Universal field development approach can help advance stalled GoM projects

Repeatable host facility, well system building blocks are key components

Richard D’Souza, Shiladitya Basu, Sandeep Khurana

Granherne – A KBR Company

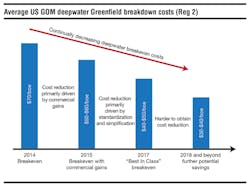

The general state of the deepwater industry is distressed. From 2010 to the oil price collapse in mid-2014, WTI prices averaged a robust $100/bbl. During this time capital spending on deepwater projects increased dramatically while the number of sanctioned projects declined. The reasons for this anomaly are attributable to upstream cost inflation, lack of capital discipline, and increasing project complexity (some controllable, some not). The upshot was that by 2014 average breakeven project costs were $70/bbl while cost and schedule overruns were the norm rather than the exception.

It should be no surprise that post-2014 only four deepwater projects with a host platform were sanctioned, including Shell’s Vito this year. This is reminiscent of a similar collapse that occurred in 1986, and now as was then, the industry is confronting an existential threat to its survival. Deepwater projects must compete for capital with onshore shale projects where breakeven costs in the prolific Permian basin are below $35/bbl.

In 2014, the industry hit the reset button to urgently find ways to bring breakeven costs of deepwater projects more in line with lower oil prices, on the premise that they would remain lower for longer. The breakeven costs averaging $50/bbl were achieved by 2017, primarily driven by significant reductions in drilling rig day rates and organic cost deflation of the supply chain.

The Upstream Capital Cost index dropped by 30%. Industry also began an urgent focus on standardization and simplification initiatives related to equipment and bulks, the complexity of which had become a major inflation driver. An additional $15/boe breakeven cost reduction is needed to enable the sanction of future deepwater projects in the GoM. This will be harder to obtain. The question and challenge is: How do we get there?

To achieve these harder-to-obtain breakeven cost reductions, the authors propose the notion of a universal field development (UFD) approach that utilizes repeatable host facility and well system building blocks for most, if not all, future GoM developments, large or small, in deep or ultra-deepwater.

The premise is that by repeating major field development building blocks, the cost and schedule efficiencies of standardization and simplification initiatives are not only fully realized but also amplified.

To analyze the value of this approach, it is necessary to begin by providing the rationale for selecting the universal field development host and well system building blocks. Then, it will be useful to demonstrate how these breakeven reductions will be achieved by not only compressing costs and schedules, but also improving delivery and performance certainty.

Host platform selection

In the early stages of field development planning, a key decision is whether the host platform supports wet or dry trees. Both types of platforms have been extensively utilized in the GoM. From 1985 to 2000, the selection was heavily biased toward dry tree TLP and spar platforms with full drilling or light intervention capabilities. While a driver was the preponderance of aerially compact, stacked reservoirs, there were lingering concerns about high drilling and intervention costs of subsea wells but also their reliability and recovery factors. From 2000 onwards, the pendulum began to swing in favor of wet trees as projects moved into ultra-deepwater and subsea technology matured.

A wet tree well system tied back to a host platform is the choice for the UFD because it:

• Provides greater field architecture flexibility to adapt to subsurface variability and uncertainty

• Significantly reduces platform size and complexity with attendant safety/operational benefits

• Offers faster cycle time to first and peak oil

• Substantially reduces drilling and intervention spread costs relative to dry trees

• Has reliability and ultimate recovery of subsea wells that approach those of dry tree wells.

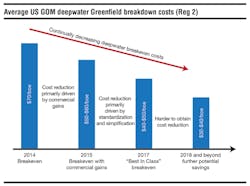

That still leaves four proven wet tree host platforms to select from – TLP, spar, semisubmersible, and FPSO. All have been repeatedly deployed in the GoM. The following selection criteria are used to drive the decision:

• The universal host must have the bandwidth to accommodate a water depth range from 3,000 ft to 10,000 ft and topsides from 10,000 tons to 40,000 tons

• The host platform must have the flexibility to accommodate multiple future subsea tiebacks and associated topsides expansion

• Topsides to hull integration and offshore installation and commissioning project phases are high risk activities with many possibilities for schedule slippage and little float for recovery and have often resulted in significant project delays and cost overruns

• The greater the number of proven EPC or fabrication contractors the more competitive the commercial bids.

Under this analysis, and with these parameters, the semisubmersible platform was selected as the best choice for advancing stalled deepwater projects in the Gulf of Mexico.

Host platform trends

The selection of a wet tree semisubmersible platform as the universal building block for future GoM developments is heuristically validated by observing trends in platforms selected from 2010 onwards. This includes platforms that were sanctioned as well as those that progressed to FEED. From 2011 onwards, all 15 platforms were wet trees. From 2015 onwards, all seven platforms were semisubmersibles, the most recent being Shell’s Vito platform sanctioned this year.

There are an additional five platforms that could potentially be sanctioned as semisubmersibles in the next three to four years (King’s Landing, Shenandoah, Anchor, Tigris, and North Platte).

Building blocks

Following the 2014 oil price collapse, industry immediately embarked on many standardization and simplification initiatives focusing on equipment, components, and bulk materials. One of the broadest is the JIP33, a global standardization initiative facilitated by a consortium of Oil and Gas Producers (IOGP) focusing on standardization of procurement specifications of equipment and bulk material (subsea wellheads, ball valves, piping and valve material). In the past, the lack of standardization meant reinventing the wheel, each time eroding considerable value. The goal of the JIP was to drive structural and sustainable reduction in upstream costs. The first phase results indicated potential reductions of up to 20% in capex and 40% in schedule compression. The universal field development approach will add to these savings by facilitating repeatability on a project scale.

Competitive rescoping

The process of simplification and standardization that begets the significant breakeven cost reductions begins by challenging institutionalized corporate orthodoxies of specifications and standards that are the chief causes of cost inflation. Major operators have undertaken various forms and degrees of rebaselining to strip projects down to their basic functional objectives.

Shell Oil is the leader in these efforts on subsea and platform systems (as well as drilling and operating costs). They follow a bottoms-up approach that begins by establishing a minimum technical scope for two small deepwater field developments generated by external contractors that had delivered “outlier” performance. The designs were calibrated and adjusted to a minimum acceptable internal scope. Only “must-have” optional functionalities were added to arrive at a competitive scope and all others shelved.

The final designs represented workable, operable systems that reduced capital costs by up to 25% based solely on scope reductions. Shell applied competitive rescoping to three major GoM projects, all of which were sanctioned after 2015.

System standardization

Significant cost and schedule savings have been achieved by many operators via standardizing designs of field development building blocks at the system level. The combination of universality and repeatability provides the biggest bang for the buck.

Standardized catalogue of semisubmersible hull and deck designs by Shell, Exmar, and GVA have streamlined procurement specifications, contracting strategies, and fabrication workflows resulting in continuous improvement through repeated execution and eventually to improved adherence to and confidence in cost and schedule. Similar standardization efforts have been successfully applied to topsides and SURF designs.

Cost and schedule benefits

The proof of the pudding is in the eating. Some examples of substantial and quantifiable benefits achieved by standardization of deepwater platforms are described below.

Shell was an early adopter of this approach, standardizing five major TLPs in the GoM sanctioned from 1989 to 1999. The Mars TLP, sanctioned in 1993, was the prototype around which succeeding TLPs were standardized, yielding continuous improvement in project performance.

ExxonMobil adopted a design one, build two approach for their large FPSOs deployed on the Kizomba A and B fields in Angola sanctioned in 2001 and 2003, with tangible improvements in cost and schedule from A to B. The approach was replicated for the TLP wellhead platforms and subsea systems that were part of the development with similar success.

They also contracted for five standard, leased FPSOs from SBM from 2002 and 2008 for deployment in various deepwater West Africa fields. SBM developed a generic FPSO design to a FEED level from a functional specification provided by ExxonMobil and adapted each for field specific applications.

Other examples of successful deepwater floating platform standardization include the suite of Anadarko’s spars and LLOG’s semisubmersibles in the GoM and Petrobras’ replicant FPSOs in the Campos and Santos basins.

Breakeven costs

To test the premise of the potential for significant breakeven cost reductions afforded by employing the proposed universal field development approach for GoM developments, a breakeven analysis was run on a hypothetical deepwater development in the GoM using the recommended semisubmersible host platform and subsea building blocks. The breakeven costs were derived by a life cycle discounted cash flow analysis that included all costs, revenues, government take, and a 10% return on capital.

The base case breakeven cost for the hypothetical field development is $42/boe. This metric accounts for commercial gains realized up to 2017 but not the benefits of building block design repeatability.

The schedule acceleration and cost reduction assumptions are based on eliminating contingency for cost and schedule overruns that are built into the base case. While drilling and operating costs are not explicitly addressed here, there is ample evidence that up to 20% reduction in base case costs are achievable by applying the principles of competitive scoping, improved supply change and logistics management, and the increasing adoption of automation and digitization technologies to reduce manning and improve production efficiency.

This breakeven analysis quantifiably demonstrates the potential for an additional 15 to 20% breakeven cost reduction to the threshold of $35/boe level, on the presumption that the full benefits of the UFD are realized.

Mad Dog Phase 2

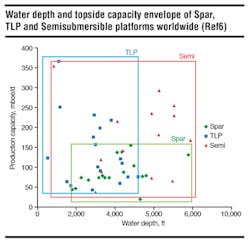

BP used the principles of standardization and simplification to sanction the Mad Dog Phase 2 project. In 2013, when oil prices were still above $100/bbl, BP recycled the Mad Dog Phase 2 project as the cost and complexity of the development plan (which had included a large spar platform with wet trees) led to questionable economics. The recycled plan included scaling down the development and selecting a wet tree semisubmersible host platform that BP had successfully deployed on the Atlantis field.

By reducing the scale of the development, standardizing and competitively rescoping the platform and competitively tendering for turnkey platform delivery (among other drilling and subsurface initiatives), BP achieved the substantial reductions in breakeven costs that enabled project sanction in 2016.

It is no coincidence that the recycled field development utilized the proposed unified field development building blocks.

Conclusion

The fundamental premise of a universal field development for the GoM is standardizing the well system and host platform building blocks. A wet tree semisubmersible host platform provides the greatest bandwidth and flexibility to adapt to all possible field development scenarios, a conclusion validated by recent field development trends.

By introducing the notion of repeatable building blocks, the UFD approach amplifies the already significant cost and schedule reductions attained by standardization and competitive rescoping at component levels.

By scaling back the size of projects and accelerating implementation of automation and digitization technologies, additional capital and operational efficiencies are generated.

Taken together, these provide the benefits shown and facilitate attaining the ultimate goal of deepwater projects competing with onshore shale projects.

Shell’s recent sanctioning of the 300-MMbbl Vito project supports this approach, with a scaled down wet tree semisubmersible, competitive rescoping, standardization and digitization. The reported breakeven cost is less than $35/bbl. •

Acknowledgment

Based on the paper “A Universal Field Development Approach for Advancing Stalled GOM Deepwater Projects” presented at the Offshore Technology Conference (OTC-28970), in Houston, Texas, April 30-May 3, 2018.