Asia/Pacific

First CGS in South China Sea installed

Brown & Root Energy Services (BRES) has installed the 91,000-ton Brown & Root Energy Services (BRES) has installed the 91,000-ton Malampaya concrete gravity substructure (CGS) offshore Palawan Island in the Philippines. The CGS marks the first such installation in the South China Sea and is also the first CGS to be constructed in Asia.

Construction began in December of 1998 at Green Beach, Subic Bay in the Philippines and was completed in May 1999. The seabed on which the CGS would set had to be prepared so that it was level and even. For that 361 mounds of crushed rock with an average height of 1.4 meters, totaling 17,000 tons, were placed on the seabed. The material was designed to flatten during installation to create an even layer with a maximum thickness of 500 mm.

Before tow-out out of the CGS, the channel to the sea was dredged from Green Beach to Subic Bay and 250,000 cu meters of soil was moved through a 750-meter floating pipe to a disposal site within the bay. The CGS began tow out on May 28 using three seagoing tugs. The CGS arrived at the Malampaya site 209 nautical miles away four days later.

Installation operations began on June 1 with four tugs arranged in a star formation around the unit. The internal compartments of the CGS were ballasted with seawater, which allowed for a controlled descend to the seabed. The unit finally settled less than three meters from target location, 43 meters below sea level. The positional accuracy was achieved using pre-installed seabed transponders to determine the exact position as it descended and adjustments were made through synchronized changes in pulling forces on each of the four tugs. Installation was completed three months ahead of schedule.

Presently, operations are underway to protect the unit from wave and tidal action. BRES is installing 3,000 tons of rock around the four corners of the base of the unit and following this, the CGS will be permanently ballasted down by placing 75,000 tons of iron ore in its open cells.

The CGS will be equipped to store up to 385,000 bbl of condensate. The 10,500-ton topsides unit will be installed in March of next year and will be ready to supply gas to power plants by October of next year.

Major action at Woodside

Woodside and BP Amoco have announced a major deal offshore Australia. The two companies have struck two separate agreements for their respective holding off the northwest shelf of Australia. In the first agreement, Woodside will acquire BP Amoco's rights to undeveloped oil discoveries and future oil discoveries in the North West Shelf Venture (NWSV) area.

Under the terms of the agreement, Woodside will take BP Amoco's 16.67% share of the reserves associated with the undeveloped Egret and Dixon oil discoveries and the company's 16.67% stake of any subsequent discoveries. In addition, Woodside will shoulder A$4 million of BP Amoco costs in the project area during 2000 and assume any costs with exploration and development of these areas. The agreement does not cover, however, the four producing oil field and all developed and undeveloped gas fields in the area.

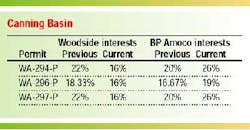

Under the second agreement, Woodside will provide BP Amoco with additional equity in three exploration permits (WA-294-P, WA-296-P, WA-297-P) in the Canning Basin and cover the company's A$8.5 million exploration costs in these permits over the next three years.

On another note however, following talks with Shell about a possible combination of interests in the A$12 billion NWSV, Shell reportedly has made a merger offer. The offer states that Shell would gain control of Woodside by creating a A$16 billion merger that would see Shell's stake in the company grow from 34% to 60% through an issue of Woodside shares at a premium.

While Woodside did not make a specific comment on the merger, the following day, John Akehurst, Woodside Managing Director, said that as Woodside improves its oil and gas output, it could see its 1999 profits double in 2000 to around $700 million. Analysts interpreted this statement as an indication that Woodside is not interested in Shell's help and can stand on its own or is waiting for better terms. But others have seen it as an attempt to bump up share price before the merger goes through. The outcome should be decided this month as the offer is reportedly on the table.

Indonesia, Vietnam change oil laws

Indonesia and Vietnam have announced changes to their countries oil laws. According to Pertamina, Indonesia's state oil company, the new law under proposal for Indonesia will not have any impact of foreign investors. The president of the company, Baihaki Hakim, said that the new law will liberalize and streamline the oil sector. He added that the new law is for internal use in the country and will not have any affect on the fiscal yields of investment by foreigners. The new law is expected to be voted on by the government next month.

While Indonesia's new law is part of government "housekeeping," Vietnam aims its new terms directly at attracting foreign investors. The new law which was passed by the government and is put into effect on the first of this month, sets sanctioned rates of return for foreign firms working on offshore oil and gas fields. These rates are expected to allow the firms to recover initial capital expenditure costs such as exploration and drilling more rapidly.

Indonesia signs seven contracts

According to the Jakarta Post, the Indonesian government has awarded four international and three indigenous companies seven oil and gas contracts. The companies, which were not named, signed three production sharing contracts and four technical assistance contracts with state-owned Pertamina. The contracts represent a total investment of $112 million for 10 years. Under the terms of the production sharing contracts, the companies will receive 155 of production while the government takes the remaining 85%.