By Bruce Beaubouef, Managing Editor

FLNG technology has advanced considerably since it was first launched eight years ago. The first company to commission a floating liquefied natural gas (FLNG) vessel was Petronas, with its PFLNG Satu vessel. This vessel began operations in 2017 off the coast of Sarawak in Malaysia, marking it as the first FLNG facility to produce and export LNG.

Eyes soon turned to Shell’s Prelude FLNG production facility, which would become the world’s largest FLNG vessel. Plans called for Prelude to measure 488 m in length and 74 m in width. Media reports indicated that Prelude would be five times larger than the largest LNG carrier at the time, and displace more water than six aircraft carriers. Analysts estimated the price tag for Prelude to be somewhere between $10.8 billion to $12.6 billion (Note: Shell has not released cost figures for Prelude).

Prelude came online in late 2018, but was soon confronted with a series of operational, safety, and technical challenges. These challenges included a loss of hydrocarbon containment (a gas leak) and multiple power-related incidents, including ast least two electrical trips. In one of these cases, in December 2021 smoke was detected in a utility area which then triggered the automatic fire detection and management systems. The vessel was then shut down as a precaution and lost power during the shutdown. But these incidents were significant enough – at least in some observer’s eyes – that they raised questions about the viability of the entire FLNG concept.

However, since then the offshore industry has made significant strides in addressing these challenges through a combination of re-engineering, design revisions, and operational adjustments. These changes and adaptations have in turn reinforced FLNG as a viable method for accessing stranded gas fields, such that it is now the second-leading floating field development option behind FPSOs.

While Prelude had its difficulties, the market forces driving FLNG forward endured. These included heightened LNG demand and consequent desire to access stranded gas reserves. There are estimated to be at least 300,000 billion cubic feet of natural gas lying in offshore fields – of which 40% is estimated to be stranded. Thus, the investment case for FLNG remained. What was needed was a revised engineering concept.

Revised FLNG concept

Prelude had been conceived as “the world’s biggest floating factory,” with estimated costs ranging from $10.8 billion to $12.6 billion (it should be noted that some analysts have placed Prelude’s cost at $17.5 billion). Industry engineers realized that those costs – starting with vessel size – needed to be brought down.

Following Prelude’s challenges, the industry began to focus on modular and scalable FLNG designs to reduce expenses. Smaller FLNG units, like Petronas’ PFLNG Satu (1.2 MTPA), have demonstrated that cost-effective solutions can unlock smaller gas fields. In fact, the PFLNG Satu and Golar’s Hilli Episeyo (2.4 MTPA) in Cameroon have demonstrated the technology’s adaptability to different regions and field sizes.

Technical advances

More than simply making FLNG vessels smaller, technical and design advances have spurred continued FLNG deployment. Innovations in liquefaction efficiency, modular designs, and digital automation have led the way. Specifically, improvements in cryogenic systems, gas pretreatment, and the adoption of mixed refrigerant liquefaction processes have contributed to higher production rates, reduced energy consumption, and lower operational costs.

In addition to these advances, engineers have also made improvements in FLNG vessel design, most notably in compact and modular design, improved storage capabilities, and enhanced mooring systems. These developments have been designed to improve efficiency, reduce costs, enhance safety, and align with environmental goals.

A more detailed examination of these improvements is provided below.

Liquefaction technology

Developers have brought forth several advances in liquefaction technologies in recent years. Some of the key technologies are highlighted below.

Improved liquefaction efficiency. Newer FLNG designs have focused on optimizing liquefaction processes to reduce energy consumption and increase output. For instance, Golar LNG’s MK II FLNG design, based on the conversion of the LNG carrier Fuji LNG, incorporates efficiency improvements over earlier units. The MK II has a liquefaction capacity of 3.5 million tons per annum (MTPA) and uses Black & Veatch’s technology for topsides equipment and liquefaction processes, achieving a competitive cost of around $600 per ton of liquefaction capacity.

Liquefaction systems have also become more compact and efficient. New designs use modular liquefaction units, reducing construction time and costs. For example, Golar LNG’s Hilli Episeyo (2017) employs smaller-scale, standardized liquefaction modules, allowing faster deployment and scalability compared to Prelude’s bespoke, large-scale system.

Advanced refrigeration processes. Newer FLNG projects incorporate optimized mixed refrigerant (OMR) and nitrogen expander cycles, improving energy efficiency by 10-15% over Prelude’s dual mixed refrigerant (DMR) process. For instance, Air Products’ AP-N LNG process has been adopted in newer designs for its simplicity and lower energy consumption.

Pressurized LNG (PLNG) processes. Research has explored pressurized LNG processes that operate at higher pressures (e.g., 2 MPa) and temperatures (165.7 K) compared to traditional LNG processes. These include cascade, single-mixed refrigerant (SMR), and single-expander PLNG processes, which can reduce energy consumption by up to 63% and heat transfer area by up to 42% compared to conventional LNG systems. These are particularly suited for offshore environments with space constraints.

Digital automation and optimization. Advances in digital automation, such as real-time monitoring and predictive maintenance, have improved operational efficiency. These technologies help optimize liquefaction processes, reduce downtime, and enhance safety by minimizing human error. In particular, advanced process control systems, using AI and real-time data analytics, can enhance liquefaction efficiency. These systems, seen in projects like BP’s Tortue FLNG (2023), optimize gas cooling and compression, reducing operational costs by up to 8% compared to earlier systems.

Advances in vessel design

Newer FLNG designs continue to lower costs, improve scalability, and reduce environmental impact. In addition, newer vessel designs are enabling operators to target smaller fields (1–3 MTPA) compared to Prelude’s 3.6 MTPA, making these FLNG systems viable for previously uneconomical reserves. This scalability is driving growth in regions like Africa, Southeast Asia, and Australia. Some of the key FLNG vessel design trends are outlined below.

Compact and modular designs. Newer FLNG vessels are designed to be smaller and more compact. In contrast to Prelude’s massive 488-meter hull, newer FLNG designs are prioritizing smaller, more versatile vessels, enabling deployment to smaller gas fields. And vendors are addressing the challenge of fitting complex LNG processing equipment into a limited footprint (roughly 25% of a land-based LNG plant). Technip Energies, for example, has developed modular designs like SnapLNG by T.EN, which accelerates deployment and reduces costs for mid-scale LNG production (up to 12 MTPA). These designs are adaptable for shallow waters, jetty-moored setups, or gravity-based structures. SBM Offshore’s Twin Hull FLNG concept, designed for mid-scale projects (up to 2 MTPA), converts existing LNG tankers into FLNG facilities, offering flexibility and cost savings.

Enhanced mooring systems. Improvements in mooring technology, such as internal and external turret moorings or spread moorings, have enhanced vessel stability in harsh metocean conditions. The Tango FLNG vessel, designed and built by Exmar Offshore Company, uses a “split-mooring” system to secure it alongside the Excalibur FSU in the Marine XII field offshore Congo. This mooring configuration, also developed by Exmar, involves dividing the mooring lines into two separate segments, each independently anchored to the seabed. This approach enhances safety and stability, particularly in challenging environmental conditions.

Severe weather resilience. More recent designs are prioritizing resilience against extreme weather, such as Category 5 cyclones, with reinforced hulls and advanced mooring systems. The Prelude FLNG itself set a benchmark with its double-hulled steel body and suction pile mooring system, and newer designs build on this with lighter, more durable materials. These designs are aimed at improving uptime and reducing or avoiding weather-related shutdowns.

LNG transfer innovations. Advances in LNG offloading systems have improved safety and operability in open water. Hose-based solutions for side-by-side and tandem transfers are now more reliable, allowing operations in rougher seas compared to traditional loading arms.

Converted LNG carriers. The conversion of existing LNG carriers into FLNG vessels, as seen with Golar’s Hilli Episeyo and the upcoming MK II, has become a cost-effective trend. These conversions leverage existing hulls, reducing construction costs and timelines. For example, Golar’s MK II project, scheduled for delivery in Q4 2027, has a budget of $2.2 billion, significantly lower than new-build FLNGs like Prelude (estimated to be somewhere between $10.8 billion and $12.6 billion).

Improved storage solutions. Newer FLNG vessels feature enhanced LNG storage systems with better insulation and sloshing-resistant membrane tanks. Coral South FLNG, for instance, uses GTT’s Mark III membrane tanks, which improve storage efficiency and safety as compared to older tank designs.

Electrification and sustainability. Vessel designs now integrate electric-driven systems to reduce reliance on gas turbines. TotalEnergies’ planned FLNG projects (post-2023) use shore power-compatible designs, cutting emissions by up to 25% compared to gas-powered setups.

Post-Prelude FLNG projects

Some notable post-Prelude FLNG projects include:

Golar LNG’s Hilli Episeyo (2018). Deployed off Cameroon, this converted LNG carrier has a capacity of 2.4 MTPA and has demonstrated rapid deployment and cost-effectiveness. Its success has spurred further conversions, like the MK II.

Petronas’ PFLNG Satu (2017) and PFLNG Dua (2021). These Malaysian facilities, with capacities of 1.2 MTPA and 1.5 MTPA, respectively, showcase Southeast Asia’s growing adoption of FLNG for smaller, remote fields.

Eni’s Coral FLNG (2022). Located in Mozambique’s Area 4, this facility produces 3.4 MTPA and highlights Africa’s emergence as a key FLNG region. Its design emphasizes modularity and scalability.

Eni’s Tango FLNG (2023). Now operating off Congo, the Tango FLNG vessel was designed and built by Exmar and was first deployed offshore Argentina (and was then known as Caribbean FLNG). The vessel was later sold to Eni and now operates off Congo in tandem with the Excalibur FSU (a converted LNG carrier). Both the Tango FLNG vessel and the Excalibur FSU utilize a “spread mooring” system, where the Tango FLNG vessel and Excalibur FSU are moored together, a first for an FLNG facility.

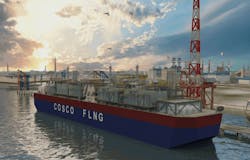

COSCO’s FLNG unit (2025). Recently approved by DNV, this unit focuses on advanced liquefaction and storage, reflecting ongoing innovation in vessel design.

Integration of CCS

In recent years, there has been a push for “greener” liquefaction. Companies are exploring the integration of carbon capture and storage into FLNG vessels to align with global emission reduction goals. The incorporation of CCS into FLNG systems is still in early stages but could reduce the environmental footprint of FLNG operations, especially in regions like Africa and Southeast Asia where FLNG adoption is growing. Projects like Eni’s Coral South FLNG (2022) have integrated CCS readiness, which has the potential to reduce emissions during liquefaction.

Projects driving advances

Some notable projects driving these advances include:

Eni’s Coral South FLNG (Mozambique, 2022). Features compact liquefaction modules and CCS readiness, showcasing post-Prelude efficiency gains.

bp’s Tortue Ahmeyim FLNG (Mauritania/Senegal, 2023). Uses a smaller hull and advanced digital controls for cost-effective production.

New Fortress Energy’s Fast LNG (2024-2025). Employs modular, near-shore FLNG units, a departure from Prelude’s large-scale, offshore model, reducing costs by up to 40%.

Future market drivers

Today, there are five FLNG units in operation worldwide, producing over 12 million tons of LNG annually. Some projections foresee 18 units in operation by 2030, producing 60 MTPA – indicating a strong market confidence in the FLNG concept.

Since Shell’s Prelude FLNG project, advances in FLNG technology have focused on improving liquefaction efficiency, reducing costs through modular and converted designs, enhancing safety and weather resilience, and aligning with environmental goals via CCS and low-carbon solutions. Projects like Golar’s MK II, Petronas’ PFLNG series, and Eni’s Coral FLNG demonstrate the industry’s shift toward smaller, scalable, and cost-effective solutions. These developments are unlocking previously stranded gas reserves, particularly in Africa and Southeast Asia, while addressing the global demand for cleaner energy.

Going forward, advances in modularization and conversions aim to further lower costs. In the future, the industry will move towards mid-scale FLNGs, CCS integration, and hybrid LNG-to-power solutions (such as iLNGP by Technip Energies) to meet remote energy needs.

Key market drivers going forward will include:

Cost reduction. New FLNG projects aim for costs below $500/ton of LNG produced annually, compared to Prelude’s estimated $1,200/ton, driven by modular designs and economies of scale.

Scalability. Smaller FLNG units (0.5-2 MTPA vs. Prelude’s 3.6 MTPA) will enable access to stranded gas fields, expanding market reach.

Decarbonization. Newer FLNG designs will prioritize lower carbon footprints, with hybrid power systems and methane slip reduction technologies.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.