In select applications, AUVs work faster, cheaper than tethered vehicles

By Gregor Bo

Dr. Robert E. Randall

Texas A & M University

E. Kurt Albaugh

Mustang Engineering

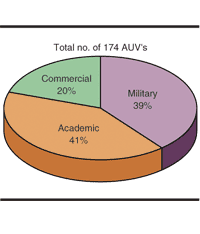

Mustang Engineering and Offshore Magazine have sponsored Texas A&M University's Ocean Engineering Program in developing a worldwide survey of AUVs (autonomous underwater vehicles). Because of the growing interest in AUV technology by the oil and gas industry, itself a function of the greater water depths these vehicles must operate in, a comprehensive survey listing of all types of AUVs was prepared. The survey, included with this article, lists 86 AUV types comprising a total of 174 individual AUV units worldwide serving commercial, academic, and military needs. This article summarizes the survey results.

"One half the cost, in one fifth the time, with the best quality data seen in deepwater yet," commented BP's Geohazard Team Leader Andy Hill on the subject of survey data produced by C&C Technology's autonomous underwater vehicle (AUV), the Hugin 3000, recently in the Gulf of Mexico. Also, Brian Schostak of Shell International E&P Inc. compared an AUV to a conventional deep tow system in 6,000 ft water depths. He found the AUV performed its work in 42% of the time, at only 70% of the deep tow cost.

In survey operations, the AUV efficiencies cited here come from the fact that an AUV is not attached to a surface vessel via a long towline. This produces a number of advantages:

- An AUV's turning time on line surveys is several minutes, versus six hours or more for conventional tows.

- An AUV's average survey speed of 4 kts is significantly higher than the deep tow's average of about 2 kts.

- Without the towline, sea surface effects on the surveying platform are negligible, thereby allowing the AUV to hold a survey line within several meters of the required path and at the required altitude, resulting in improved quality of survey data.

AUVs are capable of pure autonomy (without communication with the operator), an unusual event in today's underwater robotic world. Prudence, and operating within the comfort zone, dictates some degree of control over the vehicle, therefore an acoustic link is commonly maintained, either for data sampling or providing direct control.

History

Using the AUV definition decided upon by the oil and gas industry, the first conceivable untethered underwater vehicle is Whitehead's 1868 self- propelled torpedo. According to the 1999 MTS ROV Committee, the more orthodox history begins with Dimitri Rebikoff Sea Spook in 1960, followed by the Applied Physics Laboratory's (University of Washington) Self Propelled Underwater Research Vehicles developed in 1963 and 1973, and the Unmanned Artic Research Submersible (UARS) in 1972. For the remainder of the 1970s and 1980s, AUV development was slow, due to a need for improvements in energy, computing, and navigation technology.

By the late 1980s, cutting edge AUVs were slowly appearing, funded primarily by the US Navy: Martin Marietta's MUST Lab, and Applied Remote Technology's XP21. Elsewhere, the Soviet Union at the Institute of Marine Technology Problems (IMTP), had built the MT88, which was capable of operating in 5,500 meters water depth.

During the 1990s, improvements in computers, sensors, and batteries enabled the scientific community to develop remarkable AUVs, such as Woods Hole Oceanographic Institute's (WHOI) Autonomous Benthic Explorer and Florida Atlantic University's (FAU) Ocean Voyager and Ocean Explorer. AUV development has branched from the military and the ocean exploring scientific community to the commercial offshore survey market, notably Kongsberg-Simrad's Hugin 3000, Maridan's M600 and Bluefin Robotics' Odyssey class vehicles.

AUV capabilities

Today, AUV units are capable of performing a plethora of missions, including:

- Pipeline and cable route survey and inspection

- Under-ice exploration, mapping, and cable laying

- Coastal survey and mapping

- Product test bed

- Mine countermeasures

- Search and submarine hunting

- Communication platforms

- Hydrographic survey

- Physical and chemical oceanographic survey

- Fish counting and environmental monitoring.

AUVs operate over a range of water depths, with 59% of the surveyed AUVs rated working up to 1,000 meters, 14% from 1,000-3,000 meters, and 27% at 3,000 meters or deeper. One of the deepest rated AUVs is the US Navy's AUSS, designed to operate at 6,500 meters.

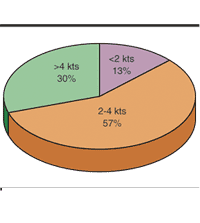

The speed of the AUV is an important factor; however, average speed and endurance may be more important. There is a broad spectrum of speeds among AUV units. Stanford's experimental Otter has a presumed top speed of 0.5 kts, whereas ISE's Dorado flies along at a top speed of 17.5 kts, with an average speed of 10 kts.

An AUV's endurance depends upon speed, mission requirements, payload, and battery type, and is quantified in both time and distance. Of the surveyed AUVs, 46% operate less than 12 hours, 19% between 12-24 hours, and 17% greater than 24 hours. Currently, Underwater Research Lab's Purl II operational limit is 2.5 hours, whereas Webb Research Corp's Slocum can operate up to 5 years.

Another important capability is the ability of an AUV to operate in adverse sea conditions, for example, at sea state 5. AUVs operate beneath the surface where wind and wave effects are drastically minimized, but launch and retrieval are very sensitive to surface conditions and involves human safety concerns. To increase the ease of launch operations, most AUVs have their own launch and retrieval system.

US military applications

The US Navy has been a long-term investor in underwater technology. Past Navy AUVs include the EAVE West, AUSS, XP21 and the MUST Lab. Currently, the Navy's vision has shifted to include hostilities occurring in the coastal region. In the Navy's Unmanned Undersea Vehicle Master Plan, the Navy's equivalent for UUV focuses on critical missions of intelligence, surveillance, reconnaissance, mine countermeasures, tactical oceanography, communications, navigation, and anti-submarine warfare. To meet the vision, an intermediary system was completed in 1999 with a follow-on project, the Long Term Mine Reconnaissance System (LMRS), with greater capability and higher performance to be completed by 2003 at a cost of $400 million.

Academic/scientific/research

Academia's drive for expanding knowledge and understanding of the oceans has resulted in the development of relatively low cost vehicles. WHOI's REMUS, FAU's Ocean Voyager II, and Heriot-Watt University's RAUVER are cost efficient AUVs. Oceanographic measurements require physical samples to be taken. This can be either expensive, in the case of research vessels, or inaccurate, as in ships of opportunity.

AUVs, such as WHOI's ABE and Southampton Oceanography Centre's (SOC) Autosub offer a less expensive means to gather water column and seafloor information, often in places they were previously unable to collect data. SOC recently completed an Antarctic mission using the Autosub, where the vehicle operated underneath the ice for several hours.

Commercial offshore

Several scientific AUVs have crossed over into the commercial offshore arena. MIT Sea Grant AUV Lab has generated equipment for Bluefin Robotics Corp., and Halliburton Subsea has purchased SOC's HS-Autosub. This burgeoning survey AUV environment is extremely fertile ground with excellent potential savings to the offshore industry.

Research indicates the anticipated savings to the offshore industry will be about $700 million over a five-year period by using AUVs for routine deepwater tasks, bathymetric surveying in deep and shallow water, and pipeline surveying. The savings are derived from two areas - more efficient AUV operations and design of structures.

By producing superior quality survey data of the ocean floor bathymetry and composition, pipeline paths can be rerouted to minimize cost, avoiding field delay costs and decreasing over-engineered designs of offshore structures.

Commercial survey AUVs are being successfully used instead of the deep tow systems. Future subsurface markets of opportunity for AUVs involve the submarine cable industry, and resource management and bathymetric surveying of the designated Exclusive Econ-omic Zones (EEZ). EEZs equate to 32 million sq nautical miles worldwide and could provide almost unlimitless work, surveying for various resources and boundaries

Issues

Even though the AUV appears to be a critical tool to conquering the deep ocean depths, there exist some issues that need to be resolved. A recent paper (Mark Patterson et al in the MTS Journal) discusses foreseeable problems with AUVs operating in areas where human diving operations are ongoing, and the possibilities of an AUV seriously injuring or killing a diver. A workgroup containing members from both the Marine Technology Society (MTS) and the Society of Underwater Technology has recently been created to discuss, with the intent of providing workable solutions to several important issues.

- What is the legal definition of an AUV?

- Is an AUV a vessel requiring surface identification at all times?

- Can you keep an AUV if you find one, or will you be charged with piracy?

Another issue relates to sensor interface standardization within the industry, particularly in the case of hybrid vehicles performing subsea docking. Yet another issue under discussion is quantifying data quality assurance and control.

Future

The US Navy's vision for the next 50 years involves battlefield dominance via unmanned systems. NMRS and LMRS are two steps in that direction, possibly in conjunction with small, inexpensive, multiple operated AUVs. In the scientific world, continuing research of alternative power for AUVs to obtain mission endurances measured in years, similar to the Solar AUV, a collaborative product of IMTP and Autonomous Undersea Systems Institute.

Other interesting research involves robotic imitation of fish for efficient propulsion and endurance, such as MIT's Robo Pike and Kato Lab's Blackbass Robot. In the commercial offshore arena survey, AUVs have a proven track record of quality data at an attractive cost. Future improvements in energy density and computer efficiency will increase mission endur-ance, data storage, and transmission. To enhance fut-ure operational efficiency, multiple tasks or missions may be carried out concurrently using coordinated multiple smaller AUVs with increasing ease of launch and recovery, possibly from small boats or even air launched.

There will likely be an increase in the number of survey AUVs taking an increasing share of the survey market away from deep tow vehicles and ROVs. With the success of commercial survey AUVs, the offshore market may be willing to research further advances in AUV task and capability expansion, and also accepting increased risk.

The next step up the AUV evolutionary ladder is the hybrid AUV/ROV and work class AUV. A hybrid AUV/ROV combines the assets of an AUV with a ROV. The AUV will taxi a ROV down to a prescribed subsea station, plug the ROV into a power grid and communications link, eliminating the surface-to-ROV tether. Research projects by MIT, MBARI, the US Naval Postgraduate School, the EU MAST Program, and others to design docking stations for AUVs, which can be easily converted for hybrid AUV/ROVs, are already producing working prototypes.

The commercial hybrid AUV/ROVs should be accepted and working within the next five years. Work class AUVs incorporate the intervention capabilities of a light work class ROV in an AUV, eliminating ROVs for all but the most work intensive, high-energy tasks. Due to the technological requirements in energy, computers, and increased sensor efficiency, industry expectations are for work class AUVs to become a reality, within the next 10 years.

Because of the initiatives of BP and C & C Technology, the benefits of AUV technology for deepwater offshore field development are now becoming more apparent to the offshore industry. AUVs will continue to evolve and provide more and better information for the offshore industry.

Authors

Gregor Bo is in the US Navy's Ocean Facilities Program. He holds a BSCE from Florida Institute of Technology and an ME in Ocean Engineering from Texas A&M University.

Dr. Robert E. Randall is Professor of Ocean and Civil Engineering, Director for the Center of Dredging Studies, and a Fellow in the Marine Technology Society, and the author of "Elements of Ocean Engineering."

E. Kurt Albaugh, PE has been with Mustang Engineering for the past 10 years, specializing in planning and economics of offshore field development.