Seven FPSO awards expected next year, analyst claims

Offshore staff

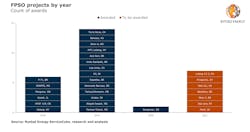

OSLO, Norway – Hit by the second industry downturn in five years, global awards for FPSO vessels will likely be limited to one in 2020, according to Rystad Energy, as exploration and production firms slash budgets and activity.

Similar to the previous downturn, awards are set to recover next year, with seven projects likely to be sanctioned, the consultant claimed.

MODEC won the only contract so far awarded in 2020 and will supply a newbuild FPSO for Woodside’s Sangomar development in Senegal. The vessel, which will be the first FPSO to operate in Senegal, will be supplied on a turnkey basis and feature topsides capable of handling 100,000 b/d of oil and 130 MMcf/d of gas. The consultant estimates that the total greenfield capex for Sangomar Phase 1 will be around $4.2 billion.

For the remainder of 2020, Rystad does not expect to see any new FPSO contracts being awarded. Over the last 10 years, only 2016 saw a lower level of activity when not a single FPSO contract was awarded. However, from 2016 activity quickly rebounded with 27 awards in the three-year period from 2017 to 2019.

Aleksander Erstad, energy research analyst in Rystad Energy, said: “This time too, we expect to see a speedy comeback in FPSO sanctioning with seven projects expected next year, including Bacalhau and Mero 3 in Brazil and Payara (Prosperity) in Guyana.”

Aside from new FPSO contracts, three charter contract amendments were disclosed in 2Q 2020.

The first contract amendment was for Altera Infrastructure’s (previously Teekay Offshore) Petrojarl Knarr, which has been on contract with Shell since 2015. The amendment extends the charter period from March 2021 to March 2022.

Under the previous agreement, Shell would pay a penalty if they terminated the contract before 2025. Now, this termination penalty has been removed in return for a new production and an oil price tariff. The day rate is also set to fall from March 2021 as low oil prices hurt the field’s profitability. It now seems likely that Shell will shut down the field a few years down the road. Liquids production at Knarr averaged 12,000 b/d in 2019.

In India, Bumi Armada and Shapoorji Pallonji Group received a notification from ONGC about its intention to extend the charter contract for the FPSO Armada Sterling. The seven-year fixed portion of the charter contract expired on April 19 and ONGC now has six annual extension options that can be exercised. The length of the current extension is not yet disclosed as contract formalizations have stalled due to the COVID-19 lockdowns in India.

Bumi Armada and Shapoorji Pallonji Group also own and operate the Armada Sterling II for ONGC, and a third FPSO for KG-DWN-98/2 is currently undergoing conversion work at Sembcorp’s Tuas Boulevard Yard in Singapore.

BW Offshore received a charter extension for the FPSO BW Cidade de São Vicente which will keep the vessel employed until Oct. 9, 2020. The FPSO operates as a well testing facility and has performed tests on multiple locations in Brazil since it started working for Petrobras in 2009 as the first production unit in the massive Lula (previously Tupi) field, kickstarting the field’s production. Ten years later, the Lula field went on to produce 1 MMb/d from nine FPSOs.

The BW Cidade de São Vicente is currently conducting an extended well test at Farfan in the Sergipe-Alagoas basin.

07/08/2020