Offshore staff

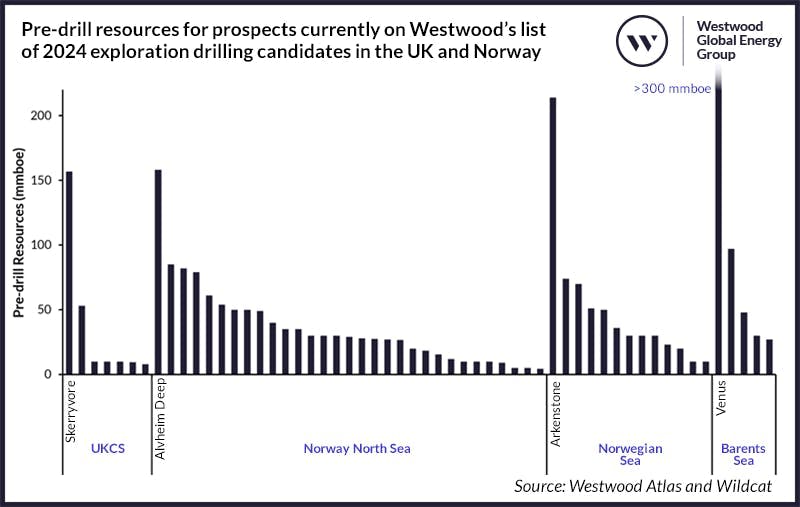

LONDON — Westwood Global Energy Group has identified a potential 49 exploration wells this year across the Norwegian Continental Shelf, targeting potential resources of about 2.2 Bboe.

According to Emma Cruikshank, head of NW Europe, much of the focus will be on the northern Norwegian North Sea, but there may also be increased activity in the Barents Sea. Here, Westwood expects five exploration wells, including three close to the Wisting Field.

Last year exploration and appraisal (E&A) drilling offshore Norway brought 15 commercial discoveries with combined reserves approaching 440 MMboe.

The largest were Carmen, Øst Frigg Beta/Epsilon, Norma and Røver Sør, all infrastructure-led wells in the northern North Sea, while only four of the successful wells were in the high-impact category and just one well was drilled in the Barents Sea.

Equinor, the dominant player on the shelf, participated in 21 of last year’s wells and operated seven of the commercial discoveries.

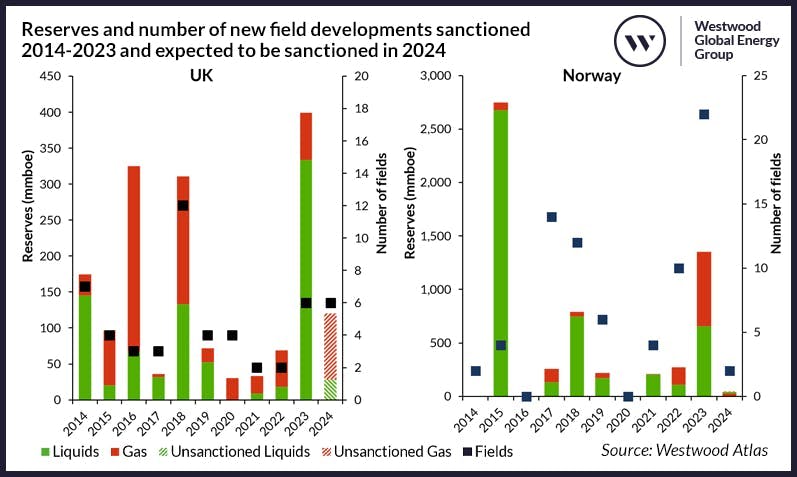

Last year the Energy Ministry approved 22 new field developments and four field extensions, with combined reserves of about 1.6 Bboe and estimated development capex totaling $26 billion.

While this will lead to multiple field startups through to the latter part of the 2020s, cost management will be critical, Criuikshank said, against a backdrop of continued global inflation and supply chain pressures.

M&A activity may be limited in 2024 as Norway has a relatively small number of companies operating on the shelf. But some of the bigger companies could rationalize their portfolios, with Equinor possibly looking to sell its equity in its higher-emission fields, while Aker BP could seek to scale back its non-core assets.

Others such as PGNiG and Sval Energi may pursue further incremental growth opportunities on the Norwegian shelf.

Over half of this was in Shell’s Pensacola in the southern North Sea, and the company was also the most active explorer, participating in three wells and operating two of the five finds.

This year Westwood expects seven exploration wells with combined pre-drill resources of about 325 MMboe, and three appraisal wells, all infrastructure-led exploration. But there is one potential high-impact well on the 155-MMboe Skerryvore propsect.

Of the 13 companies expected to participate in UK E&A drilling in 2024, NEO Energy and Harbour Energy are set to be the most active.

In 2023 the North Sea Transition Authority sanctioned six fields for development with associated reserves of 380 MMboe, led by Equinor’s Rosebank west of Shetland.

This year four fields should come onstream including Shell’s Penguins redevelopment in the northern UK North Sea, which has encountered delays to the FPSO delivery.

New field development plan submissions are being slowed by industry uncertainty and a lengthening review process. Only one field development plan was submitted in 2023, which was for Hartshead Resources’ Anning & Somerville gas fields in the southern North Sea.

But Cruikshank does foresee field development plan and environmental statement submissions this year for a few projects following M&A deals in 2023, notably the Buchan redevelopment in the central North Sea, Pilot.

Ithaca’s Cambo oil development west of Shetland faces a license renewal decision on March 31. Ithaca could take FID in 2024 to retain the license.

As for new M&A activity, deals to watch include the conclusion of the Shell and ExxonMobil southern North Sea portfolio sale, TotalEnergies streamlining its UK portfolio (with potentially a sale of Laggan Tormore west of Shetland), and farm-out processes for Rosebank and Cambo.

02.12.2024