mix of contractors (and clients). Importantly, this exposure does not require Transocean to reenter the jackup market at scale but instead adds flexibility as market conditions evolve.

The Transocean-Valaris merger is best explained by timing but justified by valuation. It consolidates premium floater rigs as the market tightens, substantially increases the value and concentration of competitive fleets, and improves overall portfolio quality following years of fleet rationalization.

The inclusion of jackups does not dilute the core strategy. Instead, it adds flexibility in a segment that has already consolidated, while leaving Transocean’s focus firmly on premium deepwater assets.

Compared with peers, the combined entity emerges with greater scale, higher aggregate fleet value, and a cleaner portfolio entering the next phase of the offshore cycle. This is not a transaction driven by urgency or diversification. It reflects a clear assessment of how offshore drilling has changed and how value is created in a supply-constrained market.

Exclusive content:

About the Author

Sofia Forestieri

Sofia Forestieri is a senior analyst at Esgian, specializing in offshore rig market analysis and energy economics. She has over seven years in the energy sector where she has in that time covered a diverse range of areas energy transition topics, economics modeling, rig market analysis and rig valuation, and energy sustainability issues. Forestieri previously held positions as an upstream Latin American analyst with Rystad Energy and senior field engineer-wireline with Schlumberger. She is also a member of Offshore's 2026 Editorial Advisory Board.

She can be reached at [email protected].