Brazil E&P entrants provide short-term boost to production

Offshore staff

EDINBURGH, UK — Mid-cap upstream operators entering Brazil’s E&P sector will make $10 billion of capex investments over the next decade, according to a report from Wood Mackenzie.

As these entrants take on fields sold by Petrobras, they will likely raise production from these assets to a peak of 485,000 boe/d by 2027 (but tailing off thereafter) and increase their remaining reserves by 980 MMboe by 2035.

“For several years, Petrobras has pulled back on its investments in mature assets, which has provided an opportunity for mid-cap operators to renew drilling in these areas and develop more efficient production operations,” said Amanda Bandeira, Latin America Upstream analyst for Wood Mackenzie. “We will see a significant shift in Brazil’s production makeup. In 2015 Petrobras held 84% of all production. That level will drop to 61% by 2030, as the majors and the independent operators’ output grows.”

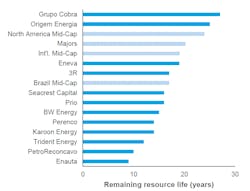

Companies in the report include 3R Petroleum, BW Energy, Enauta, Eneva, Grupo Cobra, Karoon Energy, Origem Energia, Perenco, PetroReconcavo, Prio, Seacrest Capital and Trident Energy.

“While we will see growth for these companies in the near-term; resources are finite and they will have to adjust to new strategies once these mature assets are no longer productive,” said Vinicius Diniz Moraes, another Wood Mackenzie Latin America Upstream analyst. “We already see some moves to bolster the longer-term outlooks through M&A and exploration. Late-life asset optimization will also be a focus to maximize the operational life of their mature asset portfolios.”

12.01.2022