Decommissioning data provides insight into project economics

Mark J. Kaiser

Center for Energy Studies, Louisiana State University

Mingming Liu

Academy of Chinese Energy Strategy

The Gulf of Mexico (GoM) is one ofthe most actively explored deepwater basins in the world. When projects are sanctioned, they require extensive planning, engineering, and construction work to complete.

This fourth installment of the series reviews deepwater GoM installation and decommissioning activity trends and uses end-of-life production data to infer economic limits.

Operators pursue side track drilling and tieback opportunities to maximize the value of their assets and to ‘keep the pipes full,’ and when opportunities become scarce, they may actively market their infrastructure for third-party processing or seek to divest.

Near the end-of-production, when all possible opportunities are exhausted and the structure can no longer serve a useful purpose, planning for decommissioning begins.

Only a few deepwater structures are installed or removed annually and these activity levels are not expected to change in the future.

Installation trends

In recent years, the number of fixed platforms installed throughout the GoM have diminished significantly, especially in shallow water, and in the deepwater similar trends have been observed.

Fixed platforms and compliant towers

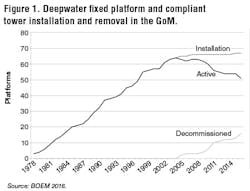

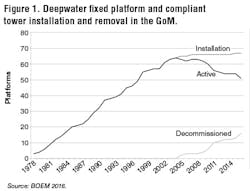

In total, 64 fixed platforms and three compliant towers have been installed in water depth greater than 400 ft (122 m), and circa 2016, there are 48 fixed platforms and three compliant towers in the region.

Shell’s Cognac platform in MC 194 was the first structure installed in water depth greater than 1,000 ft (305 m) and is currently operated by EnVen Energy Ventures. Bullwinkle, the deepest fixed platform in the GoM, was installed by Shell in 1988 in 1,353 ft (412 m) water depth and is currently operated by Fieldwood Energy Offshore.

Six fixed platforms have been installed in water depths greater than 1,000 ft and all are currently active. They include, besides Cognac and Bullwinkle, Virgo, Amberjack, Pompano, and the recently installed Coelacanth.

The three compliant towers Lena, Baldpate, and Petronius were installed in 1,000 ft, 1,648 ft (502 m), and 1,754 ft (535 m) water depth, respectively. ExxonMobil is currently performing environmental studies and seeking a permit to reef Lena in-place via partial removal. Baldpate and Petronius are still prolific producers.

Active inventories of deepwater fixed platforms have peaked and structure decommissioning is expected to dominate future trends.

Floaters

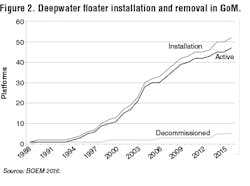

In total, 52 floating structures have been installed in the GoM and five floaters have been decommissioned, leaving an active inventory of 47 circa 2016. Floaters have been installed at a pace far exceeding removals and active floater inventories continue to increase.

Placid Oil installed the first semisubmersible in the GoM in 1988 in 1,534 ft (468 m) water depth at the GC52/Llano field. The first TLP was installed by ConocoPhillips in 1989 at the Jolliet field. Neptune was the first spar installed in 1996 by Oryx Energy in 1,930 ft (588 m) water depth, and the first FPSO was installed by Petrobras in 2011 in 8,300 ft (2,530 m) water depth at the Cascade/Chinook field.

From 1985-1999, TLPs with dry tree wells and topsides integrated with the hull at quayside dominated installations.

From 2000-2007, 30 floater developments were sanctioned and marked the introduction of large newbuild semis and the widespread acceptance and adoption of wet tree developments. Most TLP and spar developments during this period were integrated offshore.

In the aftermath of Hurricanes Katrina and Rita in 2005, updated metocean criteria was adopted and a new set of developments were installed over the past decade.

Projects sanctioned or under construction circa 2016 include: Appomattox (semi) sanctioned in 2015; and Stampede (TLP) and Big Foot (ETLP) sanctioned in 2016.

Decommissioning trends

Twenty-one deepwater structures were decommissioned through 2016, five floaters and 16 fixed platforms. Deepwater structures have been decommissioned every year since 2009, usually one or two per year, with higher levels of activity in 2011 and 2016.

All the semisubmersibles were towed back to shore for decommissioning, while the majority of the other deepwater structures were either reefed in-place or towed to a deepwater reef site.

Fixed platforms

Fourteen of the 16 decommissioned fixed platforms were primarily gas producers, and the average time to decommission after the last year of production was five years, with a range between two to 10 years.

Eight structures, all gas producers, had inflation-adjusted gross revenues of less than $3 million (2014$) the last year of production (average $750,000). In addition, these same eight structures had an average gross revenue of $6.1 million the second-to-last year of production, suggesting that on average once a deepwater gas platform generates about $6 million it has two years or so before it becomes uneconomic, and then another five years on average before it will be decommissioned.

The average and median inflation-adjusted economic limits for all decommissioned fixed platforms were $9.9 million and $2.7 million, respectively. The large difference between these statistics is due to two structures with unusually high terminal revenues of $58 and $59 million.

In total, seven structures had economic limit less than $2 million and 14 structures had economic limit less than $10 million.

Floaters

Five floaters have been decommissioned through 2016: GC29/Llano (semi, 1989), Cooper (semi, 1999), Typhoon (MTLP, 2006), Red Hawk (spar, 2014), and Gomez (semi, 2014).

Chevron’s Typhoon MTLP suffered catastrophic damage from Hurricane Rita in September 2005 and was decommissioned at a deepwater reef site at Eugene Island 367 in June 2006.

After ATP Oil & Gas declared bankruptcy in 2013 and no buyers for its Gomez semisubmersible could be found, it was decommissioned in March 2014 and towed back to port at Ingleside, Texas.

Anadarko decommissioned the Red Hawk spar in September 2014 at a deepwater reef site in Eugene Island 384.

The three semisubmersibles were each removed within one year of last production, Typhoon was decommissioned two years after last production, and Red Hawk was decommissioned six years after last production.

Inflation-adjusted revenues the last year of production for the five floaters ranged from $4.1 to $82 million, and the average revenue was $33 million ($31.2 million median).