Offshore wind report: fewer auctions held, but consents for new projects stable

Awards for new offshore wind development sites and offtake contracts were down by more than 70% in the first nine months of this year, according to TGS.

The latest TGS | 4C Quarterly Market Overview report attributes the decline to governments, developers and suppliers globally having to adapt to new market conditions.

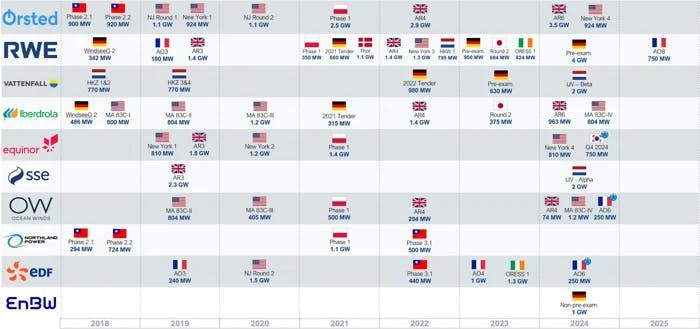

Policy stability, reliable offtake agreements and flexible policies appear to be taking precedence over larger, gigawatt-level projects, with fewer auctions and various governments putting in place new frameworks for the industry.

And some of the bigger European auctions have either been postponed or failed to attract bids from the sector’s major developers.

Developers have responded by focusing more on flexibility and risk-sharing to protect their existing projects, the report found.

So far this year, a total of 11.2 GW has been awarded globally, compared with an annual average of 70 GW over the previous three years. Alongside the decline, demand for site surveys has decreased sharply.

The report’s authors highlighted Germany, the Netherlands and Denmark as some of the countries working on new Contract for Difference (CfD) and site award frameworks to improve project profitability and restore investor confidence going forward.

Nevertheless, 14.6 GW of new projects have secured final consent this year, only slightly down on 2024, which was a record for permitting.

As for floating offshore wind, France is leading new developments, with three projects supported by €11 billion ($12.93 billion) in European Commission funding.

However, TGS | 4C’s supply and demand modeling also suggests there could be a shortfall of about 2,500 turbines (40 GW in total) by 2040. That situation may have to be addressed through expansion of manufacture globally and integration of Chinese suppliers into projects.

In addition, the report predicts that by 2040 about 3 GW of existing offshore wind projects will reach the end of their operational lifespans, rising to 27 GW by 2050. Re-powering, lifetime extensions or removals would provide new investment opportunities.