Delfin Midstream, Devon Energy enter into LNG export partnership

Offshore staff

HOUSTON – Delfin Midstream Inc. and Devon Energy Corp. say they have entered into a liquefied natural gas (LNG) export partnership that includes an executed Heads of Agreement (HOA) for long-term liquefaction capacity and a pre-FID strategic investment by Devon in Delfin.

The HOA provides the framework for finalizing a definitive long-term tolling agreement representing 1.0 million tons per annum (MTPA) of liquefaction capacity in Delfin’s first floating LNG vessel, with the ability to add an additional 1.0 MTPA in Delfin’s first or a future FLNG vessel.

In addition to providing Devon up to 2.0 MTPA of total liquefaction capacity on a long-term basis, the HOA also provides opportunity for additional future equity investments in Delfin by Devon.

Following its recent announcement of a binding SPA with Vitol and a HOA with Centrica, this announcement represents Delfin’s third major agreement in the past two months. Delfin is also in numerous advanced discussions on additional binding SPAs, HOAs and tolling agreements similar to those previously announced.

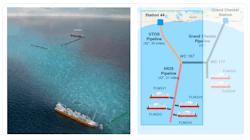

Delfin LNG is a brownfield deepwater port that is designed to support up to four FLNG vessels producing up to 13 mtpa of LNG. To advance the project, Delfin has purchased the UTOS pipeline, which it says is the largest natural gas pipeline in the Gulf of Mexico.

As a modular project requiring only 2.0 to 2.5 MTPA of long-term contracts to begin construction, and with all necessary permits in hand, Delfin says that it is on schedule to make FID on its first floating LNG vessel by the end of this year, with operations expected to commence in 2026.

09.08.2022