Offshore wind measurements: How much is enough?

Key Highlights

- Wind measurements reduce resource assessment uncertainty, enabling more favorable financing terms and lower interest rates.

- Deploying additional measurement devices increases upfront costs but yields greater economic benefits through improved debt ratios and savings.

- The optimal measurement setup balances cost and benefit, with simpler configurations offering high benefit-cost ratios and more complex setups providing maximum net benefits.

- Short-term cash flow constraints may discourage extensive measurement campaigns, but long-term gains justify the investment.

By Daniel W. Bernadett, Bureau Veritas

Offshore wind project developers face a fundamental question when planning a new project: How many and what types of wind measurements are necessary to optimize project economics?

While industry best practices provide guidance, many developers must balance these recommendations against short-term cash flow considerations. The result can be minimal measurement campaigns that may not fully capture the economic advantages associated with uncertainty reduction in wind resource assessments.

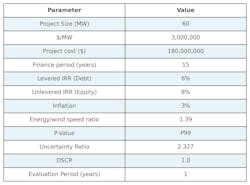

This article explores the economic value of wind measurement campaigns in the context of a 60-MW offshore wind project (Table 2). Specifically being considered is the impact of deploying one or two floating lidar buoys (with one or two lidar units per buoy) on the project’s financing structure and overall profitability.

Table 1: Uncertainty for measurement scenarios

Table 2: Project financing assumptions

Uncertainty reduction

Wind measurements—whether from onsite met masts or floating lidar buoys—reduce the uncertainty in the wind resource assessment. Lower uncertainty in annual energy production projections translates into more favorable financing terms because lenders are generally more comfortable extending debt to a project with lower risk.

This impacts the debt-equity ratio. As a project’s wind resource uncertainty decreases, the project can attract a higher debt ratio (i.e., a larger portion of the total investment financed through loans) at lower interest rates. This financing structure lowers the overall cost of capital.

Estimating economic value

To quantify the economic benefit of each measurement scenario, the following steps are taken:

- Determine uncertainty reduction: Assign a certain percentage uncertainty reduction to each incremental buoy or lidar.

- Estimate impact on debt-equity ratio: Use industry benchmarks or project-finance models to understand how reduced uncertainty translates to more debt-friendly terms.

- Calculate financing savings: Compare the financing cost with and without the additional measurements.

- Estimate net benefit: Subtract the cost of purchasing, deploying and maintaining the measurement equipment from the financing savings.

- Benefit-cost ratio: Divide the total economic benefit by the total cost to determine if the measurement scenario is economically justifiable.

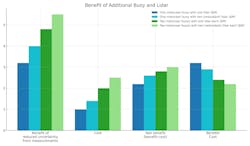

Economic benefit versus cost

Each incremental measurement adds both cost and benefit (Figure 1). While deploying additional buoys and lidar units increases upfront expenditures, it also provides proportionally greater uncertainty reduction, enabling more favorable financing terms, such as:

- Net benefit: Each measurement scenario yields a positive net benefit, meaning the savings in financing costs exceed the measurement costs.

- Benefit-cost ratio: This ratio is greater than 1.0 for all options, confirming that every measurement configuration examined ultimately pays for itself.

Figure 1. Benefit and cost of measurement scenario

Optimal configurations

In this example, the highest absolute net benefit (largest difference between benefit and cost) is achieved with two buoys, each equipped with two lidar systems (two buoys + four lidars total). Conversely, the highest relative benefit (i.e., the best benefit-cost ratio) is found in the simplest configuration of a single buoy with a single lidar.

Ultimately, all scenarios are financially justifiable, but project developers may choose a configuration based on their own specific situation, such as the available capital and cash flow, the appetite for upfront investment, or the required level of data certainty for lenders.

Figure 1 uses a 60-MW offshore wind farm. While this is considered a “small” offshore project, the same methodology can be scaled to larger projects. As project capacity grows, so does the potential benefit from incremental investments in uncertainty reduction.

Short-term versus long-term gains

One of the main barriers to deploying additional measurement campaigns is short-term cash flow constraints. Offshore developers might be inclined to choose minimal measurement configurations despite clear long-term benefits. However, this case study demonstrates that additional wind measurements for an offshore wind project is economically advantageous.

For developers, the key takeaway is that robust pre-construction measurement campaigns are not merely an added expense; they are a strategic investment that can enhance project bankability and profitability. As wind farm capacity increases, the absolute economic value of additional measurements tends to grow, reinforcing the importance of comprehensive wind resource assessment across the industry.

About the Author

Daniel W. Bernadett

Daniel W. Bernadett, P.E., is the global director of wind engineering with BV Power – Renewables Technical Advisory, Bureau Veritas. He has more than 30 years of experience in the onshore and offshore wind industry. Throughout his career, Bernadett has assembled a formidable base of experience and expertise in specialized areas ranging from power performance testing to diagnosis of plant performance issues. Bernadett is an expert on turbine technical issues, plant design and resource assessment.