CLV fleet is evolving to meet the increased demands of offshore wind

Key Highlights

- Array vessels focus on deepwater installation with relatively small carousel sizes, but future projects may require larger capacities, prompting conversions and newbuilds.

- Export and interconnector cable vessels are expanding in size and capability, with next-generation vessels expected to more than double current capacities, supporting longer and heavier cable installations.

- The versatile fleet offers adaptable solutions for emerging markets and smaller projects, acting as a buffer between specialized array and export vessels.

By Hélia Briaud and Sarah McLean, Spinergie

Growing offshore wind demand is driving unprecedented demand for subsea power cables and the cable-lay vessels (CLV) that lay them. This demand has inevitably led to an expansion to the CLV fleet which, excluding China, grew from 23 active vessels in 2020 to 37 in 2025.

Fleet growth is set to continue with current projections indicating that the fleet will reach 48 units by 2030.

This analysis outlines how the CLV fleet has evolved to meet the unique requirements of array and export campaigns. It should be noted that the export market is diverse in itself and includes wind export cables, interconnectors, and oil and gas power cables.

As there are significant differences in the technology and installation methods required for array and export campaigns, CLVs can also be categorized into array, export or versatile vessels.

The array fleet

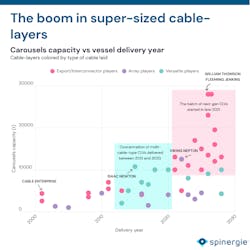

With a median carousel size of 4,000 t, the array fleet is primarily engaged in installation at deepwater wind farms. There have been few moves to increase carousel sizes in this fleet, apart from the notable example of DEME’s Viking Neptun, which has two carousels of 4,500 t and 8,000 t. This median carousel size is sufficient for now; however, as wind projects grow in size, the CLV market is likely to look toward increasing carousel capacity to keep pace.

The array fleet is primarily focused on cable laying with no operations and maintenance (O&M) activities and very little construction support or repair work. Moving forward, it is expected to undertake less pre- and post-lay surveys and cable burial activities to focus on laying operations. Specialized fleets, such as construction vessels, are gradually taking over these additional tasks as the CLV fleet gets busier.

At just 10 vessels (including barges), the array fleet size is relatively small and is under increasing pressure to meet demand. Conversions are the most cost-effective way of adding capacity and may include an additional carousel. Furthermore, they generally take less than a year to complete—much less than the two-year lead time for newbuilds.

The incumbent fleet is bolstered by some opportunistic flexlayers or construction vessels that could absorb some array cable installation demand each year. This opportunistic fleet will be most important to regions without a domestic CLV fleet like Asia.

Japan, which primarily has shallow, near-shore projects, has a small array cable barge fleet. With vessels operating small carousels of an average 1,252 t, the fleet is sufficient for now, but as Japan develops larger wind farms that require export cables, it is likely to become inadequate. One new CLV, Toyo’s NB980, is a versatile vessel signaling that the market is moving toward adaptability rather than relying on the smaller fleet.

The export fleet

Export and interconnector cables are getting longer, heavier and more technically demanding, so the fleet is expanding to fit this need. The export CLV fleet can be split into four additional sub-categories: historic, high-spec, next gen and barges.

With an average carousel size of 4,640 t, the historic export fleet is slightly undersized for the future needs of the offshore wind sector. With less capacity on board, this fleet has to undertake more trips back to cable facilities during an installation campaign—something developers are trying to avoid. Yet, despite being most likely to focus on oil and gas power cable scopes moving forward, the historical fleet still had a part to play in near-shore operations and in supporting emerging markets that require CLVs without large carrying capacities, and that lack local players.

The high-spec fleet has larger carousels and is predominantly owned by engineering, procurement, construction and installation (EPCI) cable players; two are owned by pure transport and installation (T&I) players. The two oldest vessels have carousels of 7,000 t, while the most recent have carousels with an average capacity of 11,000 t. These vessels are more suited to the larger projects they are deployed on, with the average total cable length per project being about 300 km. This is three times larger than the projects handled by the historic fleet. High-spec export CLVs can also lay multiple cables in bundles to extend their installation capacity.

EPCI players are continuing their investment into these high-spec vessels with two new vessels joining in the near term: Nexans Electra (Nexans, 13,500-t carousel) and LS Marine CLV (to be named, 16,000-t carousel). Newbuilds are the only option for additions to this fleet as conversions are not possible due to the technical complexity involved. Furthermore, newbuilds can be built to greener spec for low-carbon operations, a factor increasing in importance.

Looking to the future is the next-gen fleet, which is expected to join the market from 2026. With an average carousel size of nearly 25,000 t, these vessels more than double the existing capacity of the high-spec fleet. Once again, EPCI players take a key role in this fleet with Prysmian and NKT owning two upcoming vessels. However, Jan De Nul, which focuses on T&I contracts, is also developing two newbuilds. T&I players are likely to invest in next-gen vessels because of the internationalization of the projects creating a challenge of efficiency with longer transit and traveling distances between cable facilities and operational sites.

The versatile fleet

The versatile fleet handles array, export and interconnector installation and has the most variation in carousel size (from 5,000 t to 10,700 t). All versatile fleet owners are pure T&I players.

Essentially, the versatile fleet acts as an effective buffer to absorb demand for array and export projects that fall between demand for the historical and high-spec fleets. Versatile vessels are also relevant for emerging markets. This is evident through newbuilds, such as the under-Letter-of-Intent (LOI) Kalypso (4,215t carousel), which is aimed at the US market and set to be the first Jones Act-compliant CLV, and the aforementioned NB980 for the Japanese market.

For emerging markets, the versatile fleet is key due to their ability to lay multiple cable types. This requires less investment while also being able to respond quickly to the needs of these new markets.

A fleet of local CLV players helps reduce relocation and mobilization times, mainly since most CLVs are still predominantly European and must compensate for the lack of local players.

More cables means more need for repair ops

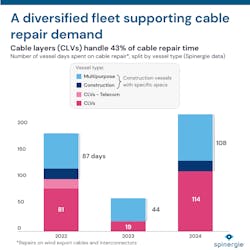

As demand rises, pressure on available repair vessels is also likely to intensify, particularly if cable layers remain the primary choice for these operations. CLVs are often selected for their carousels, deck equipment and experienced crews. Between 2022 and 2024, they represented 43% of vessel days dedicated to export cable repairs.

As demand rises, pressure on available repair vessels is likely to intensify. Diversifying the types of vessels used could help address this growing need. When CLVs are not available, or when repairs are less complex, construction and multipurpose vessels are also deployed. Equipping these vessels with more suitable technology may help balance fleet capacity and cost management. This approach is reflected in recent contracts. For example, in April 2025, DeepOcean announced a four-year framework agreement with Vattenfall for cable maintenance activities.

Conclusion

The CLV sector is moving into an era of sustained expansion shaped by the global offshore wind market. Each segment of the fleet (array, export and versatile vessels) has its own growth trajectory, but the dominant themes are increased capacity, specialization and regional responsiveness. Newbuild activity will be key to bridging capability gaps across the sector.

While installation activities are increasing, there is a parallel market of repair and maintenance. This will undoubtedly place additional pressure on an already stretched market. Balancing new projects with the maintenance of existing projects is the defining challenge for the years ahead and will be central to meeting the demands of the offshore wind sector.

About the Author

Hélia Briaud

Hélia Briaud is an offshore analyst with Spinergie with a strong focus on the subsea power cable industry. She joined the company in January 2024. She previously served as an officer in the French Navy after completing her studies.

Sarah McLean

Sarah McLean is a lead content writer with Spinergie. She joined the company in September 2022. She previously served as a senior rigs analyst with Esgian and IHS Markit.