Global upstream M&A more than doubles to $160 billion

Deal count up 40%, dollar volume more than tripled

null

Pam Boschee, International Editor

The increase in the number of 2005 upstream transactions and their values may be viewed as indicative of the health and wealth of the E&P industry globally. But the jump in numbers to levels not seen since the late 1990s has resurrected many of the same concerns of how the mega-companies impact the industry.

Companies have expanded internationally via mergers, acquisitions, joint ventures, production sharing contracts, and strategic alliances. This has resulted in larger footprints, increased reserves, new or expanded presence in fast-growing markets (such as the Asia-Pacific), and access to local/regional governments and decision-makers.

Expanding footprints

In their 2006Global Upstream M&A Review, John S. Herold Inc. and Harrison Lovegrove & Co. Ltd. analyze more than 290 upstream transactions valued at $160 billion.

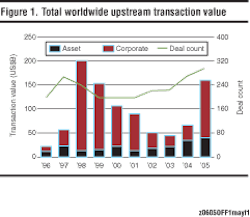

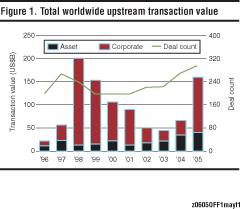

As corporate deal count rose 40% year-over-year, expenditures on corporate acquisitions more than tripled to $120 billion. Contributing to that climb was the ongoing five-year trend of a steady increase in the value of asset transactions (Fig. 1).

The top 10 deals in Fig. 2 are ranked by transaction value. Taking a closer look at two top-ranked deals provides a glimpse of the potential competitive advantages accompanying these strategic moves.

| Buyer | Seller | Deal level | Region | Transaction value (US $billion) |

| ConocoPhillips | Burlington Resources | Corporate | Multi-region | $36.4 |

| Chevron | Unocal | Corporate | Multi-region | $19.9 |

| Gazprom* | Sibneft | Corporate | Asia-Pacific | $13.0 |

| Occidental Petroleum | Vintage Petroleum | Corporate | Mulit-region | $4.1 |

| CNPC* | PetroKazakhstan | Corporate | Asia-Pacific | $3.9 |

| Maersk | Kerr-McGee | Asset | Europe | $3.7 |

| Inpex | Teikoku | Corporate | Multi-region | $3.2 |

| Chesapeake Energy | Columbia Natural Resources | Corporate | US | $3.0 |

| Norsk Hydro | Spinnaker Exploration | Corporate | US | $2.6 |

| Talisman Energy | Paladin Resources | Corporate | Multi-region | $2.4 |

| Total $92.0 | ||||

| * show acquisitions by NOCs | Source: John S. Herold Inc., Harrison Lovegrove & Co. Ltd. | |||

The recently closed ConocoPhillips-Burlington Resources deal tops the list at $36.4 billion. With the acquisition of Burlington Resources, an independent E&P company, ConocoPhillips gains natural gas resources in the East Irish Sea, Argentina, and onshore China, and oil in Algeria, offshore China, and Ecuador.

Exploration or development programs are underway in these areas as well as in Egypt, Peru, and Colombia.

At Dec. 31, 2004, Burlington Resources had total reserves of 2,001 MMboe and an estimated 2005 production of 475 Mboe/d. Together, the companies reported reserves of 11.5 Bboe using Dec. 31, 2005 data.

Analysts forecast that ConocoPhillips global energy production will increase by 7-8% annually between 2006 and 2008. Total E&P, which represents 75% of all Conoco-Phillips’ corporate profits, is forecast to rise by 4% per year from 2006-2010.

Analysts also see the deal leading to ConocoPhillips as the winner to develop Russia’s Shtokman project in the Barents Sea, where reserves of gas have been put at 3.2 tcm, with another 31 million tons of condensate. Development cost has been estimated at $10 billion to $25 billion. Production would raise ConocoPhillips’ net reserves by 12 tcf.

Picking up assets closer to home, Chevron enhanced its footprint in the US Gulf of Mexico and Asia when it bought Unocal last year.

It was already a leading participant on the continental shelf and in deepwater GoM developments such as Tahiti, Jack, Blind Faith, and Great White. Capturing Unocal’s interests in Mad Dog, St. Malo, K2, and Puma in the deep water, and its portfolio of exploration acreage, made Chevron a contender for top producer in the Gulf.

The combined Chevron and Unocal in the Asia-Pacific region claimed the top producer rank in Thailand. In Indonesia, Unocal’s extensive oil and gas producing operations offshore in both the shelf and deepwater areas augmented Chevron’s oil production, primarily onshore. Unocal also markets through the Bontang LNG plant in Indonesia, complementing Chevron’s LNG production in Australia, as well as its development of Australia’s Gorgon natural gas field and the shipment of LNG to markets in Asia and North America.

In the Caspian region, the acquisition gave Chevron the second-largest interest in the Azerbaijan International Operating Co. oil producing operations. With AIOC comes a share in the Baku-Tbilsi-Ceyhan export pipeline, further expanding Chevron’s position in Caspian oil export infrastructure.

Unocal also brought its dowry of 1.7 Bboe reserves, increasing Chevron’s total proved reserve base to a total of about 13 Bbbl, an increase of 15%.

Record prices

Sights were set on companies with multi-regional assets as buyers looked to capitalize on growing international markets.

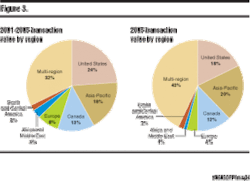

North American transaction value increased 30% to $48.4 billion, but represented only 30% of total global transaction value, down from 56% in 2004 and the five-year average of 38%.

The acquisition of companies with international portfolios represented 43% of total global transaction value, accounting for $68.4 billion. Total value for other transactions outside of North America reached $42.8 billion, an increase of 54% over 2004 (Fig. 3).

Proved reserve costs increased significantly, especially outside North America.

The review showed that global proved reserve costs tripled to $9.60/boe compared to 2004. Proved reserve values outside North America reached $8.10/boe, an increase of more than 400%. North America proved reserves, in contrast, showed a modest increase of 55%, still achieving a record $14.62/boe.

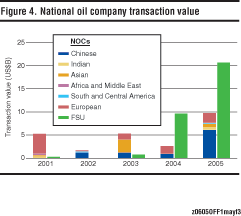

Figure 4 shows the increasing role of national oil companies in global M&A activity. NOC international transaction value rose threefold with Chinese NOCs and consolidation of Russian companies adding significantly to overall NOC transaction values.

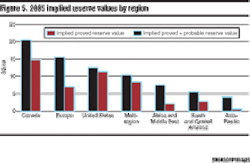

The most expensive reserve values, according to the review, were found in Canada, with 30% of deals completed at a proved reserve value of more than $30/boe. North Sea reserve values were also strong. North American transaction values were boosted by international companies’ strong interest in the GoM and Canadian oil sands (Fig. 5).

The review says international oil companies have been reticent to pursue resources in Africa, Asia, and South America, despite lower costs, because of geopolitical issues perceived as increasing risk.

Calls for scrutiny

Over the past two decades, low, volatile, and unpredictable oil prices inhibited upstream investment. Although price uncertainty is a fact of life, in the case of oil and gas, given the large upfront outlays, long gestation periods, and irreversible nature of investment, uncertain cash- flows tended to delay additions to productive capacity.

However, today’s higher crude prices have pumped up cash flow and E&P activity. With the price of oil topping $65/bbl, prices at the pump showing mostly upward fluctuations, and reported profits hitting new highs, oil and gas business has captured more attention than usual.

The heightened attention has brought with it increased criticism. Eager to put the brakes on escalating costs of oil and gas, politicians and consumers are pointing fingers at M&A activity as a contributing factor to the sticker shock.

The US Government Accountability Office issued a statement in early February expressing concern that M&A caused increased prices of gasoline. Although the GAO’s statement reflected on the mergers of the 1990s, it conveyed a cautionary note regarding mergers completed since 2000.

“Petroleum industry officials and experts we contacted cited several reasons for the industry’s wave of mergers since the 1990s, including increasing growth, diversifying assets, and reducing costs. Economic literature indicates that enhancing market power is also sometimes a motive for mergers, which could reduce competition and lead to higher prices.

“Mergers in the 1990s contributed to increases in market concentration in the refining and marketing segments of the US petroleum industry, while the exploration and production segment experienced little change in concentration. Econometric modeling we performed of eight mergers that occurred in the 1990s showed that the majority resulted in small wholesale gasoline price increases.

“While we have not performed modeling on mergers that occurred since 2000, and thus cannot comment on any potential additional effect on wholesale gasoline prices, these mergers would further increase market concentration nationwide since there are now fewer oil companies.”

Continuing, and some would contend encouraging, the GAO’s tone, bipartisan legislation, authored by Senate Judiciary Committee Chairman Arlen Specter, R-Pa., and Sen. Herb Kohl, D-Wis., would require the Federal Trade Commission and the Justice Department to study whether future mergers need tougher scrutiny, and calls on the GAO to examine whether the divestitures demanded by antitrust agencies in past mergers adequately preserved competition.

“With the high fuel prices the American consumer is enduring, it is time for an examination of what oil and gas industry consolidations have done to prices,” says Specter.

He noted his concern that there have been 2,600 mergers in the petroleum industry since the 1990s, and that the GAO found in a 2004 report that the concentration had generally led to higher wholesale gasoline prices. ExxonMobil’s 1999 merger was the largest, and six years later, the company reported the largest corporate profit in US history.

The proposed measure drops language included in an earlier “discussion draft” of the legislation that would have toughened language in an antitrust law that dictates criteria for weighing the impact of proposed mergers on competition.

The earlier draft sought to bar M&A in the oil industry that would “appreciably diminish” competition. Current law bars transactions that “substantially” diminish competition.

The proposal would also include a long-discussed NOPEC provision -- which stands for No Oil Producing and Exporting Cartels Act -- that would allow oil-producing cartels such as OPEC to be sued in US courts for price fixing or other monopolistic practices.

The bill eliminates the “sovereign immunity” of foreign nations to prosecution under US price-fixing laws and would render inapplicable the “act of state doctrine,” which bars US courts from considering acts by foreign governments that occur on foreign soil.

Additionally, the bill prevents companies from withholding oil and gas from the market in an effort to raise prices and would create a joint federal-state task force to probe whether information-sharing by oil companies has resulted in anti-competitive pricing.

During testimony before the Senate Judiciary Committee in March, ExxonMobil’s CEO Rex W. Tillerson and other oil executives argued that high global oil prices have been the primary factor behind higher gasoline prices. Past mergers, meanwhile, have allowed the companies to take advantage of economies of scale that have allowed them to keep pace with competitors.

“We need companies that have the scale to manage a large and diverse portfolio of global projects and to compete with large foreign and government-owned companies,” Tillerson said.

Tillerson said current antitrust laws “are sufficient in terms of providing oversight of the industry’s activities -- [It would] would put at risk certain optimization steps the industry takes to ensure supplies are adequate” across the United States.

“It takes an extraordinary level of financial strength to deploy such large amounts of capital in risky environments and a cyclical industry,” John Hofmeister, president of Shell Oil Co., told the senators. “Fragmented or financially insecure players cannot afford such risk. To achieve what we have set out to do, we need your help - not new barriers.”

For more information about the 2006 Global Upstream M&A Review, call 203-847-3344, 717-877-9588 or +44 207 632 1500.