US Gulf of Mexico drillship market improving

Offshore staff

HOUSTON – The US Gulf of Mexico drillship market is currently in an enviable position, according to Westwood Global Energy Group.

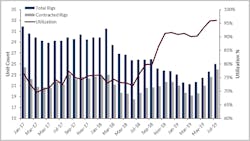

As of mid-July, marketed utilization of the 25-rig fleet stood at 96%, with 24 units either working or committed to begin contracts in the next few months. And, with it rumored that the lone stacked unit may be cold stacked soon if work is not secured, the analyst said the fleet could soon find itself with 100% utilization. In July 2018, contracted utilization stood at 76%.

Westwood’s RigLogix service predicted this scenario, but the timing is a bit ahead of the forecast schedule. On the supply side, there has been a healthy amount of movement in and out of the region, and that will continue to be the case for the remainder of 2019, according to Terry Childs, head of RigLogix.

There are currently four units in the region that will depart for contracts in Central and South America soon. One of the four was already overseas but came to a shipyard in Brownsville, Texas, for some minor repairs. Conversely, there is one drillship currently working off Mexico that will return to the US side of the Gulf for a contract starting in September. Some rumors suggest that a few additional units could be mobilized to the region, but most rig owners say they are mindful of not oversupplying the fleet, so any new units brought in will likely be done with contract in hand, Childs claimed.

As for fleet availability and considering those units anticipated to receive contract extensions (that have not yet been reported), RigLogix shows that there are three units coming free in 2019 and six in 2020. Four of the latter number do not take place until the second half of the year. However, given anecdotal evidence that there are several planned drilling programs, Westwood expects all these units to secure further work through either new charters or extensions to existing contracts.

According to Childs, one sign of how strong demand is can be illustrated by one rig owner that has multiple rigs working under long-term, multi-year contracts for a single operator.

Shell, Chevron, and BP currently have more than 50% of the contracted fleet under their control. Shell has six drillships under long-term contracts, while Chevron accounts for four units. BP has three units currently contracted, with a fourth coming in January 2020.

As for other operators, those with multiple units contracted now include Anadarko, Hess, and Fieldwood Energy. Looking ahead, the bulk of activity will continue to come from the three majors mentioned above, but other operators like LLOG Exploration, newcomer Beacon Offshore, and others also have drilling coming up that will require one or more rigs for long-term programs. According to Childs, the question will be how many rigs will they have to choose from? At the moment, it does not appear that it will be many.

In the end, while the supply numbers will move up and down, strong demand will continue, and utilization will remain in the 95-100% range, he claimed.

When utilization goes up or down, there is a lag period before day rates catch up. The most recent fixtures, all done in March-May, were in the $165,000-175,000 range, which was a decided step change up from the $125,000-140,000 range the market had experienced for some time. However, the current range was established from just four fixtures, and although many rigs here are still operating under the older, high rates established several years ago, there are still plenty of upcoming opportunities for new high fixtures to be established. According to Childs, indications are that said increases are on the way sooner rather than later.

Westwood expects new contracts in the $185-190,000 range to be concluded soon, with $200,000 likely coming later this year or in the first half of 2020. The analyst also expects a second 20K BOP equipped contract to be signed this year at a rate substantially higher than the ~$450,000 fixed in 2018.

The consensus seems to be that many operators have seen the writing on the walls as it pertains to day rates trending up, Childs said, and that they are simply trying to secure the best deals they can. However, some operators that were able to secure floaters at much lower rates, are said to be a bit surprised at the numbers being quoted now. Regardless of that aspect, it would appear most are somewhat secure with their oil price outlook as that ultimately drives drilling decisions, he concluded.

07/24/2019