New model offers tool for analyzing rig day rates

Mark J. Kaiser

Brian F. Snyder

Center for Energy Studies

Louisiana State University

Data from over 7,000 rig contracts used to test and validate

Over the years, a body of "common knowledge" has developed regarding the factors that impact offshore rig day rates. Unfortunately, this knowledge has rarely been empirically tested and quantified.

To better understand the spatial and temporal dynamics of rig day rates and their relationship to market factors, we analyzed 7,123 rig contracts from five offshore basins between 2000-2010.

In part 1 of this 3-part series, we describe the hypotheses, data, and methods used. In parts 2 and 3, empirical models are used to either support or refute the hypothesis.

Day rate characteristics

Day rates are the most watched indicator of the offshore drilling market and a primary descriptor of the industry. Increasing day rates are a sign of increased demand for contract drilling; and, as day rates increase, price and activity levels in the newbuild, upgrade, and second-hand markets generally increase.

Rig markets are fragmented geographically and within regions by water depth and levels of competition and customer base. Day rates represent the outcome of a bid process and are influenced by local and global market conditions, rig characteristics, and customer base.

Rigs consume products and services from a number of related service and support companies, including offshore supply vessels, helicopters, well services (e.g. cementing, well logging), drilling consumables (e.g. mud, chemicals, casing), and catering. As day rates and demand in the drilling market increase, prices and activity in these related offshore industries are positively impacted.

Transparency and reporting

Day rates are tracked by a number of commercial service providers and are widely subscribed by E&P and contractor firms. E&P firms require the use of drilling rigs, and need to know their location and contract status to identify what units are available to satisfy their drilling campaign and to negotiate rates. Drilling contractors attend to competitor activity and negotiated rates for business purposes.

Hypotheses

A large number of factors have the potential to influence rig day rates, and in the popular press and among industry experts, a body of "common knowledge" has developed. The purpose of our analysis is to critically review basic expectations and the evidence to support/refute selected claims, and to quantify observed differences and trends. Some of these reasons can be tested, but many cannot, and our observations are limited by the availability of data and factor analysis. We focus on single-factor effects because these are the most intuitive and amenable to evaluation, but recognize that multiple factors may influence results.

We evaluate the following hypotheses:

- 1. Demand for drilling services is positively associated with oil prices.

- 2. Day rates increase with increasing oil prices.

- 3. Day rates and utilization rates are positively correlated.

- 4. High specification rigs charge higher day rates than low specification rigs.

- 5. Long-term contracts provide a price premium over short-term contracts.

- 6. National oil companies pay higher day rates than other companies.

- 7. Large drilling contractors command higher day rates than smaller contractors.

- 8. Appraisal drilling programs pay higher day rates than exploratory or developmental drilling.

Hypotheses 1-4 evaluate basic assumptions widely held in the industry. In hypothesis 1, rig demand is the dependent variable; in all other hypotheses, the day rate is the dependent variable. Hypotheses 5-8 identify factors that contribute to the variation in day rates between and within regions. These hypotheses are less obvious and require greater scrutiny.

Drilling contractors frequently seek a mix of long- and short-term contracts to balance risk, and hypothesis 5 evaluates the costs of this strategy. For political reasons, NOCs are expected to overinvest in drilling relative to IOCs, and this is evaluated in hypothesis 6. Hypothesis 7 examines the ability of firms to use market power to influence prices. Appraisal drilling is more technically challenging than exploratory or developmental drilling and may be associated with a day rate premium. This is tested in hypothesis 8.

Data sources

Data from 7,123 rig contracts between Jan. 1, 2000, and Dec. 31, 2010, were obtained from the commercial service provider RigLogix. This service assembles information on contract variables (day rate, contract start date, contract duration, region) and rig variables (rig type, rig delivery date, rig maximum water depth, rig maximum drilling depth) using surveys and direct contact with industry personnel. Day rates are the primary bid variable, but contracts are negotiated individually with a number of terms and conditions (e.g. risk terms, mobilization costs, modifications, cost adjustment terms) that are not observable and amenable to analysis. The number of active rigs and regional utilization rates were obtained from RigLogix and Baker Hughes. Brent oil prices was obtained from the Energy Information Administration.

Categorization

Activity was considered in five offshore basins: the US Gulf of Mexico (GoM), North Sea, Persian Gulf, West Africa, and Southeast Asia. Each region was subdivided into jackup and floater classes; the floater class includes semisubmersibles and drillships. The US GoM had the largest number of contracts in the jackup market during 2000-2010; and, along with the North Sea, is the largest floater market. Jackup and floater classes were delineated by water depth, ownership, customer, and time period. The Persian Gulf does not have a deepwater segment.

Changing markets

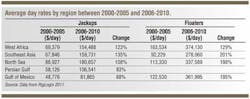

From 2004 through 2006, oil prices and day rates rose significantly, and as a result of these changes, market conditions in the 2000 to 2005 and 2006 to 2010 periods differ in significant ways that require separate analysis. In the jackup market, the increase in day rates pre- and post-2006 varied from 68% in the GoM to 135% in Southeast Asia. In the floater market, the change in day rates in pre- and post-2006 periods was more pronounced, and three of the four floater markets increased by approximately 200%.

Demand trends for rigs vary by class, water depth, and region, but the relative positioning of the regional markets remained stable during the decade. The GoM was the least expensive jackup market in both the 2000-2005 and 2006-2010 periods, followed by the Persian Gulf. West Africa and Southeast Asia experienced similar day rates in both periods, while the North Sea was consistently the most expensive jackup market. In the floater market, Southeast Asia was the least expensive in both time periods while West Africa was the most expensive market.

Approach

Individual contract records were treated as independent data points. Contracts provide information on the status of the rig market but do not directly correspond to the number of wells drilled because of differences in work requirements (multi-well programs, workovers, completions, side track operations, etc.). The number of contracts provides a direct indicator of the demand for drilling rigs by class type, region, water depth, time period, and customer.

Day rates were inflation-adjusted to 2010 using the US Bureau of Labor Statistics (BLS) annual producer price index for all finished goods and the start year of the contract. Inflation adjustment allows for comparison across the decade but may introduce bias since the US producer price index is not expected to capture inflationary pressures worldwide. Brent oil prices were inflated to 2010 values.

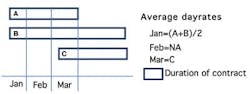

Monthly average day rates are computed as the average of the day rates of all contracts for which drilling began in that month and not the average of all active contracts in the month. As computed, monthly average day rates provide a real-time indicator of market conditions.

Moving average oil prices and utilization rates were used in several models. Moving averages are integrative in the sense that they are computed over a period of time and include information on the entire period. Interpreting moving average model results need to be performed with caution because of the nature of the derived data.

Linear regression and analysis of variance were used to test hypotheses. When multiple comparisons were performed, the Tukey-Kramer method was used. Ordinary least squares regression was employed when data was not serially correlated. Models were evaluated with and without logarithmic transformation; transformed models generally exhibited better fits than non-transformed models and were adopted, consistent with standard econometric techniques.

Editor's note: This article is the first part of a three-part series by Mark Kaiser and Brian Snyder on the factors that impact offshore rig day rates.