Kosmos/Trident joint venture acquires portfolio offshore Equatorial Guinea

Offshore staff

DALLAS and NEW YORK– Hess Corp. has entered into an agreement to sell its interests in three exploration licenses and the Ceiba field and Okume Complex assets offshore Equatorial Guinea to Kosmos Energy and joint venture partner Trident Energy for a total consideration of $650 million.

CEO John Hess said: “This sale is a further step in our strategy to focus our portfolio by investing in higher return assets and divesting more mature, higher cost assets. Proceeds from asset sales, along with cash on our balance sheet, are expected to fund the development of our truly world-class investment opportunityoffshore Guyana...”

The gross acquisition price is effective as of Jan. 1, 2017. Kosmos is expected to pay net cash consideration of approximately $240 million at close, subject to post-closing adjustments. The sale is expected to close before year-end 2017.

Under the terms of the agreement, Kosmos will be primarily responsible for exploration and subsurface evaluation while Trident, a newly formed international oil and gas company supported by Warburg Pincus, will be primarily responsible for production operations and optimization.

According to Kosmos, the transaction:

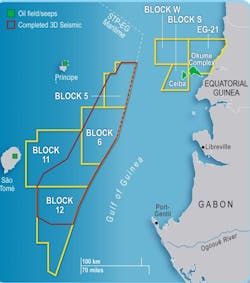

- Increases its total gross acreage in the Gulf of Guinea by about 6,000 square km (2,316 sq mi), adding to its existing 25,000-sq km (9,653-sq mi) positionoffshore Sao Tome in the same petroleum system.

- Provides exploration opportunities for large frontier prospects, as well as near-field, short-cycle tiebacks through existing infrastructure with good fiscal terms.

- Adds about 13,500 b/d of oil of net1 production (gross: ~45,000 b/d), with identified opportunities for resource and value upside.

- Includes approximately 45 MMbbl of net1 identified 2P/2C remaining recoverable resource (gross: ~155 MMbbl) based on Kosmos/Trident company estimates.

Andrew G. Inglis, chairman and CEO of Kosmos, said: “This transaction expands our significant position in a proven, but under-explored oil basin. The Ceiba and Okume fields, which our team originally discovered and managed, provide low-cost, high-margin production with several identified opportunities for resource and value upside. These discoveries de-risked the key play elements in the basin, but limited exploration in subsequent years means we have the chance to fully unlock the exploration potential of the Rio Muni basin.

“Our differential knowledge of the basin and access to under-utilized infrastructure, creates a unique opportunity for the company. Furthermore, our partnership allows us to add value through our core expertise while leveraging the proven management team at Trident to deliver the upside from theCeiba and Okume fields. In addition, the attractive purchase price means the acquisition is immediately accretive from both a value and leverage perspective, and enhances our already strong financial position.”

Upon transaction closing effective participating interests are:

Ceiba Field and | Blocks EG-21, | |||||

Kosmos Energy | 40.375% | 40.0% | ||||

Trident Energy | 40.375% | 40.0% | ||||

Tullow Oil | 14.25% | NA | ||||

GE Petrol | 5.0% | 20.0% |

10/24/2017