Mechanical index benchmark quantifies US Gulf of Mexico drilling risks

Knowledge learned from well experience has always been guarded as a secret-of-the-trade, and the basis for building competitive advantage over competing companies. Using this philosophy, oil and gas industry companies have continued making huge technological strides, then keeping the secrets to themselves. One result is a longer industry learning curve in the highly technical operations of our industry.

Exploration in deeper waters is driving well costs higher. The costs of "empirical learning" by trial and error are going out of fashion. Companies can't afford anymore to absorb failures and short-comings as simple costs of doing business. A means of shortening this "empirical learning" curve has been recognized by many participants in the oil and gas industry as an immediate necessity.

In a highly competitive environment such as the oil and gas industry, it is important to know just how well you are performing against competitors. The only way of evaluation to date, has been at the end of the year when company earnings statements are announced. This is too broad a measurement to indicate how efficiently oil and gas wells are being drilled. A more finite measure of comparison is needed to improve, even more, the efficiency with which we are exploring and drilling for oil and gas. Enter, a renewed interest in "bench marking."

Drilling performance

Miriam Webster defines benchmarking as "a point of reference from which measurements may be made" and "something that serves as a standard by which others may be measured." In oilfield terms, this means a baseline to evaluate a company's performance against its own previous performance and a common set of parameters with which to grade performance against industry averages and other participants. Achieving a sufficient baseline, requires building a reliable shared-information database from which to pull information.

The growing pains involved with this type of experience-sharing have been long and intense. The question, "Why should we share hard-earned experience and risk giving up competitive advantage?" has been asked, and answered, many times. The answer most often concluded, "a certain amount of experience sharing is crucial to the industry's deepwater future, and thus our own company's future." The proof lies in the number of operators currently involved in some form of industry-wide information sharing program.

The list of operators that participate in various benchmarking studies include 78 of the world's largest companies (original names): Agip, Amerada Hess, Amoco, Apache, Arco, BG, BHP, BP, Brunei Shell, Burlington, Canadian Petroleum, Chevron, Clyde/Gulf, Coastal, Conoco, Cultus, Danop, Elf, Energy Africa, Enron, Enterprise, Exxon/Esso, Fina, Fletcher Challenge, Hardy, Harrods, IEOC, In Salah Gas, IPLL/Red Sea Oil/Lundin, Kerr McGee, Lasmo, Marathon, Mariner Energy, Murphy, NAM, NAOC, Newfield, Novus, Nuevo Energy, OCA, Ocean Energy, Ocelot, Oil Search, OMV, Occidental, Pan-Canadian, Pecten, PennzEnergy, Perenco, Petronas, Petsec, Phillips, PlusPetrol, Premier, RAG, Ranger, Repsol, Saga, Samedan, Santos, Shell, Shell-Todd NZ, Sonarco, Statoil, Talisman, Texaco, Total, Trinmar, Tullow, Unocal, Union Texas, UPR, Vastar, Veba, Victoria Petroleum, Wapet, Wintershall, and Woodside.

Historical comparisons

The roots of benchmarking in the oil and gas industry go back to the beginning of the industry itself. The best benchmarking tool of early times was most likely a company's ability to erect well derricks quickly. The company which could construct derricks the quickest, got the most holes in the ground, and thus more oil flowing out of the ground. Measurement methods were limited, making the number of holes drilled in a given period of time the definitive indicator in which companies or groups were performing the best.

This comparison method evolved into comparing rates of penetration (ROP), footage drilled, and well costs between wells. Though simple, they were effective at yielding a baseline from which to compare performance.

With technology advancements came order to the chaos. From that new order came the need to more effectively evaluate company performance against itself and others in the industry. In 1989, BP initiated a study covering drilling in the North Sea area. Interest grew and the group of operators involved then outsourced this study to Rushmore Associates/ Sigma Consultancy in 1993.

The studies further evolved into what is today called the Drilling Performance Reviews (DPR). The DPR provides a platform for operating companies to access well data and perform independent analysis. The DPR now geographically covers Europe, Africa, Asia, Australia/New Zealand, Latin America, deep water Gulf of Mexico, as well as some Middle East and Former Soviet Union regions. To complete coverage of the well construction process, a Completions Review has been added. Other companies are involved in forms of benchmarking include ADL, Mckinsey, IPA, and James K. Dodson Company.

Benchmarking Gulf of Mexico

Beyond just offering data for companies to analyze and make interpretations, a database with full query options has been developed for use as a benchmarking tool in the Gulf of Mexico. To be considered a benchmarking tool, a common factor to all of the records in the database has to be defined.

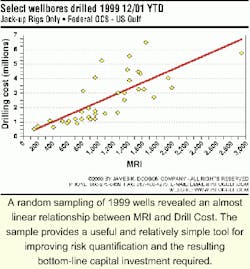

That parameter, defined by James K. Dodson Company, is called Mechanical Risk Indextrademark, or MRI.

Identifying and quantifying risk in oil and gas exploration activities has always been a task performed by operators. Each operator computes an internal well risk value with operational and accounting philosophies playing a key role in the weighting of specific parameters in the computation. However, this creates differences in a quantitative risk value between operators.

To standardize this process across the industry, James K. Dodson Company has defined "Key Drilling Factors," which are used to calculate an MRI for any given well. These drilling factors include directional attitude, gas and hydrate environment presence, depleted zones, type of wellhead system, hole size, geology anticipated, loop current potential, shallow water flow potential, and alternative weighted fluid systems use.

The weighting of each parameter in the Dodson MRI calculation is confidential, but has been reviewed and approved by drilling engineering staffs across the industry. After computing an MRI value for a given well, it can be compared to one or any other combination of well data within the Microsoft Access database. Any parameter within the company records can be queried, yielding a very flexible analysis tool. The database includes up to 10,000 wells within the Gulf of Mexico.

With a standard risk variable now available, project risk can be better quantified and appropriately planned for. Simple benchmarking of ROP and basic drilling parameters continues to be a good comparison tool, but using variables which apply more to the front-end of the well construction process will be invaluable for project planners around the world.