FLNGs gaining favor helped by shorter construction/conversion times

Global capacity for floating LNG (FLNG) terminals should increase to 42 MM metric tons per year by 2030, according to Rystad Energy.

Thereafter, capacity could reach 55 MMt/yr by 2035, almost four times last year’s estimated figure of 14.1 MMt/yr.

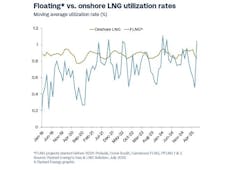

Terminals commissioned before 2024 have so far this year achieved an average utilization rate of 76%, the consultants added, comparable to the performance of global onshore LNG facilities.

Kaushal Ramesh, Vice President-Gas & LNG Research at Rystad, said: “FLNG has come a long way in less than a decade. The only real roadblocks were early teething issues that come with any new technology, as seen with projects like Shell’s Prelude, which faced cost overruns and unstable output.

“But since then, the industry has matured significantly, including Prelude itself. Utilization rates are improving, the technology is proving reliable across a range of environments, and the economics are starting to make more sense.

“From navigating permitting challenges in Canada to unlocking remote offshore reserves in Africa and Asia, FLNG is finally going mainstream.”

The picture looked less rosy in the early days of FLNG projects, such as Shell's Prelude offshore north-west Australia, which was built in South Korea by the Technip–Samsung consortium. According to Rystad, costs soared to $2,114 per metric ton, solely for liquefaction alone.

At the same time, FLNG developers are increasingly seeing vessel conversions as a cost-efficient alternative to newbuilds. BP’s Tortue/Ahmeyim FLNG offshore Mauritania and Senegal, Cameroon FLNG and Southern Energy’s FLNG MK II have all delivered lower capex levels of respectively $640, $500 and $630/metric ton from what were formerly Moss-type LNG carriers.

Those vessels’ modular spherical tank design enabled simpler integration of prefabricated liquefaction modules, Rystad noted. And more conversions could follow, with various Moss-type LNG tankers expected to be taken out of service in the next few years.

In addition, FLNG vessels are extending operations to deepwater and ultra-deepwater fields.

However, the pace of delivery to first production remains critical, with prolonged construction timelines delaying generation of revenue and putting projects at higher risks of cost overruns. On the other hand, according to Rystad, FLNG units can be delivered somewhat quicker than onshore liquefaction facilities, allowing for faster final investment decisions and more flexible execution.

It estimates that newbuild FLNG projects are typically being completed in around three years, compared to about 4.5 years for operational onshore plants. And for FLNG vessels presently under construction, the average anticipated delivery time is just 2.85 years.