Giant deepwater gas find offshore Mauritania could be largest of 2019

Offshore staff

DALLAS – BP and partners Kosmos Energy and state-owned SMHPM have discovered a potentially giant gas field in the BirAllah area offshore Mauritania.

According to Kosmos, the Orca-1 well, drilled by the Valaris DS-12 drillship 125 km (77.7 mi) offshore in 2,510 m (8,235 ft) of water to an MD of 5,266 m (17,277 ft), was targeting a previously untested Albian play. Results exceeded pre-drill expectations, with the well delivering 36 m (118 ft) of gas pay in high-quality reservoirs.

In addition, the well extended the Cenomanian play fairway by confirming 11 m (36 ft) of net gas pay in a down-structure position relative to the Marsouin-1 discovery well, drilled on the crest of the anticline.

Orca-1’s location, roughly 7.5 km (4.7 mi) from the crest of the anticline, proved both the structural and stratigraphic trap of the Orca prospect. Kosmos estimates a mean gas initially in place (GIIP) of 13 tcf.

The company’s chairman and CEO Andrew G. Inglis said Orca-1 appears to be the largest deepwater hydrocarbon discovery worldwide so far this year.

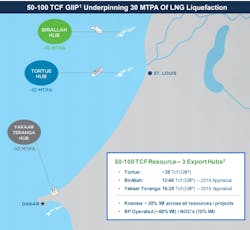

The two wells combined may have de-risked up to 50 tcf of GIIP from the Cenomanian and Albian plays in the BirAllah area, the company added, claiming that this would be more than sufficient to support a new LNG project. In addition, the partners have identified a deeper, untested Aptian play within the area and surrounding structures.

Kosmos will now extend the timeline for its offshore Mauritania/Senegal sell-down process into 2020, in order to give interested parties more time to analyze the new data.

According to analyst Wood Mackenzie, Orca-1 is the third-largest discovery made so far this year, and the largest deepwater find.

Lennert Koch, principal analyst, sub-Sahara Africa upstream, at Wood Mackenzie, said: “Orca-1 de-risks up to 50 tcf in the BirAllah area plays, which are in the same fairway as the Greater Tortue Ahmeyim and Yakaar gas discoveries. It also provides options on what to develop first.

“Nevertheless, each is faced with a major monetization challenge. Mauritania has no domestic gas market to speak of. There are plans to further develop Senegal’s gas market, but this will not be sufficient to develop these deepwater gas resources. The main way out will be liquefied natural gas (LNG).”

Koch added: “After a record year for LNG project sanctions in 2019 (63 MM tonnes per annum to date), supply by the mid-2020s looks plentiful, which may keep prices low.

“Developing another LNG project, and finding buyers for that LNG, could be challenging. Finding the right partners who can provide LNG offtake will be an important next step for the further developments after Tortue Phase 1.

“But if an onshore LNG solution can be found, BirAllah and Orca could prove to be a simpler hub than the cross-border Tortue development.”

Liam Kelleher, from Wood Mackenzie’s gas and LNG team, added: “As the resource is right on Europe’s doorstep, it will be able to compete with expensive US LNG. Meanwhile, the majors are preparing for energy transition, in which gas will be a crucial ingredient.

“We think the discoveries in Mauritania and Senegal will see the region become a major LNG hub in the long term, with a combined output of greater than 30 million tonnes per annum by the mid-2030s, pushing the region into the top 10 producers worldwide. Orca-1 simply adds to this potential.

“The region will have to compete for buyers in the competitive global LNG market, in which the US is set to become the biggest supplier in the world by 2024. Yet its lower cost conventional resource can make it more competitive.

“The delivered cost of LNG into Europe from Mauritania and Senegal has a breakeven of less than $6.2 per million British thermal units (mmbtu), while US LNG has a breakeven closer to $7/mmbtu.”

10/28/2019