Brazil’s upstream exploration gets major Bumerangue boost

Key Highlights

- bp's Bumerangue discovery is the largest in 25 years, with an estimated 1.1 Bboe in recoverable resources, revitalizing interest in Brazil's presalt reservoirs.

- Recent exploration success at Petrobras' Aram Block and new bid rounds in Foz do Amazonas and Pelotas basins signal renewed industry confidence despite environmental and technical challenges.

- International operators like Chevron, CNPC, ExxonMobil and Shell continue to participate in Brazil's exploration, though some have faced setbacks, highlighting the sector's evolving landscape.

- Brazil's upcoming open acreage bid in October aims to attract more investment, with a focus on high-potential presalt and deepwater blocks.

By Santosh Kumar Budankayala, Rystad Energy

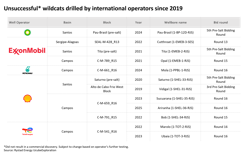

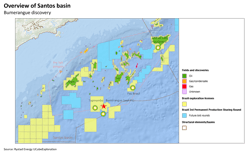

Brazil’s upstream exploration sector might have received a much-needed shot in the arm with bp’s find in the Bumerangue exploration block earlier this week. Rystad Energy currently estimates that the 500-m column of gross hydrocarbons could hold about 1.1 billion barrels of oil equivalent (boe) in recoverable volumes. This new find, which bp is calling its largest global discovery in 25 years, comes at a time when majors, such as ExxonMobil, TotalEnergies, Shell and other national oil companies (NOCs) with international portfolios (IOCs), such as Petronas, have drilled a string of unsuccessful* wells in the past few years.

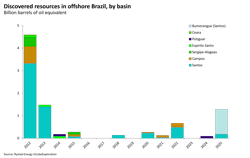

The recent exploration environment has created uncertainty around exploration success in Brazil’s presalt polygon in the Campos and Santos basins. However, this recent find along with the one at the nearby Aram Block by Brazilian NOC Petrobras have been reassuring, with the country not seeing annual discovered volumes exceeding 1 Bbbl since 2014.

A total of 14 exploration blocks were awarded to various majors and international players in the presalt blocks between 2017 and 2019, and more than $5.5 billion was spent on signature bonuses in acquiring these blocks, but exploration drilling proved unsuccessful on several and have hence been relinquished.

However, the Bumerangue discovery will inject renewed interest into the high-quality presalt carbonate reservoir, where most of the wells drilled in the recent past have failed to live up to expectations.

Petrobras’ exploration drive

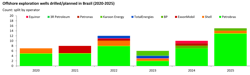

Rystad Energy also observes other positive indications in the country, with Petrobras drilling at elevated exploration levels seen over the past few years, in addition to private players taking up new blocks in the offshore Foz do Amazonas Basin.

Petrobras has drilled multiple wells on the Aram Block. Other drilling activity from Petrobras this year include an appraisal well at its Natator find in the North Brava presalt block and appraisal activity on the Aldo de Cabo Frio Central Block, in which bp holds a 50% non-operating stake. The company also made a discovery at a deeper reservoir at the Búzios Field earlier in the year.

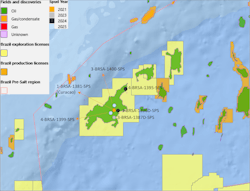

Petrobras in 2021 announced a discovery at its 1-BRSA-1381-SPS (Curaçao) well, drilled in the Aram presalt block. Following the Curaçao discovery, Petrobras successfully carried out a formation test in early 2022, confirming the productivity of thick presalt carbonate reservoirs and collecting oil samples for laboratory analysis.

While Petrobras remains tightlipped on any estimates around the in-place, recoverable resources at Aram, it has nonetheless embarked on a significant appraisal program. The operator is currently drilling ahead at its fourth and fifth appraisal wells using the Valaris DS-4 and West Auriga drillships.

The Brazilian NOC had earlier drilled two appraisal wells in 2024 and another in 2023 as well. The wells, Curaçao Extensao, Tortuga Leste and Curaçao Extremo Leste (3-BRSA-1387D-SPS, 4-BRSA-1395-SPS, and 3-BRSA-1396D-SPS), drilled in 2023-2024 have all been successful. These appraisal activities form part of the discovery assessment plan, which runs until 2027.

The block was awarded to Petrobras (80%) as operator, with the remaining stake owned by China National Petroleum Corp. (CNPC). The block commanded a signature bonus of $1.2 billion with a profit oil share offered to the government at 30%. Covering an area of about 4,500 sq km, it is also one of the largest blocks awarded in presalt rounds.

Exploration beyond presalt

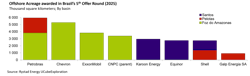

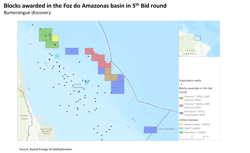

Brazil’s 5th Permanent Offer bid round on June 17 could be termed as a success as the industry saw international operators taking up blocks in the Foz Do Amazonas Basin. The round saw awards of 34 blocks, generating about $180 million in signature bonuses. The round drew intense competition in the equatorial margin, particularly in the Foz do Amazonas Basin, despite ongoing environmental licensing concerns.

The round saw new awards, particularly in the Foz do Amazonas and Pelotas basins, which have no prior production history. Despite ongoing uncertainties over environmental approvals, competition for acreage in Foz do Amazonas was intense. Of the 19 blocks awarded there, the average signature bonus exceeded $8 million per block, representing about 85% of the total bonuses raised in the round. Chevron and CNPC jointly secured nine blocks, while Petrobras and ExxonMobil took 10, split evenly, with each company operating five.

bp’s Bumerangue find

bp’s discovery well—referred to as 1-BP-13-SPS, as per Brazil’s National Agency of Petroleum, Natural Gas and Biofuels (ANP)—was spud in late May using the Valaris Renaissance drillship in a water depth of 2,372 m, and it was drilled to a depth of 5,855 m. The Bumerangue discovery was drilled within the prolific presalt Santos Basin and is said to have encountered a column of 500 m of gross hydrocarbons in a high-quality presalt carbonate reservoir with an aerial extent of greater than 300 sq km. This calls for extensive appraisal activity to determine the geographical stretch of the reservoir.

bp has also reported an elevated level of CO2, which could complicate and escalate development plan costs. Hence, detailed fluid level analysis will hold the key toward determining the recoverable volumes and development plan. Another key datapoint to look out for is the net-to-gross ratio, which determines how much of the 500-m column are productive reservoirs.

The Bumerangue discovery follows the one drilled on the Pau Brasil Block last year, with bp reporting signs of hydrocarbons at that well to ANP. However, this does not indicate a commercial find at the block. The Pau Brasil well was the first one that the London-based major had drilled offshore Brazil in 10 years as an operator. It has also been involved in drilling on the Alto de Cabo Frio Central and Alto de Cabo Frio Noroeste blocks as a non-operating partner since 2022. bp further intends to drill in the Tupinamba Block, which is located west of the Bumerangue Block.

The recently announced Brazilian discovery could become a cornerstone of bp’s strategic focus on exploration, wherein the major is set for an extensive return to deepwater exploration. The company plans to drill about 40 exploration wells in the next two years under this revised strategy.

bp first got into presalt production sharing contracts (PSCs) in 2017, with a non-operated stake at the Alto de Cabo Frio central block. In 2019, the major acquired the Pau Brasil Block with operatorship. Then, in 2022 and 2023, bp secured two of the four blocks awarded in the first two production sharing permanent offers: Bumerangue and Tupinamba, both with 100% stakes. A special highlight goes to the latter two as both were awarded with the lowest signing bonus and the lowest profit oil among the presalt PSC blocks. The Bumerangue Block also has the lowest profit oil of 5.9% in Brazilian PSCs. Other taxes in Brazil include the 15% royalty rate and the corporate income tax of 34%. However, each block awarded in the presalt rounds have a different profit oil as it is a biddable term.

The Bumerangue find is the first discovery made on the new open presalt block awards since 2022. The next iteration of the production sharing permanent offer will take place on Oct. 22 this year, offering seven blocks (Jaspe, Citrino, Larimar, Ônix, Itaimbezinho, Ametista and Esmeralda)—five in the Campos Basin and two in the Santos Basin.

The success of bp and recent indications of success at Aram by Petrobras could be the positive push the industry needs after international operators saw some failures over the last few years.

Historical performance of international operators

- bp reentered Brazil in 2017 through PSCs, taking operatorship of Pau Brasil and later full control of Bumerangue and Tupinamba. Its first operated well in a decade, Pau Brasil (2024), was unsuccessful, which raised doubts before the Bumerangue discovery restored confidence.

- ExxonMobil once pursued an aggressive acreage strategy in Santos and Campos, spending billions in signature bonuses. However, wells like Tita (2021), Opal (2021) and Cutthroat (2021) failed to deliver. The company has since relinquished blocks, signaling a pullback from earlier ambitions.

- Petronas entered through Round 16 but faced setbacks with Saturno (2020) and Mola (2024). It has remained cautious, with few new commitments since.

- Shell, a long-time Brazilian player with producing stakes in Libra (Mero) and Búzios, has not seen positive sings on the exploration side. Operated wells such as Vidigal (2019), Saturno (2020), Sucuarana (2023) and Ariranha (2025) all proved unsuccessful, though it continues to maintain a significant footprint.

- TotalEnergies, which had ambitions to drill in the Foz do Amazonas Basin, did not make commercial finds at its Marolo (2022) and Ubaia (2023) wells in the Campos Basin.

*Unsuccessful refers to wells not leading to a commercial find until date. Further testing by the operators at a later date may affect these results.

About the Author

Santosh Kumar Budankayala

Santosh Kumar Budankayala is vice president of Upstream Research at Rystad Energy, where he leads strategic analysis and insights into global oil and gas markets. With more than eight years at Rystad, he has progressed through key roles in upstream analytics and business strategy, shaping data-driven decisions for clients across the energy value chain. Prior to Rystad, Santosh held an analyst role at Enverus and gained hands-on technical experience at GE. He holds a bachelor's degree in mechanical engineering from Vellore Institute of Technology.