Santos, ConocoPhillips complete northern Australia transaction

Offshore staff

ADELAIDE, Australia – Santos has completed the acquisition of ConocoPhillips’ northern Australia and Timor-Leste assets for a reduced purchase price and an increased contingent payment subject to a final investment decision (FID) on Barossa.

Due to recent market volatility and the deferral of Barossa FID, Santos and ConocoPhillips agreed to decrease the $1.39 billion upfront payment at completion to $1.265 billion and increase the contingent payment on Barossa FID from $75 million to $200 million.

At completion, the net settlement amount was $655 million, lower than the previously forecast amount of $800 million, comprising the revised firm purchase price of $1.265 billion less cash in the acquired business from the effective date of Jan. 1, 2019 to completion with customary adjustments. The net settlement amount is before any sell-downs of interests owned by Santos in the acquired assets.

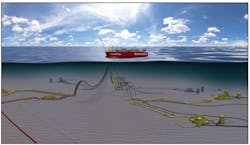

The acquisition delivers operatorship and control of a portfolio of low-cost, long-life natural gas assets and strategic LNG infrastructure. Santos’ interest in Bayu-Undan and Darwin LNG increases to 68.4% at completion and will provide a boost to 2020 production and cash flows. Santos’ interest in the Barossa project to backfill Darwin LNG increases to 62.5%.

The company has an agreement to sell a 25% interest in Darwin LNG and Bayu-Undan to SK E&S for $390 million and signed a letter of intent to sell a 12.5% interest in Barossa to JERA.

The sale of interests in Bayu-Undan and Darwin LNG to SK E&S, and in Barossa to JERA, are subject to third-party consents, regulatory approvals, and an FID decision on Barossa.

05/29/2020