Offshore Senegal Sangomar group reviewing costs

Offshore staff

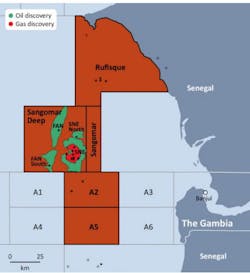

MELBOURNE, Australia – FAR has started the process of selling all or part of its interest in the Sangomar field development offshore Senegal.

Under the approved 2020 work program, FAR’s share of costs is $163 million. But following the oil price slump, the company recognizes that it is unlikely to be able to fund its future share of commitments based on its current cash reserves and future equity raises alone.

In addition to sounding out potential buyers, the company is investigating alternate sources of finance.

At the same time, the Woodside-led joint venture is working with the project’s contractors on cuts to capex and re-phasing planned expenditure to later dates in order to ease cashflow pressures on all the partners.

According to FAR, the development was running $117 million below budget for the year to end of March and this trend should continue.

Offshore West Africa, Shearwater GeoServices’ M/V SW Amundsen completed a 3D seismic survey earlier this year over the block A5 offshore The Gambia, with the program including some additional 2D seismic.

Processing of the data will continue through the rest of this year and the results used to interpret prospects within A5.

FAR and partner Petronas also agreed to postpone their Bambo-1 well, which had been scheduled to spud this year, due to the impact of COVID-19.

As for the company’s offshore Guinea-Bissau blocks 2, 4A and 5A, the plan for drilling the Atum-1X well has been suspended indefinitely.

The partners have approved formal documents for a three-year extension to the Sinapa and Esperanca licenses and are now waiting for authorization from the country’s state oil company Petroguin.

05/01/2020