Westwood reports monthly recap of offshore energy contract awards

Westwood Global Energy Group’s Offshore and New Energies teams recently reported a global data update on oil and gas (O&G)-related engineering, procurement and construction (EPC) awards, wind turbine generator (WTG) awards, and drilling rig fleet utilization and contract backlogs for jackups, semisubmersibles and drillships.

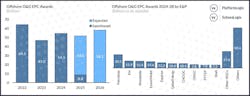

Offshore field development, EPC contracts to total $43B

Offshore O&G-related EPC contract award value year to date is estimated at US$9 billion (excluding letters of intent).

Highlights during the period under review include:

- BW Energy has taken a final investment decision on its Maromba Field offshore Brazil, which will feature an integrated drilling and wellhead platform and a refurbished FPSO unit, with first oil scheduled for late 2027.

- In the Gulf of Thailand, Valeura Energy sanctioned the redevelopment of its Wassana Field, which involves the installation of a new central processing platform and associated export pipeline, with a total EPCC value of US$120 million. The initial drilling campaign comprises 16 horizontal development wells and one water injection well, with production scheduled to start in second-quarter 2027.

- In late April, an EPCI contract with bp was awarded to the Subsea Integration Alliance for the Ginger project offshore Trinidad and Tobago.

- Contracting activities that underpinned investment in May include the engineering, procurement, fabrication, installation and pre-commissioning of 112-km rigid risers and flowlines system work scope awarded to Subsea7 for Petrobras’ Buzios XI development offshore Brazil.

- Subsea7 secured award for the transportation and installation f flexible pipelines, umbilicals and subsea components for an undisclosed project offshore West Africa.

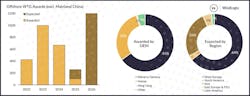

Increase in offshore wind awards expected in 2026

Google signed its first offshore wind power purchase agreement (PPA) in Taiwan, and in the broader Asia-Pacific region, with Copenhagen Infrastructure Partners (CIP). The deal covers electricity from the 495-MW Fengmiao Phase I offshore wind farm, which reached financial close in March 2025.

In addition, Orsted is halting the development of the 2.4-GW Hornsea 4 wind farm offshore England, UK. The developer stated that this decision has been made due to increases in supply chain costs, higher interest rates and an increase in the risk to construct and operate the wind farm within the planned time frame. Orsted also reported it will evaluate options for future development of the wind farm given its continuing seabed rights, grid connection agreement and development consent order.

Finally, the Norwegian government has launched the Utsira Nord floating offshore wind lease tender round. The deadline for applications is Sept. 15 of this year. The allocation of lease sites and state aid will take place in two stages. In the first stage, three project areas will be allocated to the bidders that score the highest in a competition-based qualitative criteria. State aid will be awarded through a competitive process following a maturation phase. To participate, developers must submit a license application and a bank guarantee. The auction will proceed only if at least two qualified developers apply.

Offshore drilling rigs contract backlog decreases

The global committed jackup fleet remained at 391 units in April. Marketed available and cold-stacked jackup counts now stand at 52 and 54, respectively, with marketed committed utilization and total utilization at 88% and 79%, respectively. During the month, a total of 17 new contracts were awarded, amounting to 16,175 days (44.3 rig years) of backlog added.

ADES' Admarine V was awarded a 1,095-day contract by Petrobel to drill offshore Egypt in April 2025, at an undisclosed day rate.

The global committed semisubmersible count increased by one to 60 units in April, with 16 available and eight cold-stacked rigs remaining in the fleet. During the month, marketed committed and total utilization increased to 79% and 71%, respectively. There were three recorded fixtures, amounting to 482 days (1.3 rig years) of backlog added.

Transocean Equinox had its two 45-day options exercised by Zenith Energy to drill offshore Australia in June 2026, at a day rate of $540,000.

Finally, the global committed drillship count increased by three to 78 units during the month, leaving 11 marketed rigs available plus 13 cold-stacked units. Marketed committed and total utilization increased to 88% and 76%, respectively. Seven new fixtures were recorded in March.

Noble Globetrotter I was awarded a 45-day contract by Murphy Oil to drill offshore the US in April, at a day rate of $350,000.

Noble Venturer was awarded a 16-well, 1,060-day contract by TotalEnergies to drill offshore Suriname in October 2027, at an undisclosed day rate.

| Contract Backlog Month-on-Month (Rig Years) | Jackups | Semisubs | Drillships |

| April 2025 | 867.4 | 82 | 157.8 |

| May 2025 | 838.6 | 77.3 | 152.6 |

| Difference | -28.7 | -4.7 | -5.2 |