Africa leading growth of FLNGs in mid-late 2020s

Offshore staff

LONDON — Only five FLNG (floating liquefaction natural gas) units with combined capacity of 12.1 MMt per year are in service worldwide, nearly 12 years after Shell took FID on its Prelude FLNG off northwest Australia, according to Westwood Global Energy Group.

Mark Adeosun, director of Westwood’s SubseaLogix & PlatformLogix services, pointed out that the construction delays and operations challenges besetting Prelude are well-documented, and various other planned FLNG projects have since failed to reach FID.

These include the Kumul FLNG and Western LNG projects offshore Papua New Guinea, Steelhead LNG’s Kwispaa LNG project offshore Canada and the Main Pass Energy Hub offshore Louisiana. A common factor was high development cost and project financing.

FLNGs in operation

There have been success stories post-Prelude such as the redeployment of Petronas’ PFLNG Satu from the Kumang Cluster development offshore Malaysia to the Kebababgan Field in 2019, without the need for drydocking.

Others in operation are Golar LNG’s FLNG Hilli Episeyo (Cameroon), Petronas’ PFLNG Dua (Malaysia) and Eni’s Coral Sul FLNG unit (Mozambique).

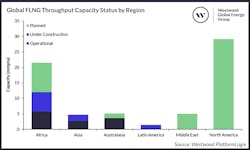

With increasing energy demand and energy security issues, the need for gas is driving new investments in the FLNG market. Westwood expects 18.3 MMt per year of additional capacity to come onstream by 2027, with associated EPC contracts amounting to $13 billion.

A further 36.5 MMt per year should start up post-2027 from FLNG units sanctioned during 2023-27, with an EPC value of $22 billion.

Africa should account for 56% (10.2 mmpta) of capacity onstream during the 2023-27 period. The Golar Gimi FLNG for bp’s Tortue project offshore Mauritania is due to start production in fourth-quarter 2023, with the first LNG cargo likely exported in first-quarter 2024.

In December, the Eni-owned Tango FLNG purchased last year from Exmar Group should start service at the Marine XII Block offshore Republic of Congo. A second FLNG under construction by Wison Heavy Industry in China should be installed in the same block by 2025.

Perenco recently sanctioned a 0.7-MMt-per-year FLNG unit for deployment at the Cap Lopez Oil Terminal LNG off Gabon, and UTM Offshore’s FLNG, destined for OML 104 offshore Nigeria, should receive sanction next year, with JGC working on FEED studies.

But UTM has still to finalize a gas sales agreement with the block owners, ExxonMobil and NNPC.

Other FLNGs set to be sanctioned in the coming years include a second at Eni’s Area 4 development offshore Mozambique and other(s) for bp’s Yakaar-Teranga and BirAllah gas discoveries offshore Senegal and Mauritania.

Golar LNG recently secured an option to acquire a 148,000-cu.-m Moss-design LNG carrier for a 3.5 MMt per year MKII FLNG conversion. If the deal completes in the current quarter, it could be deployed offshore Africa, Adeosun said, with EPC negotiations said to be in progress.

Across the Atlantic, Delfin Midstream plans to install four floating vessels in US waters producing up to 13.3 MMt per year, and it has secured four one-year extensions to begin construction of the onshore metering, compression and pipeline facilities. Last September the company announced a 2.5 MMt per year long-term supply agreement, said to be required to start construction of the first FLNG later this year.

NFE has entered master service agreements with Sembcorp Marine for the engineering and conversion of two Sevan cylindrical drilling floating platforms, Sevan Driller and Sevan Brazil, to FLNG units, including fabrication and integration of LNG topside modules.

Elsewhere, Chevron is investigating potential deployment of an FLNG on the Leviathan gas field offshore Israel and another is under review for Transborder Energy’s LNG project offshore Australia.

Oversupply and delays

But LNG supply growth, specially from the US and Qatar, could lead to oversupply in the market and delay riskier and higher cost projects, Adeosun warned. So FLNG developers should focus on speed to market and flexibility.

Use of FLNG units to develop large gas reserves offshore Mauritania, Senegal, Tanzania and Mozambique is also seen as a lesser security risk to IOCs than local onshore alternatives.

However, the drive to develop renewable and other new energies, such as hydrogen, in Europe and some traditional LNG-rich markets in Japan, South Korea, Taiwan and China could pose a downside risk for additional FLNG capacity post-2030, Adeosun said.

04.04.2023