Tracking offshore assets via an improved technology

RFID provides quick, complete asset tracking

Ted Moon, Technology Editor

For any E&P player with equipment working offshore, the need to know both the location and condition of each asset at any given time is critical. In today’s climate of high day rates for drilling and other support services, a company must have a thorough understanding of how its equipment is working and when it needs to be reworked or replaced.

Offshore service and equipment companies are beginning to embrace a technology that has previously found some success in the retail business sector with the likes of so-called “big box” retailers like Wal-Mart and Target. Radio frequency identification, or RFID, is a technology that was first invented almost 60 years ago, but has only recently starting taking hold in the business world.

In simple terms, RFID works by placing a special tag that emits a radio signal onto an object one wishes to track. A monitoring device, or reader, placed near the tag picks up the signal.

RFID tags are not necessarily new to the oil and gas industry, but recent advancements by some RFID providers have caused the industry to take a new look at the technology, as a means to improve efficiencies and to reduce downtime.

One such provider is Fitiri, a company whose name stands for “First Time Right.” As Ashe Menon, director, Strategy for Fitiri, says, “the two major areas where RFID tracking come into play is for managing of assets and maintenance activities.” Previous inventory methods, including the old “guy with a clipboard” method, are error prone and increasingly unrealistic as asset tracking becomes more vital in the era of Sarbanes-Oxley.

Menon provided several examples of just how challenging asset tracking can be. He cited one company that possessed more than 60 mud pumps which were sold and then subsequently repurchased because they were not clearly evident in inventory to begin with. Another company could not account for over $100 million worth of assets. As Menon points out, “prior to today’s business environment, a company’s CFO may not have wanted to know about these types of assets, since if they don’t know, they can sign off (on financial statements) without any legal implications.” In today’s environment of Sarbanes-Oxley, CFOs must sign off and account for all assets.

The state of the art, and easiest mode, for asset tracking technology had been the use of bar codes. While they are cheap and easy to use, bar codes are not without their problems. “They will not work on all kinds of drilling equipment,” says Menon. “During routine workovers, bar codes may be painted over or pressure washed, and they may no longer be readable 2 months out.”

RFID emitters, on the other hand, do not rely on a direct line-of-sight reading by the receiver in order to work. Emitters typically hang on equipment with strong polyethylene tags or are drilled onto the equipment.

The downside to RFID has traditionally been the challenge of using it on anything metallic, which of course accounts for the vast majority of equipment used on rigs and vessels. Unlike cardboard, metallic surfaces typically dampened the RFID signal to the point that it is essentially unreadable.

Fitiri previously faced challenges to get most RFID tag manufacturers to invest R&D money into developing more sophisticated tags because their major focus had been on the retail sector, where the requirements are for quick reads on plastic and cardboard.

Fitiri worked closely with universities and a few key RFID manufacturers to develop new tags that reportedly work effectively on metal, and provide a read distance of 20 ft. The company recently started work with a drilling equipment manufacturer in the US to embed tags into the equipment as it is being built, which according to Menon is a first for the industry.

Menon says that the landmark of achieving tags that work on metal with longer read distances has made the job of tracking assets shipped back and forth from a platform infinitely easier.

Asset tracking in and out of the yard

This longer read distance allows for the use of fixed readers on entrance gates to a yard. With fixed readers, “you know when equipment came in on the back of a truck without needing to count items individually off a clipboard,” Menon says. This tracking speed benefits a driller who needs to move equipment quickly out of the yard and back into service.

Tracking equipment in and out of a yard via RFID reportedly avoids slowdowns with paperwork as well. “A driller can take equipment out at night without the need for filling out forms,” says Menon. The RFID system keeps track of what was taken and by whom, and any necessary paperwork can be filled in at a later time. “With day rates of $60,000/day, you don’t want to be tied up in the yard.”

RFID streamlines maintenance activities

Fitiri is focusing on RFID as a competitive tool for maintenance activities as well. Menon says that “the entire repair or maintenance history of an asset is written directly on its tag.” Fitiri developed a software package called RigMS that installs on a handheld reader or workstation, and stores data about the asset for transmission to command centers.

Experienced offshore workers are retiring or are moving to other companies for more pay, which has made RFID a valuable training tool as well. Menon says that the combination of the RFID tags and RigMs allows “someone just off the street to know immediately what needs to be done to an asset.”

“As new guys come into the industry to replace retiring maintenance folks, they may not know all the intricacies of the drilling equipment, but they do understand handheld technologies such as video games and cell phones,” says Menon. “This technology can be used to pass on the seasoned workers’ experience to the new guys.”

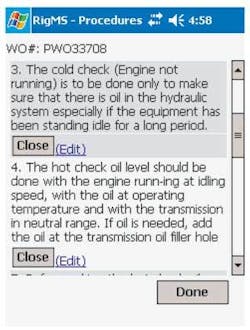

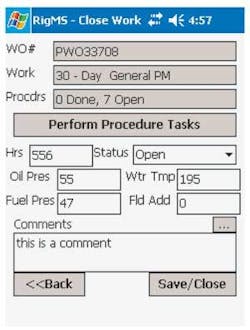

Equipment can be scanned via a handheld reader, and a work schedule for that asset comes up on the screen, as does a detailed step-by-step process for what needs to be done in terms of maintenance or repair. Any time a change is made to the equipment, the worker must close and sign off on the work order. In that way, the next worker who comes along will have a living history of the equipment.

If a worker observes a piece of faulty equipment, a message can be sent via server to a home office or warehouse. The message could be an order for a replacement part, including the part number and the quantity needed. Rather than sending the entire piece of hardware to shore, the replacement part can be quickly sent to the asset.

In the event that a piece of equipment needs to go onshore for more extensive repair, Menon says that RigMS can take much of the guesswork out of diagnosing problems. “If a broken mud pump is sent to a shop for overhaul, you may not know when or what type of previous repair work was done, or who did the work. RFID provides all of this information instantly.”

RFID aims for global reach

Is RFID really all that it is cracked up to be? As with most technologies, the answer is a matter of opinion. It is true that a few years ago, RFID technology did not quite live up to the potential and demands put on it within the retail industry. However, Menon points out that improvements have been made and the technology has evolved to the point where now it is more affordable and dependable.

The price has dropped considerably over the past few years. “Each tag used to cost about $12, and we are now down to about $1 or less per tag,” Menon says. This is a small price to pay, even for some offshore platforms or vessels that may require hundreds of different assets to be tagged and tracked.

While offshore drilling equipment was the original market of choice for Fitiri, the company is branching out to address tracking needs for other segments of the offshore market, on a global scale. It is not alone in this endeavor, as some of its competitors have reportedly made inroads with seismic vessel and equipment manufacturers such as Western Geco and Sercel.

Still, Menon is confident of his company’s growth prospects in other vessel segments, particularly support vessels. “Many vessel companies are contacting us, although they want to make sure that our solution addresses their painpoints.”

One thing is certain: in the fast-paced and competitive offshore E&P market, the need for efficiency-driving technologies such as RFID is there, and companies such as Fitiri seem ready to deliver.