Sputnik extends Barents oil province

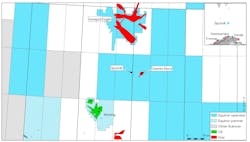

Equinor and OMV have revived hope of an oil province in the Barents Sea with their Sputnik discovery in the northern Hoop area. Recent wildcat drilling on other prospects across the sector had delivered sub-commercial gas at best.

Sputnik is in the southern part of the sea in license PL855, 30 km (18.6 mi) northeast of the two companies’ 440-MMbbl Wisting development. The semisub West Hercules drilled the latest well in a large channel system, penetrating a 15-m (49-ft) oil column in a Triassic sandstone reservoir. This was a play Equinor had first targeted in 2017 with its minor oil find, Gemini Nord.

Nick Ashton, svp for exploration in Norway and the UK, commented: “The geology in the Barents Sea is complex, and more work lies ahead to determine commerciality. But this discovery shows that persistence and our ability to learn from previous well results does pay off.”

Equinor estimates recoverable resources in the range of 20-65 MMbbl. Although Sputnik is remote, lying over 300 km (186 mi) north of the Norwegian mainland, it could be tied into a phased development of the Wisting area, according to Wood Mackenzie analyst Jamie Thompson, potentially coming onstream toward the end of the 2020s when Wisting will likely come off plateau. The new find emphasizes the need for the industry to commit to new infrastructure in the basin, Thompson said. Later this year Equinor is set to drill the Mist prospect, close to its Johan Castberg complex, and there are plans for further potential high-impact wells in the Hoop region and the southeastern Barents Sea in 2020, he added.

Equinor starts up Mariner

Mariner, Equinor’s first operated greenfield project in UK waters, has come onstream in the East Shetland basin seven years after sanction. This has been one of the company’s most complex developments in its entire portfolio, admitted Anders Opedal, EVP for Technology, Projects and Drilling. Texaco discovered the field in the early 1980s, and like its successor Chevron ended up defeated by the combination of heavy oil and ultra-complex reservoirs.

Equinor, however, brought a fresh approach, drawing in part on its experience at the Peregrino heavy oilfield in the Campos basin, and the company expects to produce over 300 MMbbl over the next three decades through the conventional fixed steel platform and up to 70,000 b/d at peak. Analysis of new seismic data improved understanding of the reservoirs, Opedal explained, resulting in fewer wells and more optimal placement, which led to an upgrade of the resource. The team plans to continue applying modern solutions such as automated drilling, digital twins, and field worker tools to sustain the optimization process and to raise recovery further through additional drilling and future tieback opportunities.

Total investments have so far exceeded $7.7 billion, making this the largest UK offshore development of the past decade, said Oil & Gas UK’s upstream policy director Mike Tholen.

PowerBuoy on trial at Huntington

Premier Oil has agreed to the first ever offshore trial of the PB3 PowerBuoy at the Huntington oilfield in the UK central North Sea. Developer Ocean Power Technologies and Acteon Group will manage the program, which is supported by the Oil & Gas Technology Centre (OGTC) in Aberdeen. The moored buoy, which can operate in water depths of 20 m (66 ft) and above, will constantly recharge itself using wave energy. This will be harnessed to power onboard sensors for monitoring purposes, including protection of the surrounding subsea architecture.

Premier plans to use the system to assist decommissioning at Huntington; according to the OGTC, it could also be adapted to support small field developments or to serve as a charging hub for AUVs.

ExxonMobil’s UK future in doubt

ExxonMobil is the latest major reportedly seeking to sell its UK North Sea interests. Much of the value in the company’s estimated $2-billion portfolio resides in its share of the Gannet, Penguins, and Shearwater hubs.

Any buyer, according to Wood Mackenzie analyst Neivan Boroujerdi, would look to focus on increasing recovery and deferring abandonment, although that would also depend on Shell’s investment plans, as a 50-50 co-venturer in the assets. •