TGS selling two Ramform vessels, cites market downturn

By Jeremy Beckman, Editor, Europe

TGS has agreed to sell two of the Ramform seismic data acquisition vessels that came with the company’s purchase of rival PGS last year.

During a results presentation, CEO Kristian Johansen said both the Ramform Explorer and Ramform Valiant had been stacked for some time, with associated costs mounting up. Both will be sold at a relatively low price, he added, with the contractual terms prohibiting redeployments as seismic source vessels.

Both vessels had worked in the offshore oil and gas and offshore wind streamer sector.

“We see weakness in both these markets,” Johansen explained. “If a need arises in [the] future, it will be served by another vessel in our fleet.”

OBN surveys

The picture for ocean-bottom node (OBN) surveys is healthier, with all TGS’ OBN vessels currently chartered on a mixture of long-term and short-term contracts, and multiple new charters in prospect over the next six to 12 months.

However, once some of the present deals expire, the company will look to reduce the number of vessels it charters and focus more on the spot market, Johansen said.

Going forward, TGS will revise its acquisition approach. For OBN, that means pursuing new, more efficient source technologies that allow for fewer people to be stationed on the vessels and bringing in electrically operated ROVs.

“We are also looking at different types of OBN vessels compared to what we have done in the past,” he said.

Neither development is great news for suppliers of ROV and source vessels, he added.

Second-quarter 2025 updates

During the second quarter, TGS’ revenues were hit by several unexpected factors. Data licensing was below expectations due to various licensing deals being postponed. In Asia, bad weather impacted work on a streamer project, leading to the acquisition vessel being removed before returning three months later to resume work.

There was also lower-than-expected participation by co-venturers in certain multi-client projects, leading to lower revenues and higher investment expenses on TGS’ part.

But there were some positives. Offshore Argentina, the company completed Phase 3 of the Malvinas seismic acquisition survey, with the 3D library now at 25,000 sq km. The geology looks promising, Johansen noted, with clients very interested in the findings to date.

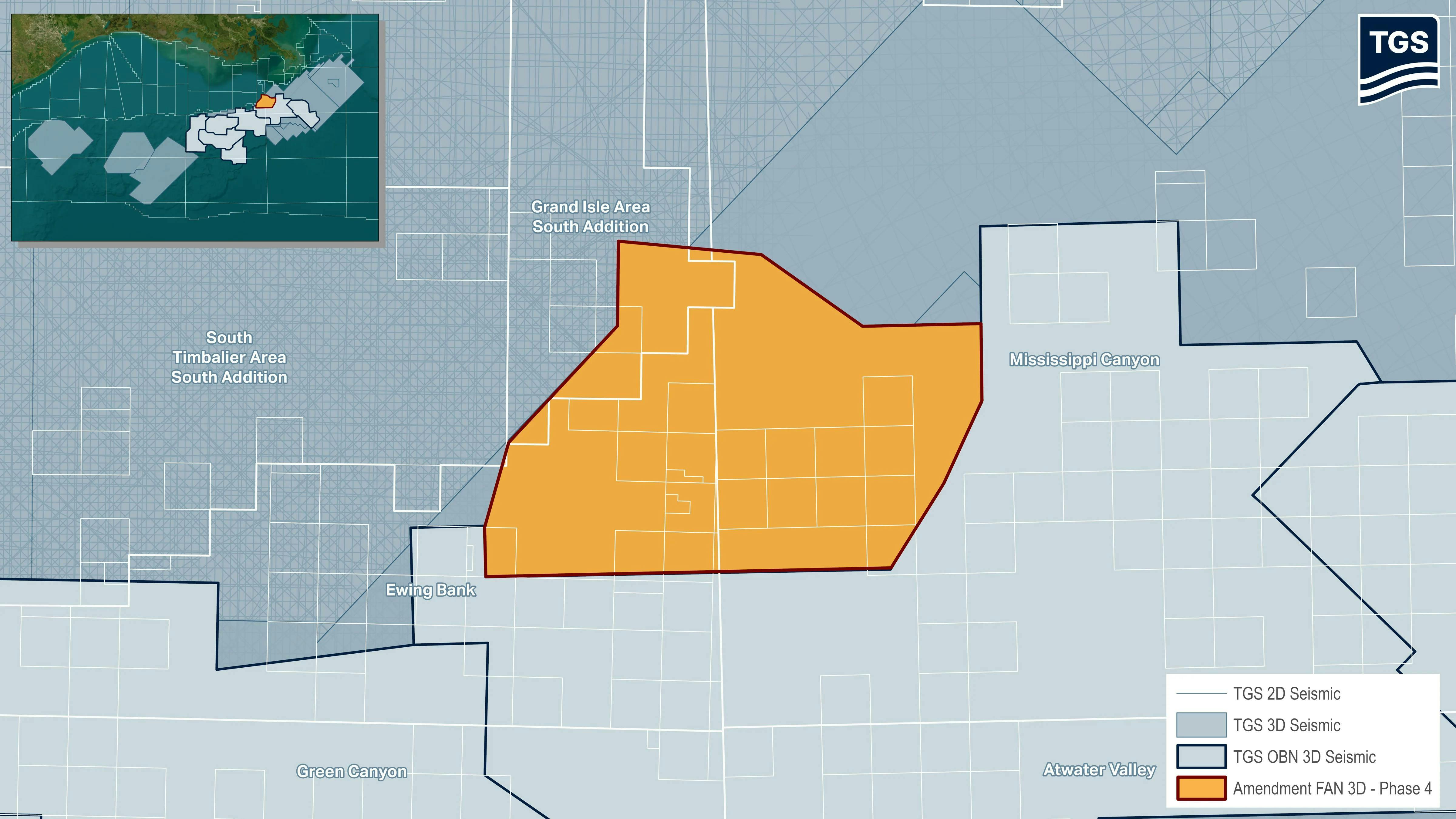

In partnership with Viridien, the company completed Phase 2 of the Laconia 3D OBN survey over the Garden Banks and Keathley Canyon areas of the US Gulf of Mexico. And TGS also finished work on the Amendment Phase 4 ultra-long offset OBN survey, spanning 49 outer continental shelf blocks in the Mississippi Canyon and Ewing Bank protraction areas.

Brazil’s ANP recently staged the Equatorial Margin licensing round, over a region which Johansen described as one of the world’s last big frontier basins. Here, the company has already built a significant seismic database, he added, via the multi-client Pama project, and further activity is planned over the next 12 to 18 months.

Recently TGS started work on a newly awarded OBN survey offshore Trinidad, and it has numerous other 4D contracts lined up offshore Norway.

In addition, the company has entered a collaboration with Equinor to advance digitalization of carbon capture and storage (CCS) operations. Northern Lights onshore/offshore Norway will integrate TGS’ Prediktor Data Gateway into its digital system to support management of the CO2 value chain, from the onshore CO2 reception terminal to permanent subsurface storage in the North Sea.

The software, providing real-time and reliable data (according to TGS) should support more efficient operations decision-making across the CCS process, notably in terms of simulation, capacity planning, CO2 tracking, emissions and financial reporting, permitting, compliance, trading, audits, and health and safety.

The future of offshore exploration

Looking ahead, the industry will have to step up exploration of oil and gas, Johansen predicted, with some international oil companies down to seven years of oil reserves in their inventories.

“The average three-year replacement ratio for the industry is only 40%— that means only 12 to 13 years of reserves remaining, unless you explore more," he said. “We believe frontier and deep water offer the highest exploration upside, and both require high-quality seismic.”

In the future, Johansen also foresaw a trend toward fewer but bigger deals with a smaller number of clients for multi-client surveys; longer-term, more selective streamer acquisition projects; and a greater focus on higher-end OBN data acquisition.

Want more content like this?

Visit the Geosciences section for more offshore news, project updates and technology trends.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.