Panoro looking to co-fund Gazania wildcat offshore South Africa

Offshore staff

OSLO, Norway – Panoro Energy has signed a farm-out agreement offshore South Africa with a subsidiary of Africa Energy Corp. (AEC).

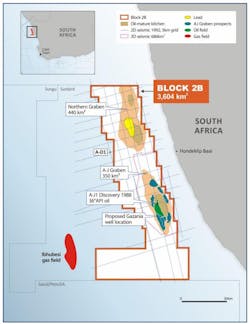

The company will gain a 12.5% interest in block 2B off the west coast in the Orange basin in exchange for carrying the AEC subsidiary for up to $2.5 million of the planned Gazania-1 exploration well.

Block 2B contains a rift basin oil play, with an existing discovery. Gazania could hold 349 MMbbl.

The well could spud during 4Q, depending on regulatory approvals and rig availability. Panoro’s total share of drilling costs including the AEC carry should be around $5 million.

Under a separate farm-out, Namibia-based Azinam will take a 50% share and operatorship of the block.

The A-J graben rift basin is said to exhibit similar characteristics to other basins in which major oil accumulations have been discovered by Africa Energy’s technical team in Uganda and Kenya.

Oil was generated in lacustrine source rocks present in the deepest parts of the basin. The oil migrated and accumulated in fluvial and lacustrine sandstone reservoirs around the basin flanks.

According to Panoro, there is also significant potential in other rift grabens to the north and south of the A-J graben plus the prospect of significant gas discoveries in the shallower sequences above the rift graben succession across the entire block.

Soekor discovered and test flowed 191 b/d of 36° API oil in 1988 from a 10-m (33-ft) sandstone interval with the A-J1 well.

More recent 3D seismic data suggests significant upside potential in six prospective areas in locations up to 800 m (2,624 ft) shallower than the original well.

Gazania-1 will be drilled into the Gazania and Namaqualand prospects identified on this data.

02/25/2020