UK government extends offshore levy in spring budget

Offshore staff

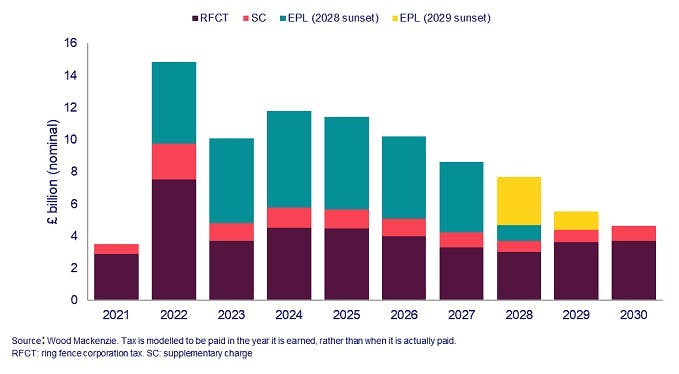

LONDON — Britain’s Chancellor of the Exchequer Jeremy Hunt has extended the Energy Profits Levy (EPL) on UK oil and gas operations until March 31, 2029.

The announcement, in yesterday’s spring budget statement, could lead to energy companies handing a further £4.1 billion ($5.2 billion) of their future cashflow to the UK government, according to a report by Wood Mackenzie.

The consultant bases it calculation on a current Brent price forecast of about $80/bbl.

“The extension of the EPL is a surprising choice by the government, as it will not generate any income for the government for at least four years,” said Graham Kellas, senior vice president of Global Fiscal Research with Wood Mackenzie. “And a tax that is now expected to have a seven-year lifespan under stable prices does not abide by most definitions of a ‘windfall’ tax.”

By retaining the current allowances and rates, Kellas added, the government’s reasoning appears to be that extending the levy will not alter companies’ investment plans.

Wood Mackenzie’s Lens database has pinpointed £28 billion ($35.72 billion) of future capital expenditure in the UK, associated with incremental investments on assets in production and the potential development of 1.8 Bboe of additional oil and gas resources.

At the same time, the industry has warned that investment could be at risk, due to the impact of the fiscal regime.

“The extension of the EPL is unlikely to impact investment decisions,” Kellas said. “However, the cumulative fiscal instability has really unsettled North Sea investors. And, in an election year, the opposition Labour party’s tax plan has added significantly to the fiscal uncertainty.”

03.07.2024