Coverage and competition growing

Victor SchmidtVicious market! Competitive, competitive! Very competitive! It is tough! Not for the faint of heart! These are just a few of the phrases used to describe competition between seismic contractors in the Gulf of Mexico, the most active market for speculative seismic in the world.

International Editor

Equally tight is the seismic vessel market. The US Gulf has seen seismic vessel utilization rates averaging 93% for the past year, according to World Geophysical News. The industry as a whole has made a major long-term commitment to deeper water.

Three years ago, oil companies cut deals with drilling contractors to extend the capability of the semisubmersible fleet, and more recently to expand the floater fleet by building new semisubmersibles and drillships. Many investment plans flow naturally from those earlier decisions.

Deepwater rig contract commitments of 3-5 years pre-suppose drillable prospects and represent millions of dollars in sunk costs that must be justified by drilling. Thus, producers are funding the creation of two inventories:

- Deepwater leases on which to drill

- 3D seismic surveys with which to locate drillable prospects.

Under-explored

The deepwater US Gulf is an under-explored region and makes up the majority of the acreage there. Producers are moving there to search for large oil and gas fields. Many technologies are combining to create cost effective approaches to explore and develop this vast region. However, it must meet economic hurdle rates.Deepwater royalty relief by the Minerals Management Service (MMS) last year was an enabling event that improved the viability of the 10-year terms deepwater leases carry. Each new lease sale produces a scramble for strategic acreage.

Sales of deepwater blocks over the past two years grew to half the new leases sold, which expanded demand for new seismic surveys.

The most recent Western Gulf of Mexico sale continued the deepwater trend with shelf and deepwater leases split 3:1 in favor of deepwater.

Companies that coordinate, shoot and market speculative 3D seismic surveys are using all available equipment to gather data in the US Gulf's many water depth ranges: bays, transition zone, shelf, and especially deepwater. Efficiency and productivity have become buzzwords and bywords for all contractors. Many programs are proposed, but will only be shot when the proper timing brings operator's needs, seismic equipment, and funding together in the proper sequence.

Improved surveys

Now, many larger oil companies are bypassing 2D in favor of regional 3D surveys. This has come about because of advanced technology:- High capacity vessels

- Satellite positioning

- Streamer location networks

- High capacity data capture

- Onboard processing

- Satellite delivery of data

Companies must have lease positions before they can play the deepwater game, and must make educated choices among the many prospects imaged by regional 3D surveys. Improving data and enormous data volumes have forced companies to apply "quick-look" techniques to the 3D data sets prior to a sale.

Benefits of scale

In the 2D technique, the "tails" fold build-up (seismic record overlap) on either end of the line, which produces data of limited use. It is not until the fold count reaches its designed full-fold limit (6, 12, 24 etc.) that a fully interpretable seismic line begins.Once full-fold is reached, the 2D line can be shot the length of the water body, producing full-fold data in a linear format. This is efficient data collection that creates economies-of-scale favoring long 2D seismic lines.

With the 3D technique, similar economies-of-scale occur by an order of magnitude. The 2D "tails" expand to become a "halo" of limited data ringing the full-fold interior of the 3D survey. The fold build-up in the 3D technique favors large surveys. A larger 3D survey produces more full-fold data and the lowers the cost per record.

Operators adjusting

To meet the increasing pace of exploration and the schedules required by the long-term exploration plans, operators are changing the way they explore. In the recent past, operators would use 2D surveys to high-grade leases prior to the semi-annual lease sales. Detail work was done later with additional 2D programs or a "postage stamp" 3D program over the prospective areas. Traditionally, small 2D or 3D surveys of limited area were used to cover only the blocks under an operator's control.Companies have plenty of data but limited numbers of geoscientists to interpret it. Quick high-grading of data sets is key for companies before lease sales. For this smaller companies are returning to 2D seismic.

Suddenly, everything "old" is new again. For the recent class of geophysicists, 2D seismic is "new". Most have never worked with reconnaissance lines, only with 3D data sets. Such surveys are generally less expensive on a project basis and suitable for quick lease evaluation.

Deepwater surveys farther from shore create problems for seismic contractors. Longer logistical chains increase the cost of supporting the crews. Crew changes are generally by long-range helicopter. The seismic vessels are continually moving so supply vessels have a tricky transfer situation: locating the vessels, matching speed, and transferring supplies while moving. These operational problems are beginning to increase the survey costs.

Contractor differences

Most seismic contractors have staked their claim to specific areas of the US Gulf. Since different water depths require different equipment, a natural differentiation occurs by equipment type. Some contractors specialize in shallow water bays. Others use a mix of equipment to shoot the transition zone. Densely developed areas of the shelf require bottom-cable or vertical seismic methods of data collection in conjunction with radio telemetry.Major contractors operate vessels in the deeper, less developed or open areas of the Gulf by pulling very long steamers. Survey location is everything in this part of the offshore oil game. Some contractors collect very broad regional surveys while others are trend specialists. Still others set themselves apart with specialized processing, currently focused on imaging salt structures within the Subsalt Trend.

All speculative seismic programs are driven by the next lease sale or rather the timing of future lease sales. A regional speculative survey gains the most sales if it is available sufficiently ahead of the scheduled lease sale for operators to interpret the data and make strategic lease choices. If a survey is late it will not get additional data sales for a year. During that time it could be overshot by a competitor.

US Gulf shootout

Data collection rates are faster than in the past. This is creating a fear among the contractors that the US Gulf will be "shot-out" before long. For example, the region over the Flex Trend was fully surveyed within five years. Similar sized areas of the deepwater were shot in about one-third the time. The US Gulf is large and with intensive shooting could be blanketed with high quality 3D surveys in a relatively short time.Intensive shooting also reduces the half-life of a survey as contractors overshoot one another. This forces contractors to earn more money upfront to pay-out the initial investment. Thus, costs are rising because contractors cannot rely on significant future sales.

Most of these fears are groundless. Similar fears were expressed when the 2D vessels surveyed the shelf in all different directions. Technical advances and a paradigm shift to 3D seismic kept everyone in business. The industry has not seen the last of the technical advances or the last of productive hydrocarbon trends in the US Gulf. Each new trend creates a need for new shooting to correctly image the reservoirs.

Contractor's outlook

Overall, the mood is upbeat with the worldwide vessel fleet continuing to expand. Offshore's most recent seismic vessel survey (March) indicated expansion of the fleet by 11 vessels. Additional new vessels will be entering the fleet over the next few years.Seasonal shooting will send foreign vessels into the lower latitudes during the winter. This will increase the number of vessels available to the US Gulf, continuing the competitive pressures. One good aspect is that vessels will become available for special projects, especially if the regional programs continue to occupy most vessels.

Seismic contractors continue to chase a limited exploration budget and compete hard for the largest portion of the market. With many contractors producing similar programs, getting commitments is a matter of timing and vessel positioning. The whole package must come together before any program begins.

Falling oil prices have not really affected expenditures for most programs. Because of the long time frames involved, most deepwater money has been budgeted. Special processing is considered discretionary by most companies and will wait until prices increase. Oil companies will continue to target the lease sales with regional surveys to lock in leases for future development. The US Gulf will continue to be shot and re-shot as long as there is the potential for significant petroleum finds.

Acknowledgement

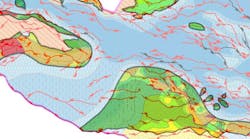

The editor wishes to thank Energy Graphics for permission to publish the accompanying map. Energy Graphics is a Houston-based company specializing in energy-related databases in the Gulf of Mexico, and providing services and software for mapping, managing, and reporting exploration data.Copyright 1998 Oil & Gas Journal. All Rights Reserved.