Peak oil timeline dependent on progress in renewables, report finds

Offshore staff

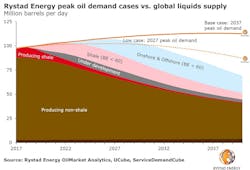

OSLO, Norway – Rystad Energy expects global oil demand to peak by 2037, although increased technology efficiencies could bring the peak forward to 2027.

“If all discovered shale, onshore, and offshore fields with breakeven oil prices below $60/bbl are sanctioned per their current timelines, global production will meet and exceed Rystad Energy’s low case oil demand through 2031,” said the company’s vice president Matthew Fitzsimmons.

“Through their investment patterns, major operators appear to be taking steps to ready themselves for this risk.”

Although various majors have invested in renewable energy in recent years, these projects still struggle to compete cost-wise with fossil fuel counterparts, Rystad claimed.

Last year Equinor revealed that production costs at its offshore wind farms were close to €200 ($225) per megawatt hour.

Its current fossil fuel power production costs are far lower, in the range €40-120 ($45-135) per megawatt hour.

“If Equinor and other renewable energy project operators are successful in driving down renewable production costs over the next decade, we may start to see a greater investment shift from fossil fuels to renewable energy,” Fitzsimmons said.

Rystad’s review of capital budgets also shows that oil and gas companies are being more cautious on investing in new assets in order to mitigate risk and boost paybacks.

Previously E&P companies favored large, long-term investments. Now the preference is for developing assets one phase at a time, allowing investment decisions and their associated commitments to be spread out.

“We already see this trend on the ground, as majors have shifted their focus from long-term offshore projects to phased shale investments,” Fitzsimmons said.

“This strategy will allow them to manage the inherent uncertainty of the energy transition, maintain cash flow at almost record highs, and thus grant them the financial flexibility to move into renewables as soon as emerging green technology makes such a shift economically attractive.”

03/12/2019