Offshore staff

ABERDEEN, UK — Ithaca Energy has entered an exclusive arrangement to acquire most of Eni’s UK upstream assets.

These include UK field interests held by the Neptune Energy group, which Eni itself acquired earlier this year, while excluding Eni’s carbon capture and storage and Irish Sea interests.

The exclusivity will remain in place for four weeks to allow the two parties to progress the contractual documentation related to the potential combination.

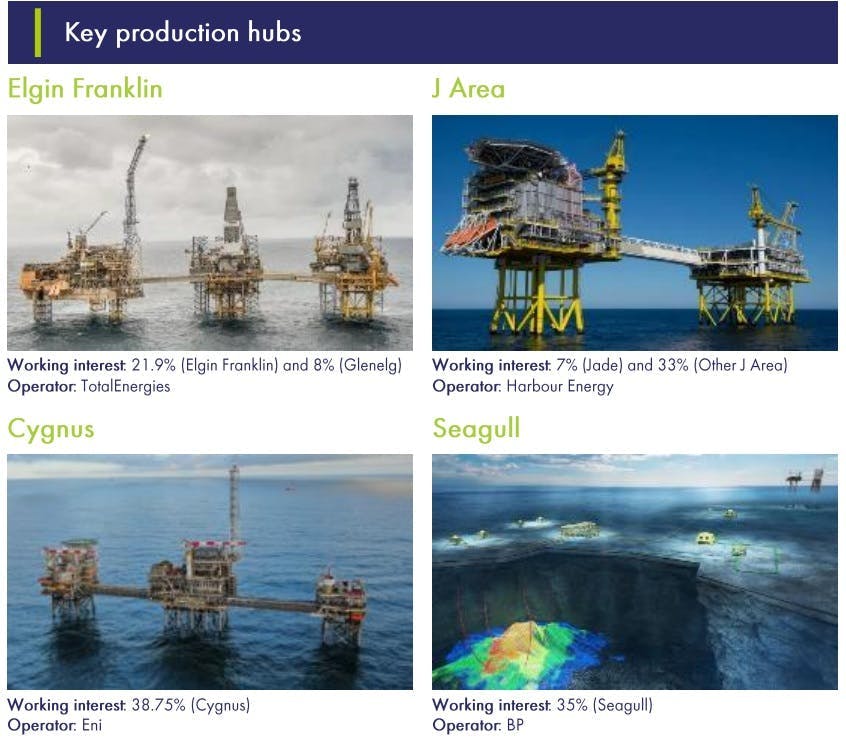

In the UK North Sea, Eni has interests in the Elgin Franklin hub, operated by TotalEnergies; J-Area (Harbour Energy), Cygnus (operated, via Neptune) and Seagull. Ithaca is itself a partner in the Elgin Franklin and Jade (J-Aea) fields.

Last year, Eni’s UK business had pro forma production of 40,000 to 45,000 boe/d and 2P reserves of about 100 MMboe.

If the merger goes through, Ithaca’s pro-forma production would rise above 100,000 boe/d, making it the UK’s second largest independent operator in terms of production.

The company has also commented on its existing UK projects in its latest results statement. At the Rosebank deepwater project west of Shetland, operated by Equinor, work has started in Dubai on upgrading the Petrojarl Rosebank FPSO (ex-Petrojarl Knarr), including making the vessel electrification-ready to comply with the objectives of the UK’s North Sea Transition Deal.

Later this year, installation of templates and satellite structures will get underway.

At Captain in the central UK North Sea, Phase II of Ithaca’s polymer EOR project is more than 90% complete with first polymer set to be injected into the subsea wells this summer. Remaining work includes final commissioning on the topsides and subsea tie-ins, with drilling already completed.

Phase I has to date recovered more than 12 MMbbl from the Captain Field. Subsurface modeling to refine the predicted EOR Phase II polymer response, based on reprocessed seismic and new field data, has confirmed initial EOR Phase II reserve recovery predictions. But the company expects Captain production under Phase II to take longer to build to a peak in 2026, before plateauing.

Following the extension of the milestones for the Cambo license west of Shetland to March 31, 2026, Ithaca continues talks with potential farm-in partners on a joint venture that could progress the Cambo oilfield project towards FID.

At the Shell-operated Pierce Field, issues with the FPSO’s mooring system have caused a temporary production shutdown, which should be rectified by mid-year.

Ithaca is projecting UK production this year in the range of 56,000 to 61,000 boe/d. It has scaled back investments in planned near-term projects due to the impact of the government’s Energy Profits Levy.

Programs deferred or cancelled include those at the Greater Stella Area, Montrose Arbroath Area, Elgin Franklin Area and Alba in the central UK North Sea.

Beyond 2024, the company foresees its production rising again toward 80,000 boe/d, supported by returns from Captain EOR Phase II project and first oil from Rosebank.

03.27.2024