DNO gains full ownership of North Sea independent Sval Energi

DNO has completed its acquisition of Norwegian E&P independent Sval Energi Group from HitecVision for a cash consideration of $450 million.

This figure is based on an estimated enterprise value of $1.6 billion, DNO added.

Sval Energi brings interests in 16 producing fields offshore Norway, which should quadruple DNO’s North Sea production to 80,000 boe/d.

It also quadruples the company’s proven and probable (2P) reserves in the North Sea to 189 MMboe, with its contingent 2C resources now totaling 316 MMboe.

Norway and the UK now account for almost 60% of the enlarged group’s global production and nearly 45% of its global reserves, with the remainder mainly in the Kurdistan region of Iraq.

Sval Energi CEO Halvor Engebretsen will serve as managing director of the expanded DNO Norge AS.

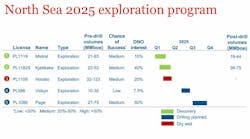

DNO already had involvement in various offshore field development projects and multiple discoveries being matured for project sanction. It believes it now has sufficient North Sea 2P reserves and 2C resources for 15 years of production at current rates.

But it also wants to move some of these projects forward.

“It takes most Norwegian oil companies a ridiculously long eight to 10 years to bring a discovery to first production, even with simple subsea tiebacks to existing platforms,” said DNO’s executive chairman Bijan Mossavar-Rahmani. “Compare that to the two to three years, if that, to execute this task in other established basins,” he continued.

Last week, the company raised $400 million in hybrid bonds to support the acquisition.