Field development process speeding up

Offshore staff

LONDON – Oil and gas project operators are seeking faster returns and shorter cycle investments for field developments, according data/analytics provider GlobalData.

Anna Belova, senior oil & gas analyst at the company, said: “Projects now go from final investment decision (FID) to first oil/gas in under three to four years, even for larger integrated developments with midstream components.

“Globally, this trend was observed with Zohr [offshore] Egypt, which produced first gas only 22 months after the FID, and more recently with Liza in Guyana.

“Aside from phased approaches, shorter development timelines are enabled by continuing push towards standardization, both with production drilling and well design. Furthermore, the offshore environment continues to move towards subsea tiebacks and FPSO units are the dominant development concept.”

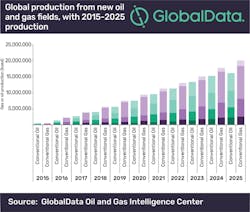

This year GlobalData expects 99 new gas projects to start production. Although the number of new oil projects is larger, at 112, the gas projects will be producing 17% more hydrocarbons per boe by 2023 once they reach maturity, the consultant claimed.

Due to uncertainties over long-term demand, oil and gas operators look set to shy away from high-cost oil reserves, GlobalData added.

In 2020, 14 ultra-deepwater oil and gas projects are set to start production. All but two are off Brazil and in the US Gulf of Mexico.

01/29/2020