Wet tree facilities drive subsea demand in deepwater GoM

Molly Reyes

Wood Mackenzie

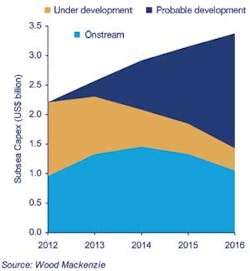

Subsea capex is set to reach record highs over the next five years as facilities using wet trees have become the preferred deepwater Gulf of Mexico development option. During 2012-2016, $14.2 billion is expected to be spent on subsea capex in the region. The majority of this capex targets large fields with complex reservoirs in ultra-deepwater.

There has been a distinct shift toward the use of wet-tree facilities to better accommodate fields that cover a large area, to help manage facility payload constraints, and to accommodate increasing water depths. Discoveries in the frontier Lower Tertiary, Jurassic and subsalt Pliocene/Miocene plays will be developed with wet-tree facilities. These fields have a large amount of recoverable reserves and a high well count, further driving subsea demand.

Historical subsea success

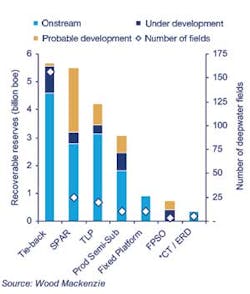

Due to increasing water depth, larger discovery size, and reservoir complexity, subsea equipment has been vital to success in the GoM, and the region has been at the forefront of its evolution. Historical subsea activity has been supported by infrastructure-led exploration. Nearly 70% of the commercial fields in deepwater GoM are developed as subsea tiebacks to pre-existing host facilities, accounting for 5.7 Bbbl of reserves. Tiebacks have enabled many small fields to become economic with high rates of return, which otherwise would have been marginal at best.

Subsea tiebacks have become less prevalent as exploration migrates to deeper waters. Nearly 85% of commercial production from fields that are not yet onstream will be produced via standalone facilities. Wood Mackenzie expects that 17 out of 19 future standalone facilities will use wet trees, accounting for 5.1 Bbbl of reserves.

Shift toward wet-tree facilities

Over the past decade, explorers shifted their focus to the ultra-deepwater and made several discoveries in the Lower Tertiary play. This geologic trend holds billions of barrels of oil in place, but these hydrocarbons are locked in tight high-pressure/high-temperature (HP/HT) formations. These complex reservoirs require additional subsea equipment such as pumps and boosters to enhance recovery and to make these remote discoveries economic.

Wet-tree facilities provide greater development flexibility in ultra-deepwater, and have become the favored option in the region for a number of reasons. These facilities require fewer risers as multiple subsea completions can tie in to a single manifold. This is preferred because top-tensioned risers fatigue sooner and become less reliable in greater water depths. Additionally, as wells increase in pressure, riser walls get thicker and heavier. The use of fewer risers results in a lighter payload which creates more options for facility design and helps minimize capex. Finally, wet-tree facilities can better accommodate fields with a large areal extent – more common in frontier plays.

Wet-tree facilities do present some challenges to operators. Development and maintenance drilling on wet-tree systems must be conducted with a floating rig which is considerably more expensive than a platform rig. Long tieback lines can also create flow assurance issues.

Near-term demand is strong

Over 200 new development wells are expected to be drilled between 2012-2016, with 90% of them using wet trees. During this period, $14.2 billion will be spent on subsea capex. In the deepwater GoM, subsea costs include the construction and installation of wet trees, manifolds, control units, and pumping systems. More than 40% of this capital will be spent on fields currently onstream. This includes the phased development of fields like BP-operated Thunder Horse and Atlantis, as well as brownfield investment in fields such as Shell-operated Auger and Mars. Seismic advancements have improved subsalt imaging, identifying brownfield development opportunities which are expected to create additional subsea demand.

Of predicted subsea capex during 2012-2016, $3.7 billion will be spent on fields currently under development. The Chevron-operated Jack/St. Malo co-development and the Anadarko-operated Lucius field account for over half of the spend in this category. There is also a healthy pipeline of probable developments such as Hadrian and Appomattox that are expected to keep subsea spending on an upward trend.

Leaders in subsea spending

The subsea spend of the Top 10 operators is 84% of the total during 2012-2016. BP has the highest expected subsea capex at $3.6 billion and is focused on development at Thunder Horse, Atlantis, and Mad Dog. Over 80% of BP's subsea spend during the next five years will be on producing assets and signals its priorities in the region.

Chevron is expected to spend $820 million on Jack/St. Malo which accounts for nearly half of the major's subsea spend during this period. These fields target the Lower Tertiary horizon and have higher subsea costs than other plays.

Shell rounds out the top three and is expected to spend $1.3 billion in subsea capex. The majority of this will be on producing fields, which includes brownfield investment in Auger and Mars. Probable developments such as Appomattox and Stones are expected to create additional subsea demand for Shell once each receives project approval.

Nearly 75% of subsea capex spent during the next five years will be on sanctioned projects. Therefore, there is a high likelihood that these investments will be made. Ongoing permitting and drilling delays could defer the timing of probable developments, putting this portion of subsea capex at risk.

Promising future for subsea activity

The predominance of wet-tree facilities, increasing brownfield investment, and ongoing infrastructure-led exploration will continue to support subsea demand in GoM deepwater. The challenging environment of emerging plays creates opportunities to advance subsea technology. Operators already are considering subsea processing and increasing HP/HT specs. Future subsea advancement will enhance the economic potential of deepwater GoM.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com