Subsea standardization initiatives aim to remove uncertainty, improve quality

Kristan Berg, DNV GL – Oil & Gas

Oil and gas operators need cheaper subsea solutions to recover more from mature fields and enable economically sustainable deepwater projects. There is a substantial incentive for the subsea industry to meet these needs.

If oil remains in a $60 to $70/bbl range, the subsea market could grow by about 7% annually up to 2025, according to Rystad Energy.1 However, the analyst warned that “a significant portion of this activity is at risk” if the Brent crude oil price falls to $50/bbl.

These facts of commercial life are sustaining an appetite for collaboration in the standardization of equipment and practices, enabling cost-effective and safe subsea solutions. While operators seek to keep costs down by using the same technologies from project to project, modifications are always needed. Joint industry projects (JIPs) can ensure industry guidelines and standards remain current and cost-effective.

JIPs managed by DNV GL have led to a recommended practice (RP) offering criteria, technical requirements, and guidance on qualification, manufacture, and testing of carbon and low alloy steel forgings for subsea applications2; and quality management requirements.3

Uniting efforts to advance subsea production

More recently, such collaboration has resulted in the launch of a new RP to standardize operator requirements for welding and inspection of subsea equipment. For the first time, DNVGL-RP-B204 Welding of subsea production system equipment provides agreed and harmonized operator requirements and best practice guidelines that will ensure consistency in the fabrication of subsea pressure containing equipment such as wellheads, xmas trees, manifolds, and jumpers.

This RP aims to improve on the current practice of major operators having company-specific requirements for subsea welding, in addition to requirements in API, ASME, and ISO standards.

This disjointed approach creates uncertainty during tenders and project execution, as suppliers are prevented from standardizing tenders and manufacturing processes.

It will also lower the cost and time involved by reducing non-value-added work and lessening the amount of qualification activity performed in each project.

The JIP, which started in February 2017, involved 12 operators, contractors and fabricators, and will continue to extend the scope of the RP to additional applications within subsea production systems.

The RP has already been included as a contract reference in several new subsea development projects.

For subsea boosting, the new DNVGL-RP-F303 Subsea pumping systems provides a detailed specification to deliver more cost-efficient subsea processing across more projects. Subsea processing technologies improve both hydrocarbon recovery and the environmental footprint of a field.

It specifies normative and informative technical requirements for an entire subsea pumping system with pressure rating up to 1,035 bar (15,000 psi) and water depths down to 3,000 m (9,842 ft). It applies to single phase, hybrid, and multiphase pump types.

The RP aims to provide a comprehensive specification for subsea pumping systems, reducing risk and increasing the reuse of qualified technology. It seeks to lower cost, offer predictability, and act as a contractual reference document between purchaser and supplier.

2020 vision for subsea investment and skills

According to DNV GL’s latest outlook, the oil and gas industry is on a clear path to increase efficiency and reduce its carbon footprint. The 10th annual report surveyed more than 1,000 senior oil and gas professionals globally, and interviewed a range of experts, business leaders, and analysts. Those reporting that their organization is actively adapting to a less carbon-intensive energy mix jumped from 44% two years ago to 60% in 2020.

New Directions, Complex Choices: The outlook for the oil and gas industry in 2020 outlines expectations that capital may not flow as freely into large oil and gas projects in the year ahead. However, companies operating across the industry’s value chain expect to boost investment this year in areas that will allow them to forge a long-term position in the energy transition.

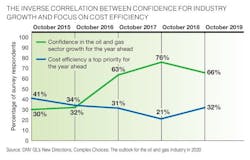

Cost efficiency will be the top priority for nearly one-third of senior oil and gas professionals’ organizations (32%), up from 21% a year ago. Eight out of 10 (81%) respondents believe the industry needs to develop new operating models to achieve further cost efficiencies, recognizing the fact that much of the more obvious cost-cutting has already taken place following the 2014 oil price crash.

For more than half of those questioned (56%) digitalization remains the highest priority for first (or further) investment in 2020. However, spending in the subsea sector is on par with energy storage (22% and 21%, respectively). Notably, investment intentions for subsea jump to 28% for those questioned in Latin America.

For the first time, the annual report looked at the most pertinent skills needed in the industry in 2020. Nearly one-fifth (18%) specified the requirement for more subsea engineers and marine specialists, while the greatest demand was for project managers and planners (31%).

Standardized interfaces

In order to keep pace and stay competitive, it is essential for all involved in the subsea industry to work together to standardize operations and avoid unnecessary cost and risk. DNV GL research found the trend to collaborate has remained relatively stable over the past two years, from 66% in 2018 to 62% this year.

There is even more scope to cut costs for subsea parts, modules, and systems. With oil prices where they are, cost-efficient subsea solutions are needed for hydrocarbons to remain lucrative. Three-quarters of respondents (75%) expect their organization to achieve greater standardization of tools and processes to reduce costs in the year ahead – up from 70% in 2019.

Standardization involving whole subsea systems could gain impetus from a trend toward digitalization and electrification in the sector. Operators plan to operationalize all-electric solutions in frontrunner subsea projects from 2020.

A new DNV GL study4 predicts that if implementation challenges are solved, all-electric will be applied to greenfield developments in sensitive areas and in deeper waters toward 2030, before becoming the mainstream option.

According to Neil Brown, innovation & technology manager – Norway, UK & Canada, Subsea 7, the industry now has normative standards and design codes for most of what it designs and engineers.

He believes hardware and software interfaces for whole subsea systems could be the next frontier in subsea standardization.

“Having many different connectors does not create value, but having a standardized item does,” Brown said. “It is easier for people trying to differentiate between two products if they have a standard way of connecting to other equipment or infrastructure.”

This approach has boosted innovation in other industries, he observed: “We can learn from the experiences of the automotive, aerospace, and IT hardware and software sectors. USB [universal serial bus] connectors on personal computers are an example of a standard interface that enables innovation of peripheral equipment.”

USB 1.0 became a de facto standard in 1996, only two years after seven computer and microchip companies began collaborating on its development.

Accelerating subsea technology development

While cost is the obvious driver, subsea solutions and expertise also offer safety and environmental benefits as they enable the use of fewer personnel in hazardous conditions, as well as boasting an intrinsically lower carbon footprint than topsides.

To speed the journey of innovative subsea technologies to commercial deployment, a DNV GL research project called Safety 4.0 is developing a framework of work processes, methods, and tools for standardized and quicker demonstration of safety for novel subsea technologies. It will introduce more highly integrated solutions, advanced use of sensor data and data analytics, and new safety philosophies. The initiative will be applicable in all oil and gas regions.

The project, with involvement from oil and gas operators and academia, grew out of the observation that demonstrating the safety of novel subsea technologies can be complicated, because current standards represent current technologies.

Insight and learnings from the project may be used to update future regulations and standards, and can be valuable and applicable to other industries beyond subsea. •

References

1. ‘High stakes for subsea markets if oil price slides’, Rystad Energy, press release, 22 August 2019 https://www.rystadenergy.com/newsevents/news/press-releases/high-stakes-for-subsea-markets-if-oil-price-slides/

2. ‘DNVGL-RP-0034 Steel forgings for subsea application’ https://www.dnvgl.com/oilgas/download/dnvgl-rp-0034-steel-forgings-for-subsea-applications.html

3. ‘DNVGL-RP-B202 Steel forgings for subsea applications - quality management requirements’ https://www.dnvgl.com/oilgas/download/dnvgl-rp-b202-steel-forgings-for-subsea-applications-quality-management-requirements.html

4. ‘Technology Outlook 2030’, DNV GL, 2019 https://www.dnvgl.com/to2030

5. ‘Safety 4.0’, DNV GL, 2018 https://www.dnvgl.com/research/oil-gas/safety40/index.html