TechnipFMC to split into two engineering supergroups

Offshore staff

PARIS – The board of TechnipFMC plc has approved a plan to separate the group into two independent, publicly traded companies.

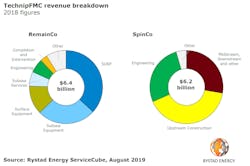

RemainCo, an integrated technology and services provider, will focus on energy development. SpinCo, as a leading engineering and construction (E&C) player, will seek to capitalize on the global energy transition.

TechnipFMC claimed the separation would improve flexibility and growth opportunities.

The transaction will likely be structured as a spin-off of TechnipFMC’s Onshore/Offshore segment and headquartered in Paris. Pending approvals, the separation should be completed during the first half of 2020.

Two years ago, Technip and FMC Technologies merged to form what was claimed to be the world’s sole fully-integrated subsea service provider.

Doug Pferdehirt, chairman and CEO of TechnipFMC, said: “Since the creation of TechnipFMC, we have pioneered the integrated business model for subsea and transformed our clients’ project economics.

“To further enhance value creation, our board of directors and management team have continuously evaluated strategic options and, after a comprehensive review, determined that it is in the best interest of TechnipFMC and all of our stakeholders to create two diversified pure-play leaders.

“We are confident that the separation would allow both businesses to thrive independently within their sectors, enabling each to unlock significant additional value.”

SpinCo, with around 15,000 employees, should be uniquely positioned to capture LNG opportunities, TechnipFMC said, due to its project delivery model, demonstrated capabilities and proven track record.

It would comprise the company’s Onshore/Offshore segment, including front-end engineering and design specialist Genesis; Loading Systems, a specialist in cryogenic material transfer products; and subsea robotics. process automation developer Cybernetix.

SpinCo’s CEO will be Catherine MacGregor, currently TechnipFMC’s president, New Ventures, with Marco Villa as COO.

RemainCo, headquartered in Houston with around 22,000 employees, will focus on integrated production solutions adapting TechnipFMC’s integrated model in subsea to surface technologies.

Doug Pferdehirt will be chairman and CEO, with Maryann Mannen as executive vice president and CFO.

Rystad Energy’s head of oilfield service research Audun Martinsen said: “This move shows that TechnipFMC is a forward-thinking company with the ability to shape the business environment it operates in.

“The successful integration of FMC Technologies into the Technip organization in 2017 was impressive in its own right, creating a leading subsea entity on the global stage. Then to turn around two years later and manifest the value creation by splitting the company in two is truly remarkable.”

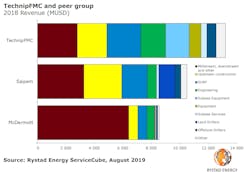

According to the consultant, TechnipFMC’s subsea division is now the market leader with $4.4 billion in revenues, well ahead of Subsea 7 ($2.4 billion) and Saipem ($2.2 billion).

Its success has largely been built on integrated contracts, which enable it to deliver entire subsea field development projects to oil and gas companies.

Today integrated contracts comprise around 60% of new field developments, Rystad added.

“The potential savings from integrated projects are sizeable for E&P companies and have been a big reason why larger operators tend to prefer this model on major projects,” Martinsen said.

“Subsea developments will be the main focus for RemainCo, which means that more resources, R&D and management attention can be devoted to accelerating this trend forward.”

Mhairidh Evans, principal analyst, at Wood Mackenzie, said: “In 2017, Technip and FMC Technologies completed one of the hallmark oilfield service company mergers of the cycle. The business plans to split in the first half of 2020 – but not back into Technip and FMC – rather into ‘upstream’ and ‘mid/downstream.’

“The upstream company, termed RemainCo for now, will be, in essence, the legacy FMC Technologies’ equipment and services business, plus Technip’s subsea vessels and subsea, umbilical, riser and flowline (SURF) manufacturing business. This will also include the surface wellhead business. We believe that the subsea sector is a growing market.

“The mid/downstream company, termed SpinCo, will be an engineering and construction business, focusing on LNG, downstream, and petrochemicals, and will build on the legacy Technip position in those areas.”

Evans said the proposal appeared to be “less about ‘correcting’ something that is not working today, rather with an eye on the longer game ahead. Essentially, the demerger is a proactive positioning move for a longer-term market shift.

“The demerger provides focus and flexibility for each of its divisions, which were already fairly distinct. For example, we’d expect the subsea division to build on its market leadership – perhaps by considering other acquisitions or strategic directions that the wider TechnipFMC couldn’t support.

“The two new companies will have different appeal for investors. We think the market will like RemainCo, the more pure-play upstream company, which is already a market leader in subsea.”

SpinCo, she added, “as a longer-term horizon, and is less capital- and asset-intensive than its upstream counterpart. It’s also a deliberate sidestep away from the upstream cycle, towards the energy transition…”

08/26/2019