Subsea boosting advances reduce cost, lower risk

David McLaurin

Rebecca Roth

INTECSEA

The offshore industry has faced an era of increasing challenges, not only from reduced oil prices but also the need to develop new methods to enable development of previously inaccessible reserves. There are currently many common goals among operators. Reducing costs, increasing operational capability and reducing risk facilitate more widespread utilization of subsea processing. Technological advances are being made today with these key goals as the driving factor. On the forefront of innovation, operators are investing in the future of all subsea processing systems, but have primarily focused on subsea boosting due to the field proven status and clear benefits of the technology.

Status of subsea processing

Since its inception, subsea processing has maintained the primary goal of enabling operators to develop fields that were previously not economical, as well as allowing for recovery of additional reserves. The equipment on the seabed may also reduce topsides facilities space and weight requirements. Operators have achieved these goals with the help and technology from subsea pump suppliers, system integrators, and independent engineering firms. Subsea processing technology as a whole is considered to be mature, with subsea boosting, gas compression, separation, and flowline heating field proven at this time. Subsea processing continues to evolve in terms of cost and capability. Operators considering subsea boosting now significantly benefit from standardization, new technologies and a more competitive environment among manufacturers.

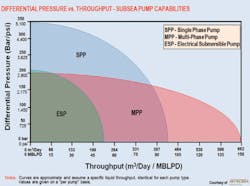

The development of ultra-deepwater fields; fields with long tiebacks; or low-pressure reservoirs has pushed the industry to develop cost-efficient solutions for mitigating hydrostatic head in deepwater and friction losses of long tiebacks. The industry-accepted solution is subsea boosting. The capabilities of subsea boosting systems have increased during recent years. Larger throughput and differential pressure capabilities and wider tolerance for production anomalies have lowered both capex and risk associated with subsea boosting systems.

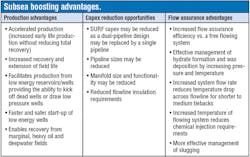

Whether the project is a declining brownfield project or an up and coming greenfield project, the enhanced oil recovery (EOR) provided by boosting systems can significantly increase the value of the field, and does not necessarily require significant up-front investment. Along with EOR, subsea boosting also provides production, capex, and flow assurance advantages.

Technology advances

There are a number of advantages that can be derived from the latest subsea boosting technologies. These include:

Reducing capex. The standardization of pump hardware and simplification of equipment specifications have enabled the streamlining of the design and fabrication process, decreasing lead time and reducing capex.

New technologies such as the high voltage motors currently available on OneSubsea pumps are enabling boosting systems to be installed with longer tiebacks, without the use of subsea transformers. High voltage motors allow for increased voltage between VFDs and motors, decreasing voltage drop caused by long power conductor step-outs. Pump hardware has also increased in size and capability (shaft power, pressure differential and throughput) allowing lower pump quantities to satisfy project requirements and decreasing cost. For example, pump systems with 0.8 to 1.5 MW shaft power were considered high power in the past. Today, 3.0 MW pumps are common and suppliers are now qualifying equipment to reach as high as 6.0 MW shaft power.

Additionally, advancements in motor drive and pump designs such as modular pump stages with subsea VFDs have reduced the topsides real-estate and weight requirements. Innovative barrier fluid solutions such as water-based barrier fluid systems (for permanent magnet motors) eliminate the need for barrier fluid dehydration topsides. There are even qualified pump systems which completely eliminate the need for barrier fluid and remove all barrier fluid equipment from topsides and subsea.

There has also been an increase in the quantity of subsea boosting system suppliers. The increase in competition has been a key facilitator of lower capex.

Up-front planning to enable subsea boosting for a project can lead to significant capex savings when the boosting system is installed. One of the largest challenges for suppliers developing boosting systems on brownfield projects has been the lack of real estate, weight capacity and power on the host facility to install these systems. There are also benefits to enabling tie-in and isolation in the subsea hardware during front-end design as this could prevent a shutdown of production when subsea boosting equipment is installed.

Increasing operational tolerance. Increasing boosting system performance and tolerance to production conditions such as high gas volume fraction (GVF) or gas slugs has been a primary goal amongst operators and boosting system suppliers. The increased motor efficiency of permanent magnet motors (used on TechnipFMC and BHGE pumps) and increased motor speed capability of both permanent magnet motors and high duty induction motors allow pumps to better handle high GVF. Enhancements in recirculation systems such as upstream homogenization and downstream compact liquid recirculation separators also enable pumps to handle higher GVF. The results of all these advancements are multiphase pump systems which can operate with production from 0-95% GVF and at 100% GVF for limited durations.

In combination with higher power motors, new innovative subsea pump designs allow for enhanced control of pump stages, more effective pump stages and greater tolerance to changes in the well-stream. Modular, compact subsea pumps have been developed by Baker Hughes, a GE company which include subsea VFDs for each separate, modular stage. This allows for control of each pump stage individually and can increase the pump’s ability to handle changes in the well-stream. Helico-mixed pumps are a new, qualified technology from Aker Solutions which allow for more pressure to be generated per pump stage.

Reducing risk. Over the past several years, there have been large advancements in the reduction and control of risk associated with subsea boosting systems. Standardization of subsea pump equipment such as rotors, impellors and seals has allowed for proven understanding of performance. At the same time, new developments have been made in pump system designs which incorporate lessons learned as boosting system performance is better understood.

Another enabler for risk reduction is condition monitoring. New hardware such as proximity probes allow for better visibility of subsea pump status and behavior. Proximity probes are a more capable alternative to accelerometers for vibration monitoring. Condition monitoring software and service packages, provided by pump suppliers, allow for in situ performance analysis, trending and predictive maintenance/intervention at times of opportunity rather than times of failure.

Subsea processing poster

This issue ofOffshore also contains the 2018 Worldwide Survey of Subsea Processing poster, the eleventh installment of this industry resource. The primary aims of this poster are to chronicle the development and developers of these systems and to document the continued commitment of oil companies to the application of these technologies. For online access to view and download all posters, please visit http://www.offshore-mag.com/maps-posters.html.