Sustained offshore activity in APAC region benefiting rig, vessel operators

Operators across Southeast Asia could award $37 billion in new offshore contracts between now and 2025, according to Westwood Global Energy Group.

These would be led by deepwater gas projects offshore Indonesia and carbon capture and storage (CCS) initiatives in Malaysia.

During a presentation in Singapore last month, Westwood analysts revealed rising demand for offshore drilling rigs throughout the Asia-Pacific region, with utilization rates for jackups and tender-assist rigs in the sector above 85%.

Between January and October, they added, there were 41 rig contract awards, which was more than the total for 2024. Most of the assignments were for short-term programs.

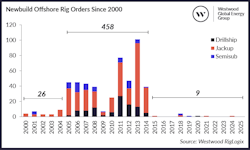

However, high construction costs and low day rates have deterred the newbuild orders needed to renew the region’s rig fleet. Jackups typically cost about $300 million to construct and some drillships more than $1 billion.

With financing a big challenge, some companies have instead opted to upgrade existing rigs and improve maintenance equipment to extend the lives of their assets.

At present, the region’s rig fleet comprises about 45 jackups, 14 semisubmersibles, nine drillships and 18 tender-assist rigs. Many newly built rigs have departed the region of late, Westwood noted, with only two rigs cold stacked, suggesting limited excess capacity.

Deepwater drilling is picking up, with two new programs set to start offshore Indonesia over the next few months.

The same issues with fleet renewal apply to the region’s offshore support vessel sector, with aging vessels and only limited scrapping taking place.

Currently Westwood counts 84 active platform supply vessels and 449 anchor handling tug/supply vessels in the APAC region, operated mainly by Wintermar, HADUCO and Nam Cheong. Day rates for these vessels have dropped recently but still remain above the historical average.

Activity has risen offshore Australia, Indonesia and Thailand in particular.

Exclusive content:

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.