OE 2019: UK offshore market poised for revival

Offshore staff

ABERDEEN, UK – Rystad Energy expects a new wave of UK field development projects to be sanctioned toward 2022.

The consultant forecasts that final investment decisions (FIDs) could be reached on as many as 38 new UK offshore projects over the next three years, representing $22.6 billion in greenfield expenditure if UK prospective resources live up to expectations.

Audun Martinsen, head of oilfield services research at Rystad Energy, said: “If operators’ plans play out as intended, the 38 potential project commitments expected over the next three years will provide fertile ground for contractors, and a quick look at successful UK North Sea service companies from the recent past sheds some light on who may capture this growth in the near future.”

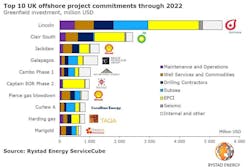

TechnipFMC has been the top service provider in the UK market in recent years, measured in revenues, followed by Wood and Schlumberger.

With project sanctioning forecast to accelerate in the UK, Rystad expects the EPCI market to grow by 65% over the next three years, while the subsea and seismic markets are each forecast to expand by 35%. Maintenance and operations, well services and commodities, and drilling contractor purchases are each expected to grow at a more subdued rate.

“After several tough years, the sun may finally be ready to shine again on the UK offshore market,” Martinsen remarked on the opening day of Offshore Europe.

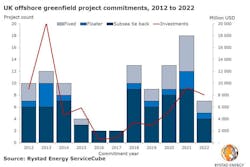

UK offshore greenfield investments declined from a peak of $20 billion in 2013 to $550 million in 2016, and in turn causing oilfield service unit prices in the region to fall by 27% on average.

The consultant expects the number of UK project commitments to shrink slightly this year before rising sharply in 2020 and again in 2021, when it forecasts a new peak with about 18 FIDs worth a combined $9.3 billion. Only about seven projects are expected to be sanctioned in 2022, but they include some major developments and the collective capex commitment is projected at $8 billion.

“The largest single development on the list is Hurricane’s Lincoln project, at an estimated $5.4 billion, albeit recognizing that its schedule could be hindered depending on the viability of its fractured basement reservoir,” Martinsen said. “The largest project likely to be sanctioned before the end of this year is the $1-billion first phase of Siccar Point’s Cambo development.”

09/03/2019