Deepwater opportunities beckon

Oil and gas executives forecast new prospects and projects

This oil and gas barometer takes the pulse of senior executives at a challenging time for the industry. New risks are emerging, and new relationships and ways of working are replacing time-honored business models. “Black swan” events like Macondo can change the operating environment and the perception of risk, seemingly overnight.

But there is room for guarded optimism. Companies are prepared to invest for the future, and are willing to meet new safety and environmental standards.

Results from a global survey of senior executives indicates Southeast Asia will offer the greatest opportunities for their business in the next 12 months.

Whether in response to new regulatory challenges, the growing competition for increasingly marginal acreage, and more capital-intensive deepwater and tight gas developments, it is clear that oil companies must adopt new risk assessment strategies. They must also create new relationships with contractors, suppliers, resource-holders, and competitors.

With the outlook for stable prices, at least for a year or two, and natural gas prices likely to bottom out and revive within a couple of years, the investment climate remains inviting. A growing proportion of future resources are likely to be found in harder-to-extract territories, with more punitive fiscal regimes, so the relative calm foreseen for the market over the next year or so presents a welcome opportunity.

The oil and gas industry has come through a period of unprecedented price volatility, with record prices followed by a crash and then a slow recovery. Asked to look ahead over the next year or so, industry executives surveyed and interviewed by the Economist Intelligence Unit see investment opportunities during a period of relative price stability, especially in the fast-growth economies in Asia.

The technological advantages enjoyed by some of the international oil and gas companies give them leverage to develop resources in some of the most challenging environments, such as the deepwater offshore, and to open up previously unavailable reserves, such as unconventional gas.

However, there are enormous challenges ahead. TheDeepwater Horizon disaster at BP’s Macondo oilfield in the Gulf of Mexico has many recalculating the risks the industry faces as it pressed into these new frontiers of oil and gas development. After the pressure on the US government during that six-month spill, there is a new attitude to oversight in the industry in the US and elsewhere. This may lead to higher costs for industry and restrict the opportunities to those who can afford it.

In the meantime, international oil companies (IOCs) must navigate increasingly complex relationships with national oil companies (NOCs), both from the resource-rich countries and with those representing the interests of the emerging economies.

Key findings emerging from the research include the following:

Industry investment plans remain on track

Companies are upbeat about oil industry capital investment, with oil prices remaining relatively high and steady, mainly owing to robust demand from emerging markets. Survey respondents, on average, see benchmark oil prices averaging $83/barrel in a year’s time, despite a near-term supply overhang. Natural gas prices, however, could remain depressed next year before Asian demand starts to erode oversupply. Nevertheless, executives remain relatively bullish: 28% expect to see gas prices rising by at least 10% over the coming year, with 18% seeing a rise of 25% or more. Very few expect to see big declines, while many (35%) expect a fluctuation of less than 10% either way.

Spending will remain focused on core oil and gas projects

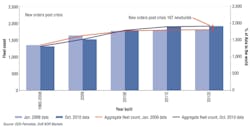

This is especially true since new reserves are predominantly in tough, deepwater areas. A majority of respondents plan to invest more capital in oil and gas projects, although such enthusiasm did not transfer to the biofuels, wind, solar and other renewable energy sectors. Capital expenditure (capex) remains strongly correlated to oil prices, but there is a recognition that future resources will cost more to extract. A clear trend is that resource structures have become more complex, with reserve additions in deepwater areas an increasingly prominent feature in global oil and gas production.

Asia is an emerging area of opportunity

Companies see opportunities focused in the emerging economies of the East. The largest proportion of respondents (32%) sees Southeast Asia as offering the greatest opportunities over the coming year, with that proportion rising to 58% when combined with China and the Far East.

North America is the next significant region, identified by 30% of respondents.

Natural gas has emerged as a “game changer”

Natural gas has gained widespread credibility as a relatively low-carbon “transition fuel”, especially for electricity generation. Global demand for liquefied natural gas (LNG) has grown as countries in Asia and Europe have sought to increase their supply options.

The emergence of large reserves of “unconventional” gas in North America has proved highly attractive to oil and gas companies looking to replace declining production. However, both the recession and the sense of abundant supply have depressed natural gas prices.

US benchmark Henry Hub natural gas prices stayed at around $4 per million British thermal units during the recession, around one-half of their recent peak level in 2008, despite rising oil prices. Weak European demand has similarly kept prices low and put pressure on suppliers like Gazprom and Statoil to make concessions on contracts for big buyers. But Asia has held up better. In November, for example, LNG demand from Japan meant that customers there were paying premiums to US gas prices of more than $11, compared with $7 in the previous summer.

Costs will rise post-Macondo

After BP’s Macondo oilfield disaster, government policy and regulation will impact operational risk, although perhaps in unpredictable ways. A very large proportion (72%) of respondents expects regulation to become more stringent in North America. A substantial majority (68%) expect cost increases in general.

The longer-term impact of Macondo will be on companies’ operational strategy, especially as their safety record will become a more important factor in gaining access to global reserves.

As BP has already demonstrated, companies will review their managerial reward structure, as well as their relationships with contractors and suppliers, to better manage operational risk.

Smaller companies vulnerable to operational risk

Around 60% of oil and gas production in the GoM comes from independent exploration and production firms. Proposals to raise the $75 million liabilities cap on offshore oil spills may have the most decisive impact in forcing operators out of the Gulf as insurance becomes unavailable or cost-prohibitive.

There will be more complex relationships with NOCs

Although one in four executives polled expect the policies of government-owned NOCs towards IOCs to be more favorable over the next 12 months, about one in three expect that policies will be more restrictive. Even more significantly, the greater proportion (42%) believes that NOCs will account for the majority of new E&P opportunities.

In the past, IOCs were happy to use generic production-sharing contracts and tax-and-royalty schemes as their business models in oil-producing countries. The future seems to lie increasingly with a “bespoke” approach, whereby they provide specialized services in conjunction with NOCs in development projects, and they may also have to agree to fund infrastructure projects, such as water or electricity.

NOCs are becoming more international

NOCs themselves are facing new forms of competition. While the traditional NOC, as seen in large parts of the Middle East, still focuses on developing domestic resource where it holds a monopoly, the new breed of Asian internationalizing NOCs—or INOCs—has emerged as disruptive competitors over the past two years. Companies such as PetroChina, Petronas and Korean National Oil Co. (KNOC) boast healthy cash flows and already operate in ways similar to IOCs.

These new market entrants have created consternation for NOCs and IOCs alike.

About this report

This outlook for the oil and gas industry in 2011 was adapted from an Economist Intelligence Unit report that aims to provide a barometer for the industry from the point of view of top-level operators, including CEOs and other board-level executives and policymakers. The report is sponsored by GL Noble Denton.

This inaugural barometer focuses on investment prospects, the changing risk environment, and the new industry dynamic, whereby international oil companies and national oil companies are redefining their relationships in developing conventional and unconventional hydrocarbons assets.

The Economist Intelligence Unit editorial team executed the survey, conducted the interviews and wrote the report. The findings and views expressed do not necessarily reflect the views of the sponsor.

This report drew on two main initiatives:

- A global survey of senior executives during September and October 2010. In total, 194 executives took part, representing a cross-section of firms in the oil and gas industry. These executives were very senior: one in three respondents were CEOs or managing directors, while all hailed from management positions. They represented firms ranging in size from less than $500 million in revenue (39%) to more than $5 billion (35%).

- To supplement the survey results, in-depth interviews were conducted with numerous executives, including CEOs, divisional heads, senior lobbyists, and policymakers.

James Gavin was the author of the report, and James Watson and Tony McAuley were the editors.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com