P.2 ~ Caution, capital realities to drive deepwater GoM operations

View Article as Single page

Combining the need to address cash flow but not over-react, the focus is likely to be where the impact is more easily reversible should the current price plunge reverse in whole or part. However, not all decisions will be choices; commitments already entered into will drive actions. Short-term revenue protection from hedging will allow a few months or a year or so for some activity to continue where otherwise cash flow realities might make any decision moot. For some companies, in an otherwise healthy position, the fall in prices might actually represent an opportunity, whether to press ahead with an acquisition or a project that might now cost less as construction and manufacturing constraints disappear and costs adjust accordingly.

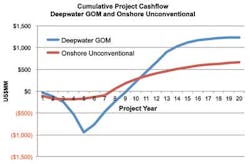

Costs, investment levels, and returns for individual companies in the deepwater GoM can be comparable with the unconventional, even though the life cycle of each of these types of development projects is quite different. The analysis conducted by GCA compared the expected rate of return (ROR) of two investment scenarios – one in the deepwater GoM, and the other in onshore unconventional shale resources. In both scenarios the capex over the lifecycle of the investments amounts to about $1 billion. While the onshore project outperforms the deepwater GoM at higher prices, at less than $80/bbl the deepwater GoM is the more attractive unit. It becomes marginal or uneconomic at less than $60/bbl.

Another difference is the manner in which capital investments are made. In the GoM project, much or all of the $1 billion capital will be committed and spent perhaps five years before any cash starts flowing back. What is critical then is not the price of oil in 2015, but the price of oil in 2020. From a decision-making perspective, that means the expected price of oil in 2020 and the risk that it may be something different when 2020 arrives. Projects under way are unlikely to be stopped. Exploration in 2015 is the 2018-2020 investment project, and halting exploration prematurely may mean not having the next project to take advantage of a stronger price environment at a later time.

In the onshore unconventional shale investment, decisions can be much more short term. Drilling can be cut back, or ramped up, in fairly short order. GCA's analysis found that the $1 billion of capital may in fact be only $100-200 million of exposure, depending on the drilling intensity being undertaken, and this can be adjusted to accelerate or decelerate as market and corporate circumstances dictate.

The data suggest that it is possible for deepwater GoM projects to be viable above $60/bbl, which suggests that for the medium term, even if prices were to stay around mid-December 2014 levels, there is sufficient incentive for ongoing activity without the benefits likely to accrue through cost reduction initiatives. However, the extent of longer-term activity relative to that which has arisen following three to four years of generally $100-plus/bbl is still going to be affected by where future oil prices appear to be settling, and the extent to which the industry is able to address cost inflation that has arisen in that same time window.

The range of companies in the onshore unconventional and deepwater is quite different. Onshore has a huge mix of players from small independents to majors, and the former are going to be driven heavily by having to address their financing needs. On the other hand, deepwater GoM is the preserve of the large independents and majors for whom it is more an issue of capital allocation than financing. Thus to preserve value for the future suggests that companies with both asset types in their portfolio onshore unconventional projects will be preferentially be deferred, where other factors do not prevail.

The start of 2015 is therefore likely to be driven by a combination of caution and capital realities. Both fundamental economics and the flexibility of US unconventional development – relative to offshore operations – suggests that this will be the focus of cost reduction. Activity within the GoM will be more heavily influenced by perceptions of the medium- to long-term oil prices, and any changes in activity levels are expected to lag behind those experienced in the unconventional shale and tight oil plays.

The authors

Bob George is an executive director and senior strategic advisor with more than 40 years of experience in the international oil and gas industry. He participates in and manages GCA's advisory activities relating to financial, strategic assistance, government policy as well as expert opinion and testimony.

Neil Abdalla is a geoscientist with experience evaluating, and modeling conventional and unconventional reservoirs. His recent focus has been on field development strategies, due diligence, asset evaluations/valuations, and reserve evaluations for unconventional reservoirs. He graduated in 2012 from Penn State University with a BS geosciences degree and expects to graduate in 2014 with a MS in geology from the University of Houston.

Cecilia Jing Cui specializes in economic, financial, and fiscal analysis on oil and gas business entities, with recent work focusing on North American unconventional resources. She graduated Magna Cum Laude with a BA in mathematics from Agnes Scott College, Georgia, and obtained a MS in economics from the University of Texas.